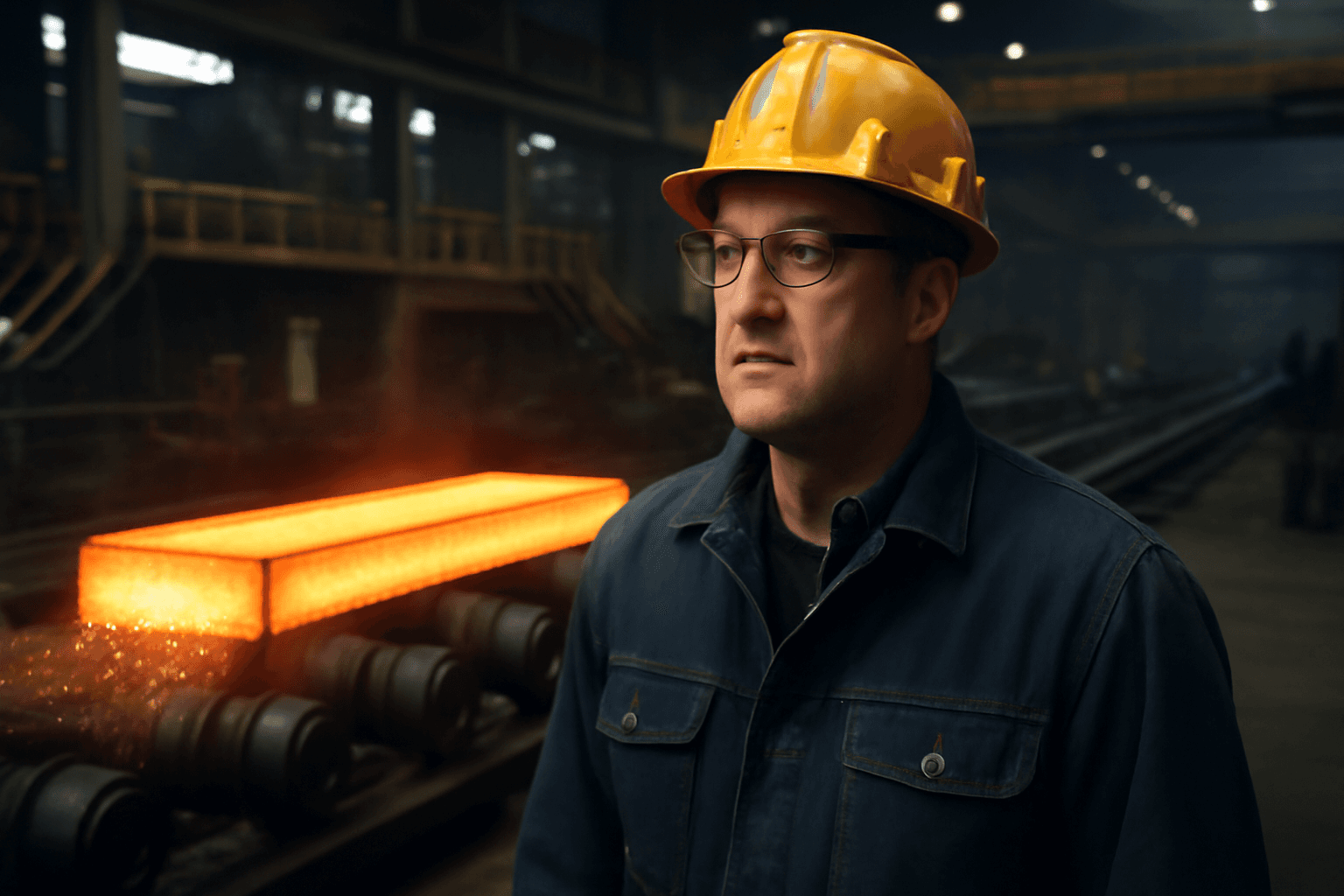

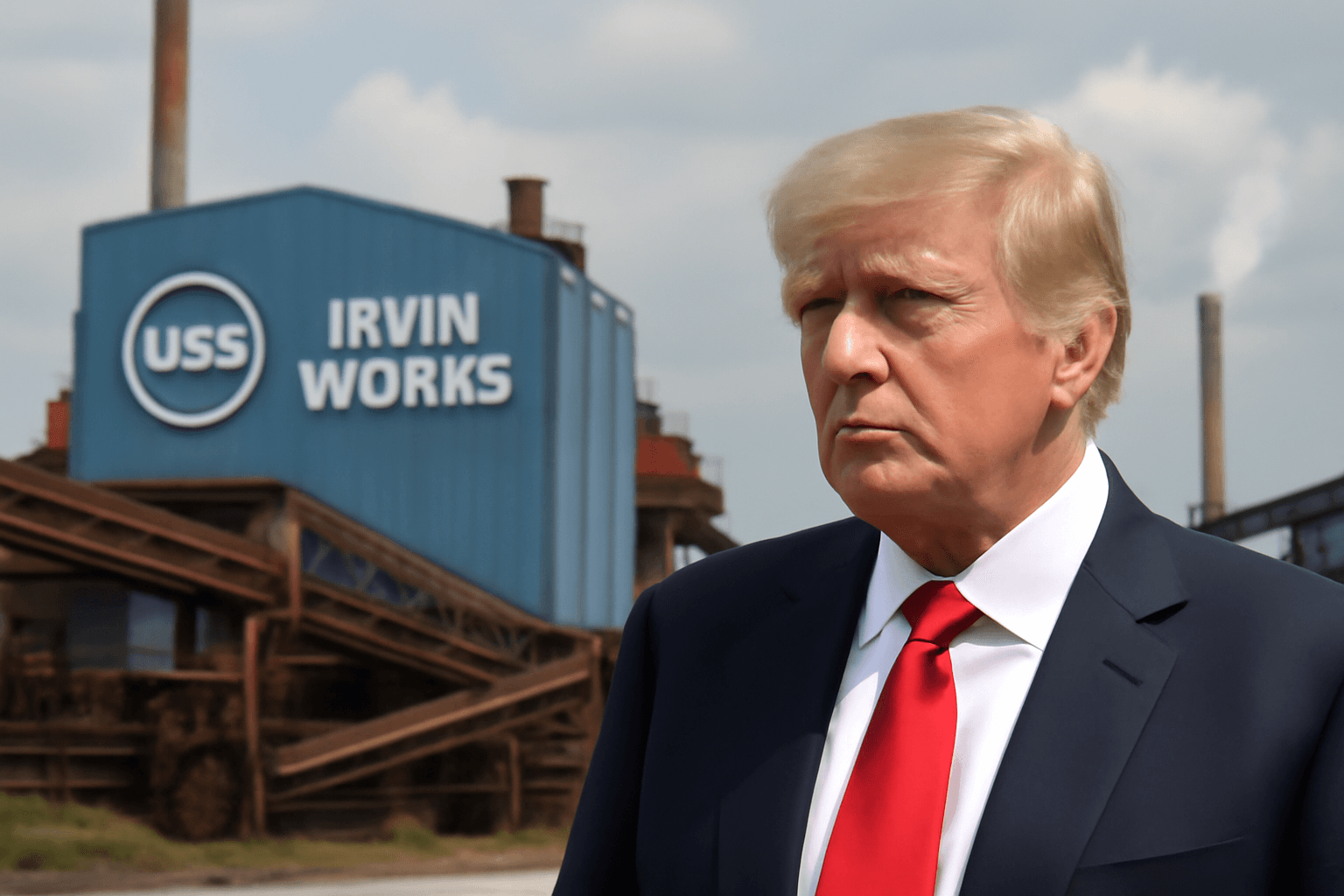

In a significant move aimed at strengthening the American steel industry, the United States government announced plans to increase steel import tariffs from 25% to 50%. The announcement was made during a visit to a U.S. Steel plant in Pennsylvania, a pivotal state contributing to recent election outcomes.

The increase in tariffs is intended to further protect domestic steel producers by making imported steel more expensive. "We're going to bring it from 25 percent to 50 percent, the tariffs on steel into the United States of America, which will even further secure the steel industry," the President stated during his speech to factory workers.

This tariff hike is scheduled to be implemented next week and reflects ongoing efforts to prioritize American manufacturing and preserve jobs within the sector. The president emphasized that these measures have helped sustain the local steel plants, preventing closures and job losses.

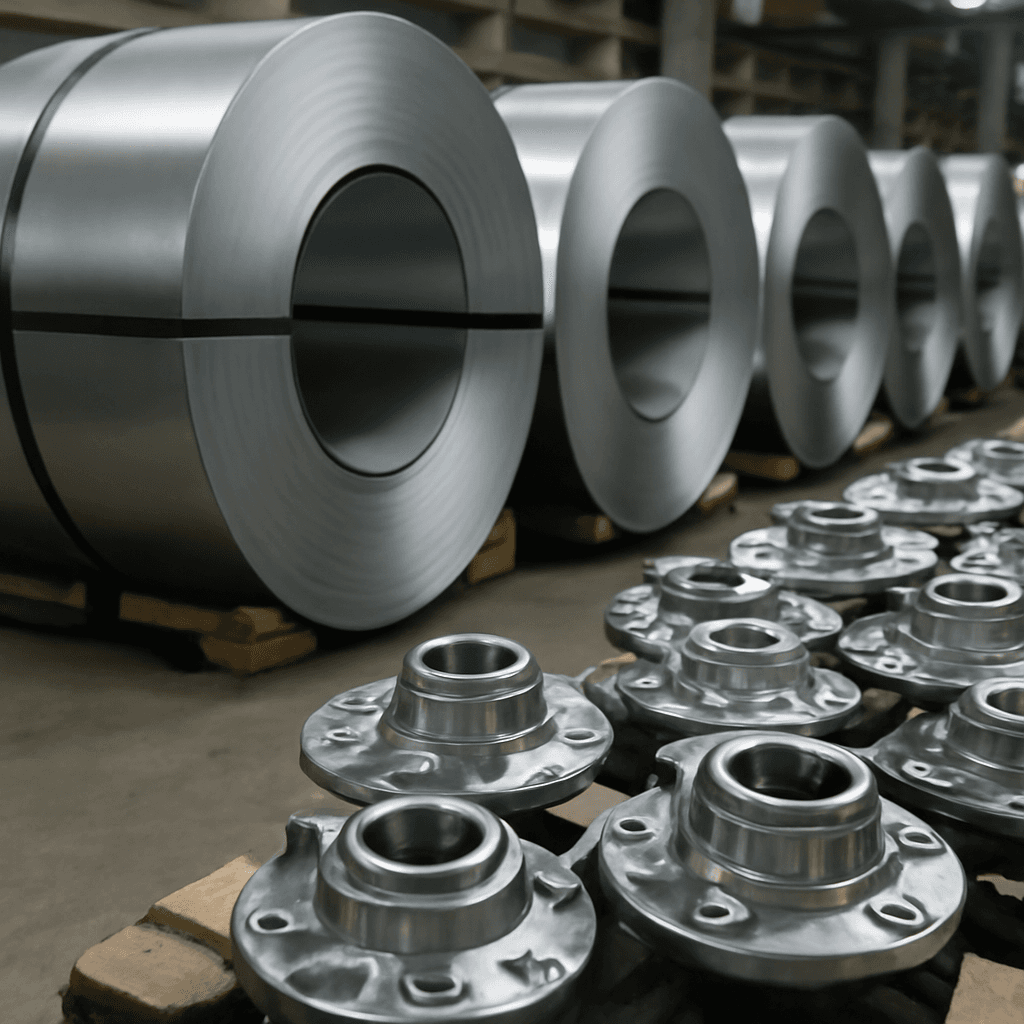

Amid this announcement, a new partnership between U.S. Steel and Japan's Nippon Steel was highlighted. Despite this collaboration, the steelmaker will remain under American control, with headquarters retained in Pittsburgh. Assurances were made that the deal would not result in layoffs or outsourcing of jobs.

Previously, a $14.9 billion acquisition effort by Nippon Steel faced bipartisan opposition and was blocked on national security grounds by the former president. However, current discussions indicate openness to foreign investment under terms that maintain strong U.S. operational control.

The United Steelworkers union, representing thousands of employees, expressed skepticism about the details of the partnership and highlighted ongoing concerns regarding investment conditions and job security.

This tariff increase and continued support for domestic steel production underscore the administration's commitment to reinforcing the nation's industrial base amidst a complex global trade environment.