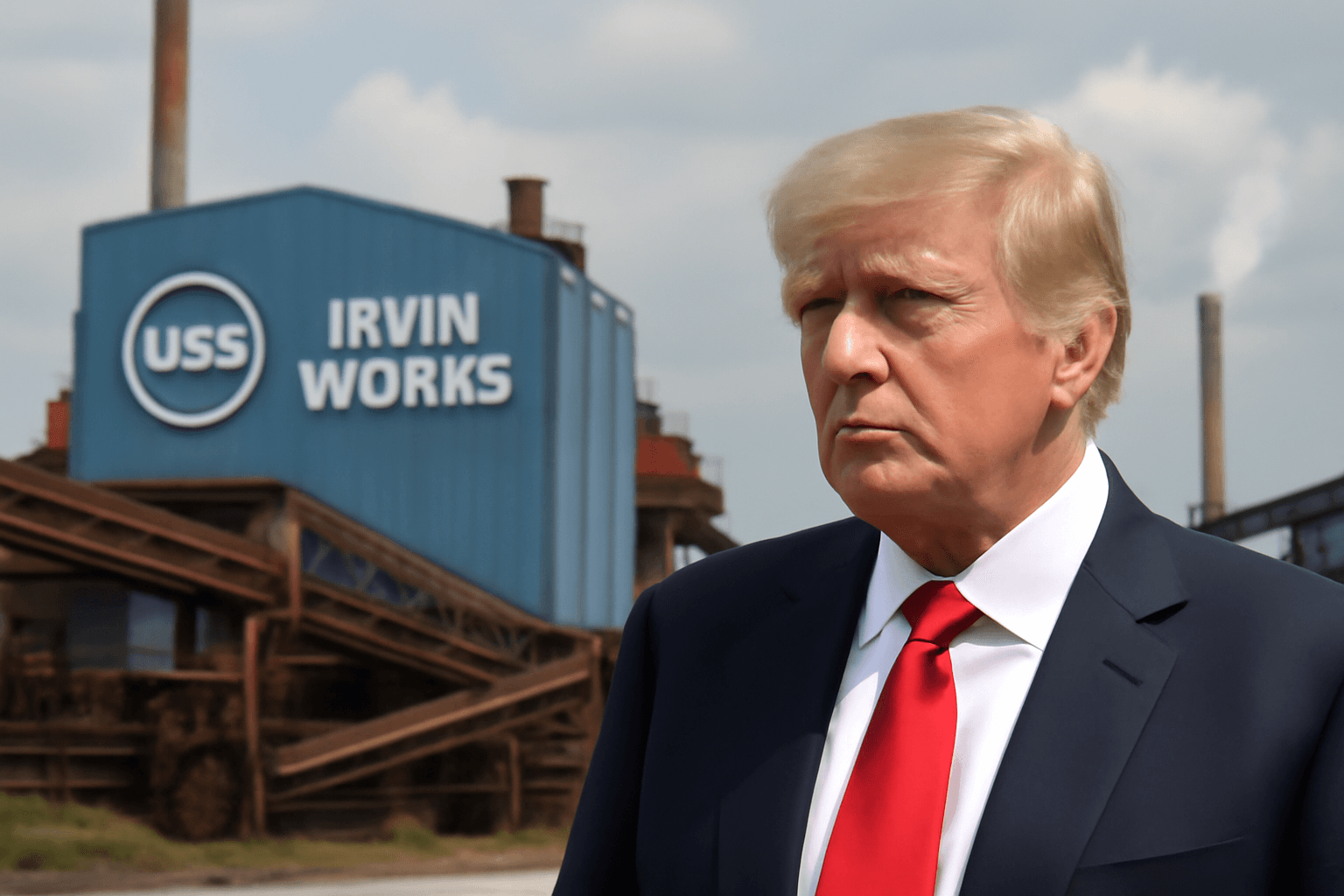

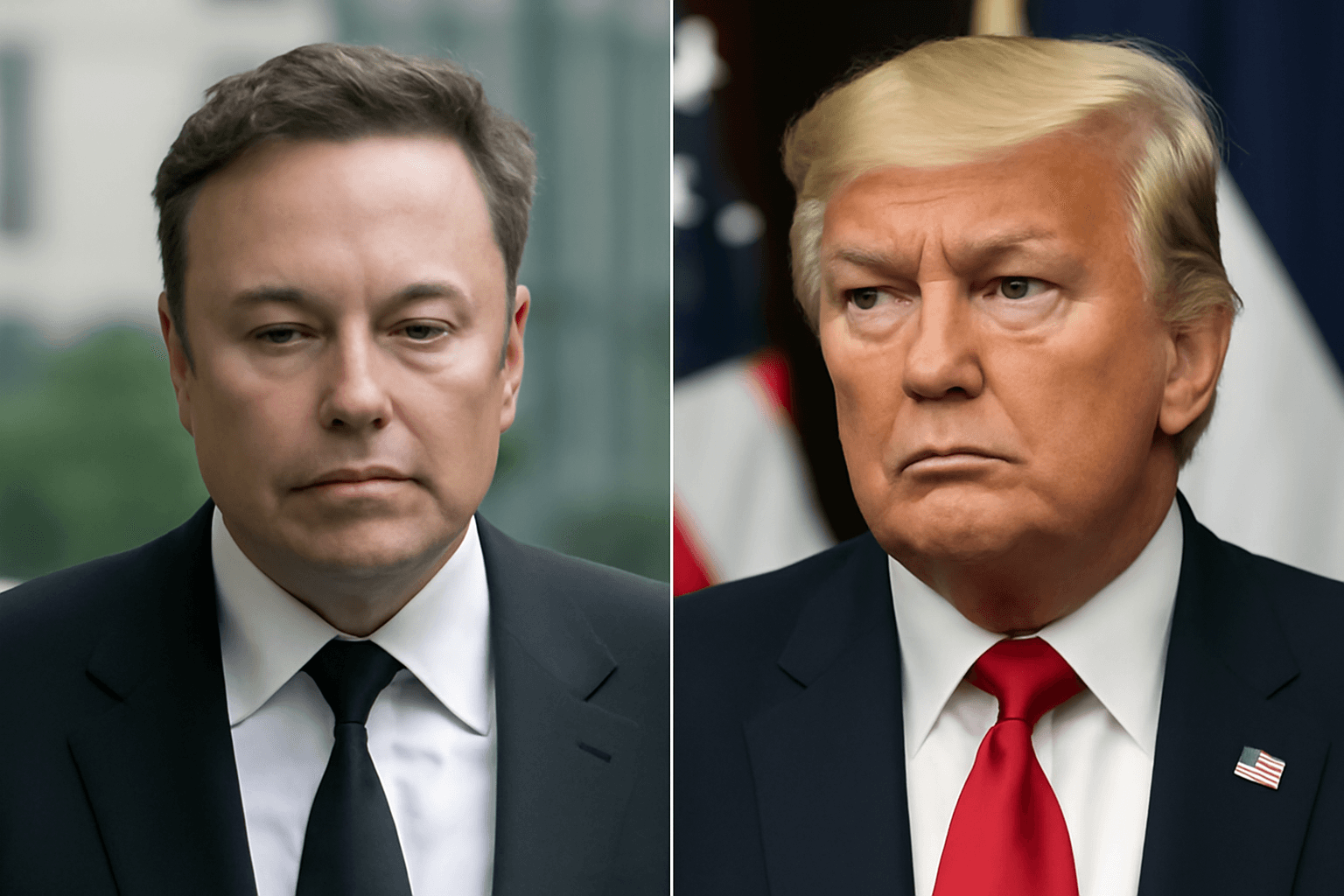

Former President Donald Trump is scheduled to hold a rally on Friday at the U.S. Steel Irvin Works plant in West Mifflin, Pennsylvania, near Pittsburgh. This event follows his recent announcement signaling approval of a significant merger between U.S. Steel and Japan's Nippon Steel.

The merger involves U.S. Steel becoming a wholly owned subsidiary under Nippon Steel North America, with Nippon promising a $14 billion investment over 14 months. Despite the acquisition, U.S. Steel’s headquarters will remain based in Pittsburgh, preserving the company’s long-standing American roots.

Trump described the deal as an investment with partial ownership while maintaining that U.S. control will prevail. However, comprehensive details regarding the deal's structure remain limited to the public. Reports indicate Nippon is expected to acquire U.S. Steel shares at $55 per share, which was Nippon’s original offer before the deal faced rejection on national security grounds under the previous administration. The Biden administration had blocked the initial acquisition attempt, citing concerns about critical supply chain security.

Pennsylvania Senator Dave McCormick revealed that the U.S. government will hold a so-called "golden share," granting it authority over several board appointments. The agreement includes provisions that ensure a majority of the board members and the CEO will be American citizens, and production levels at U.S. Steel will not be reduced. This arrangement is described as a national security agreement designed to maintain domestic control over this vital industrial asset.

White House Trade Advisor Peter Navarro emphasized that Nippon Steel will participate as a shareholder but will not control the company. Similarly, a U.S. Trade Representative highlighted that the details remain confidential but asserted that the U.S. must retain control over critical industries despite foreign investments.

The United Steelworkers union, initially opposed to the merger, has stated it cannot assess the deal’s impact without more information. The union raised concerns about Nippon’s track record regarding trade law compliance and the potential risk to domestic steelmaking capacity and union jobs.

As the rally approaches, investors, union members, and other stakeholders are keenly awaiting further clarification on how this partnership will unfold and what it means for the future of U.S. Steel within the American manufacturing landscape.