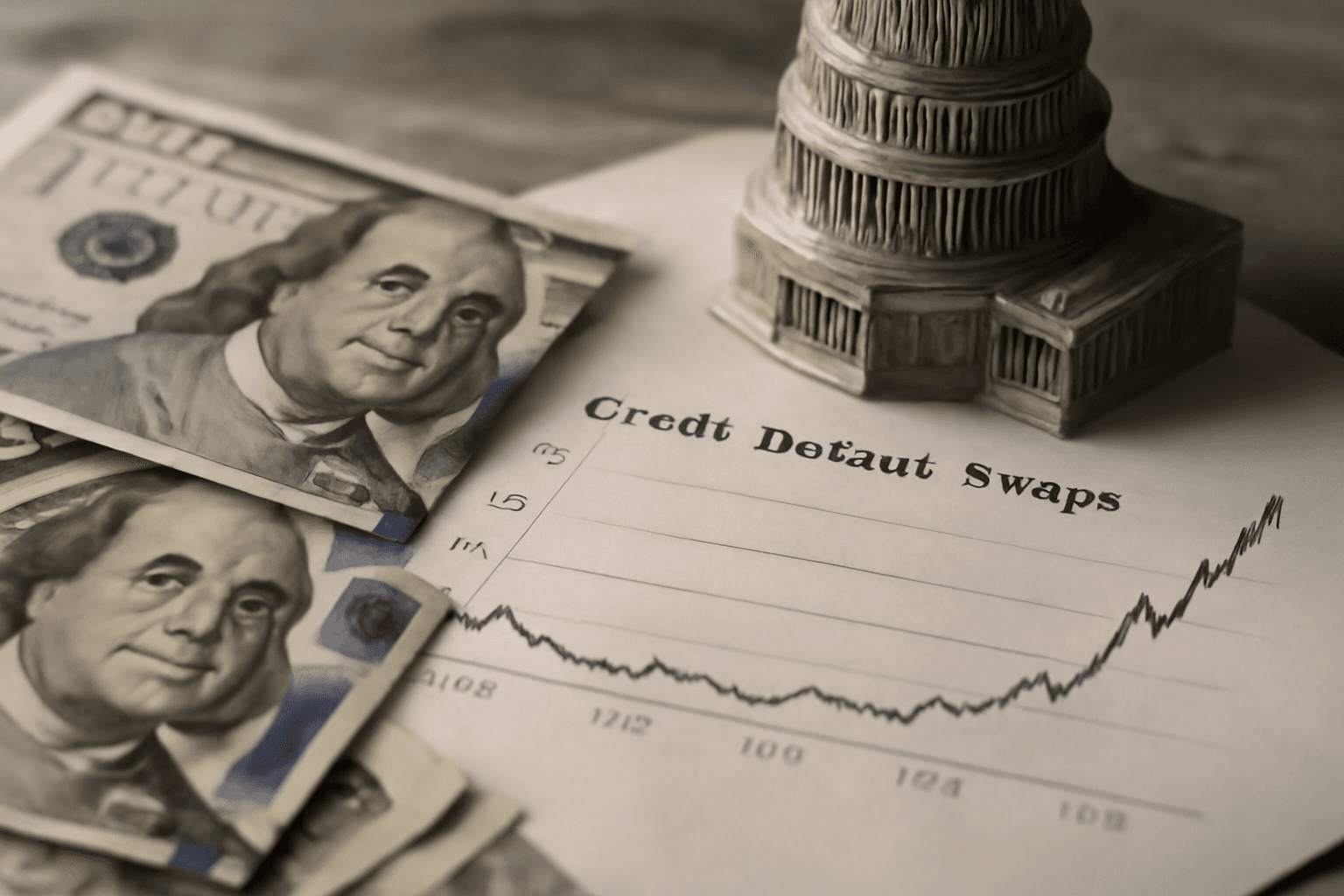

Credit default swaps (CDS), a form of insurance against debt default, have seen rising costs as investors grow increasingly uneasy about the U.S. government's ability to manage its debt. Data from LSEG reveals that the spread on the one-year CDS for U.S. government debt has climbed to 52 basis points as of May 28, 2025, up from just 16 basis points earlier this year.

CDS function by allowing buyers to pay premiums to sellers who promise compensation if the debt issuer defaults. The rise in costs signals heightened concerns among investors, primarily driven by the unresolved U.S. debt ceiling issues rather than fears of an imminent government insolvency.

Rong Ren Goh, portfolio manager at Eastspring Investments, emphasized that this increase reflects a hedge against political risks stemming from fiscal policy uncertainty and legislative gridlock, not a fundamental belief that the U.S. will default. Similarly, Freddy Wong of Invesco noted the popularity of CDS amid the ongoing debt ceiling stalemate. The statutory debt limit was reached in January 2025, leaving the Treasury with limited borrowing capacity as highlighted by the Congressional Budget Office.

The Treasury Department is closely monitoring incoming tax receipts to project the "X-date" — the point when the U.S. exhausts its borrowing ability. Historical trends show that spikes in CDS spreads coincide with heightened debt ceiling concerns, such as in 2011, 2013, and 2023.

Despite these worries, analysts believe there remains sufficient time for Congress to act. The House has passed a significant tax cut package awaiting Senate approval, and Treasury Secretary Scott Bessent urged the Senate to raise the debt ceiling by July to avoid a default before the August recess.

Past debt ceiling crises have been resolved at the last moment, preventing actual defaults. Market observers expect the current CDS price surge to be temporary as investors anticipate a budget deal.

Experts distinguish the current situation from the 2008 financial crisis when CDS were tied to failing mortgage-backed securities. Spencer Hakimian of Tolou Capital Management pointed out that sovereign CDS reflect political risk hedging rather than a genuine expectation of default.

Ed Yardeni of Yardeni Research reaffirmed confidence in the U.S. government's commitment to debt payments, calling default fears unjustified.

Nevertheless, Moody's recent downgrade of U.S. credit rating from Aaa to Aa1 due to fiscal concerns underscores the importance of resolving the debt ceiling standoff promptly. Should Congress increase the debt limit, increased Treasury issuance may bring fiscal deficits back into focus.