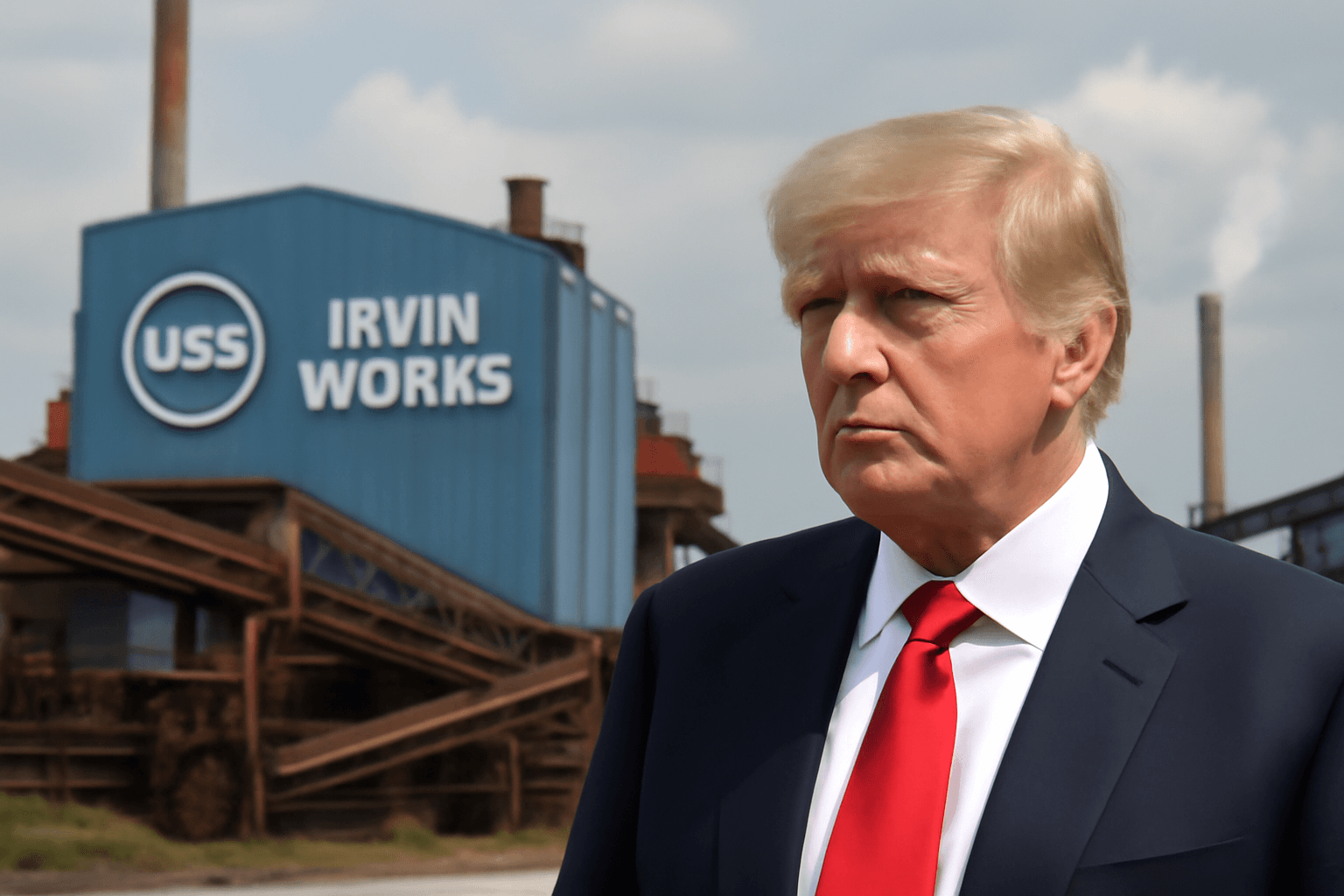

Former President Donald Trump is scheduled to hold a rally in Pennsylvania on Friday to endorse a revised agreement concerning the acquisition of Pittsburgh-based US Steel by Japanese firm Nippon Steel. This marks a significant reversal from his initial pledge to block the deal, which he now describes as a "partial ownership" arrangement intended to maintain American control over the historic steelmaker.

Trump's support follows last week's announcement of the proposed deal's new structure, although precise details remain unclear. Pennsylvania Republican Dan Meuser told Fox News, "It's American-owned, American-run and remains in America," while acknowledging the agreement is "still being structured." The plan reportedly involves Nippon Steel investing billions into US Steel's operations spanning Pennsylvania, Indiana, Alabama, Arkansas, and Minnesota. Crucially, an American-majority executive team and board would manage the company, and the US government would retain veto power through a "golden share" mechanism, granting it authority to approve three board members.

Despite officials' enthusiasm, both US Steel and Nippon Steel have refrained from confirming the revised terms publicly. Nippon Steel issued a brief statement endorsing the concept of a "partnership" but offered no further detail. The White House also declined to comment further. US Steel has yet to communicate specifics to investors.

The United Steelworkers union, which has consistently opposed the acquisition, remains skeptical. The union noted, "Nippon has maintained consistently that it would only invest in US Steel's facilities if it owned the company outright," and expressed doubt that Nippon has altered that stance.

For Trump, the outcome of this deal carries major political implications. US Steel, once the world’s largest corporation, symbolizes America's industrial might and national security. Its fate is particularly significant in key battleground states like Pennsylvania, where manufacturing jobs are vital to local economies. Supporters argue the "golden share" provision safeguards American strategic interests while permitting necessary foreign investment.

Nonetheless, without official disclosures from the involved companies, questions remain regarding the actual level of American control going forward.

(With inputs from AP)