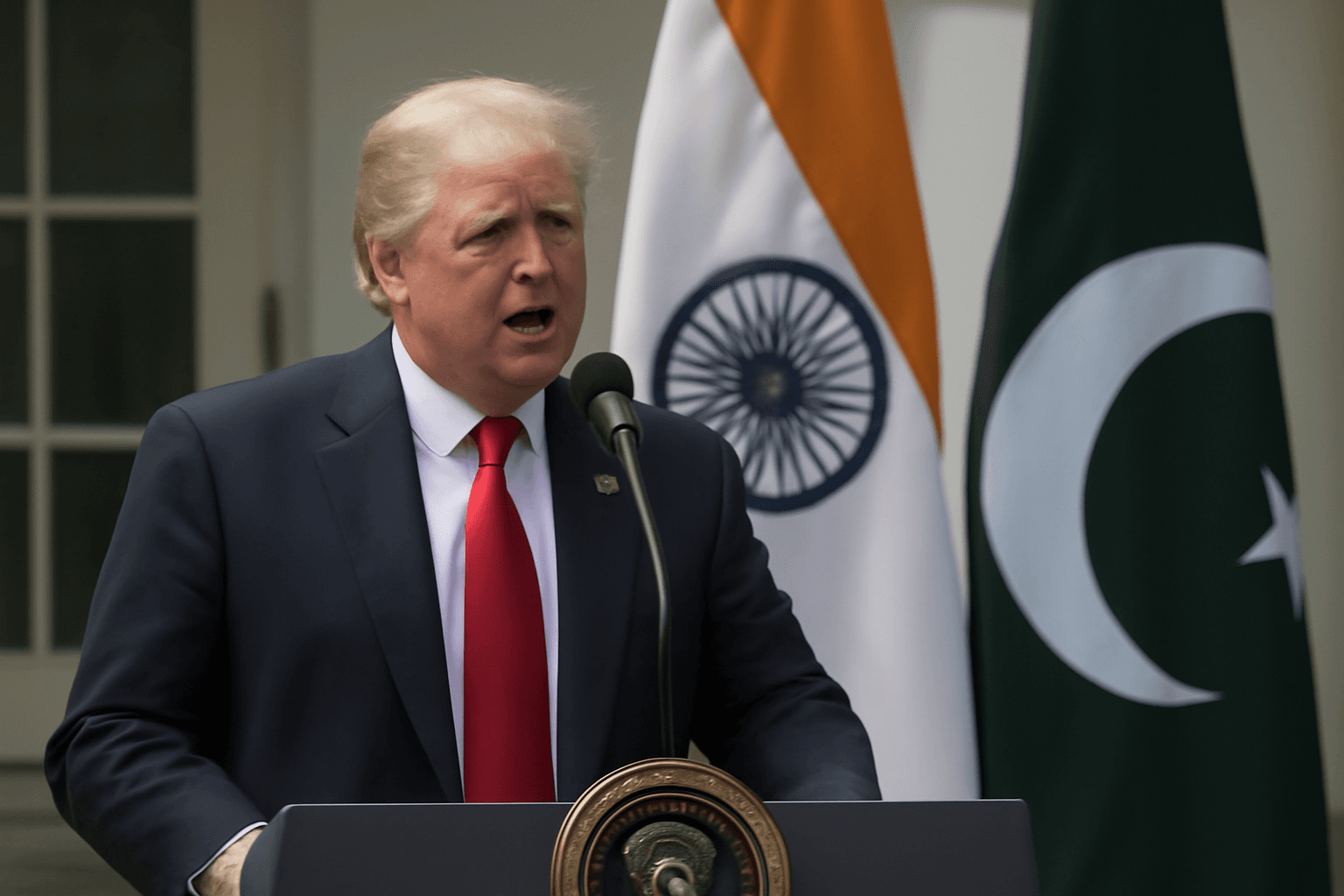

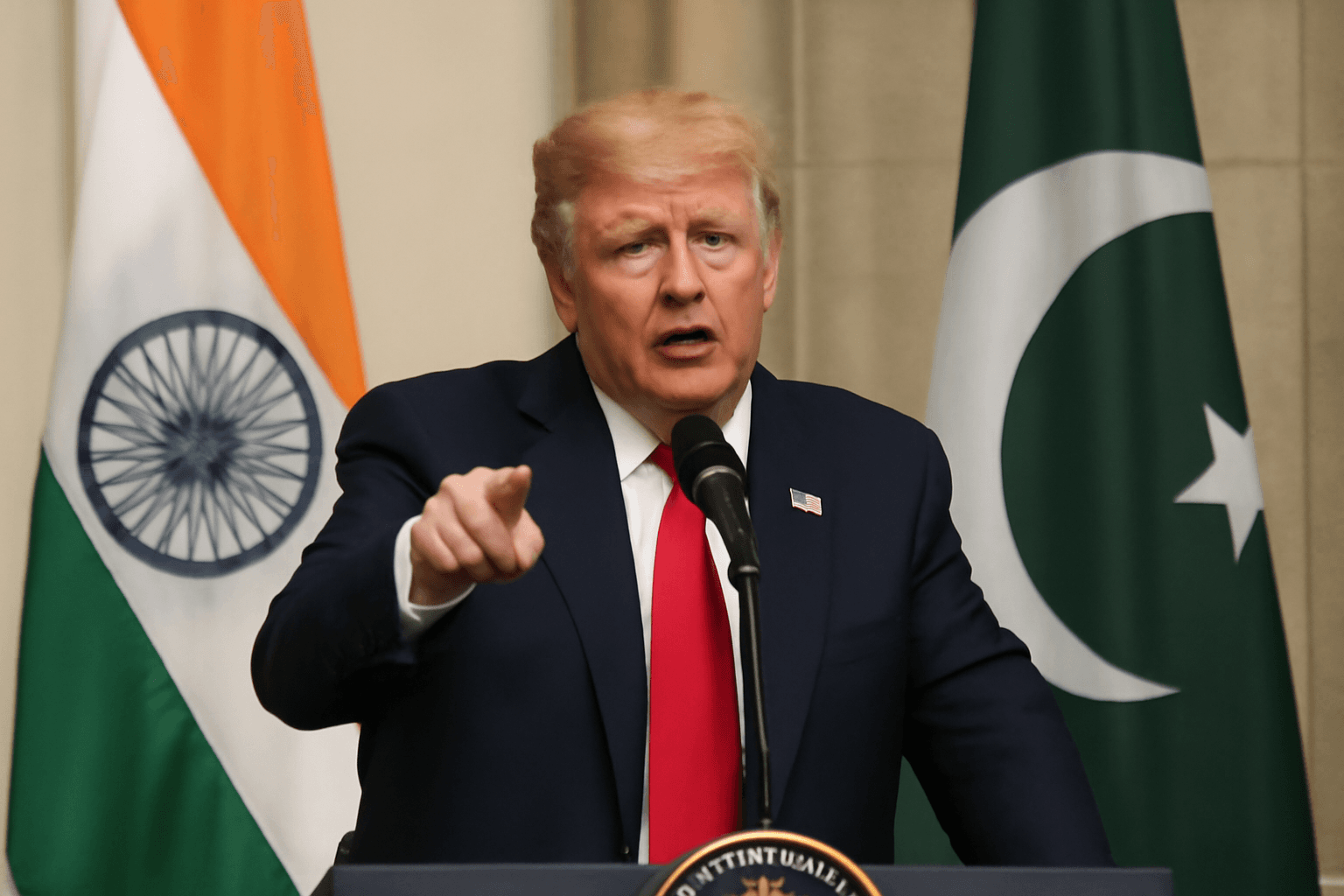

US President Donald Trump announced a significant escalation in trade policy by doubling tariffs on steel and aluminium imports from 25% to 50%. The new tariffs were declared during a visit to US Steel Corporation's Mon Valley Works plant near Pittsburgh and are scheduled to take effect on the following Wednesday.

The decision reflects an ongoing effort to support the domestic steel industry amid notable price increases. Since Trump's return to office in January 2025, steel prices in the United States have risen by 16%, reaching $984 per metric tonne in March 2025. This is considerably higher compared to $690 in Europe and $392 in China, highlighting the competitiveness concerns for US manufacturers.

In a related development, Trump endorsed a deal where Japanese company Nippon Steel plans a partial acquisition of US Steel. This marked a departure from previous opposition to foreign ownership of the iconic American steelmaker. The proposed transaction reportedly includes commitments for substantial investments in US Steel’s facilities across multiple states, including Pennsylvania, Indiana, Alabama, Arkansas, and Minnesota.

Key features of the arrangement involve maintaining an American executive leadership team and board structure, as well as granting the US government veto power over critical decisions through a "golden share" provision, ensuring continued US influence over the company’s direction.

Trump emphasized the importance of keeping US Steel an American company, stating, "This storied American company stays an American company. You’re going to stay an American company, you know that, right?"

The United Steelworkers union expressed cautious concern regarding the merger, focusing on potential impacts on national security, workers, and local communities. While some union members remain apprehensive, others have softened their stance amid fears of possible plant closures, particularly in the Pittsburgh area.

In 2024, the United States produced approximately three times more steel than it imported. Its primary foreign steel suppliers include Canada, Brazil, Mexico, and South Korea. The recent tariff increases have been credited with revitalizing the domestic steel sector, but analysts warn that higher import levies could drive up steel prices further. This escalation poses potential challenges to downstream industries such as housing and automotive manufacturing.