Seoul, May 29, 2025: South Korea's central bank has lowered its benchmark interest rate to 2.5%, marking the fourth reduction since October, in an effort to support the faltering economy. Alongside the rate cut, the Bank of Korea significantly downgraded its 2025 economic growth forecast to 0.8%, nearly half its prior prediction of 1.5% issued in February.

The decision aims to mitigate the adverse effects of escalating trade tensions triggered by US tariff policies and subdued domestic demand further challenged by recent political instability. The Bank of Korea cited continuing global economic uncertainties resulting from US-China trade frictions and geopolitical risks, which continue to hamper market performance despite a mild easing of trade disputes.

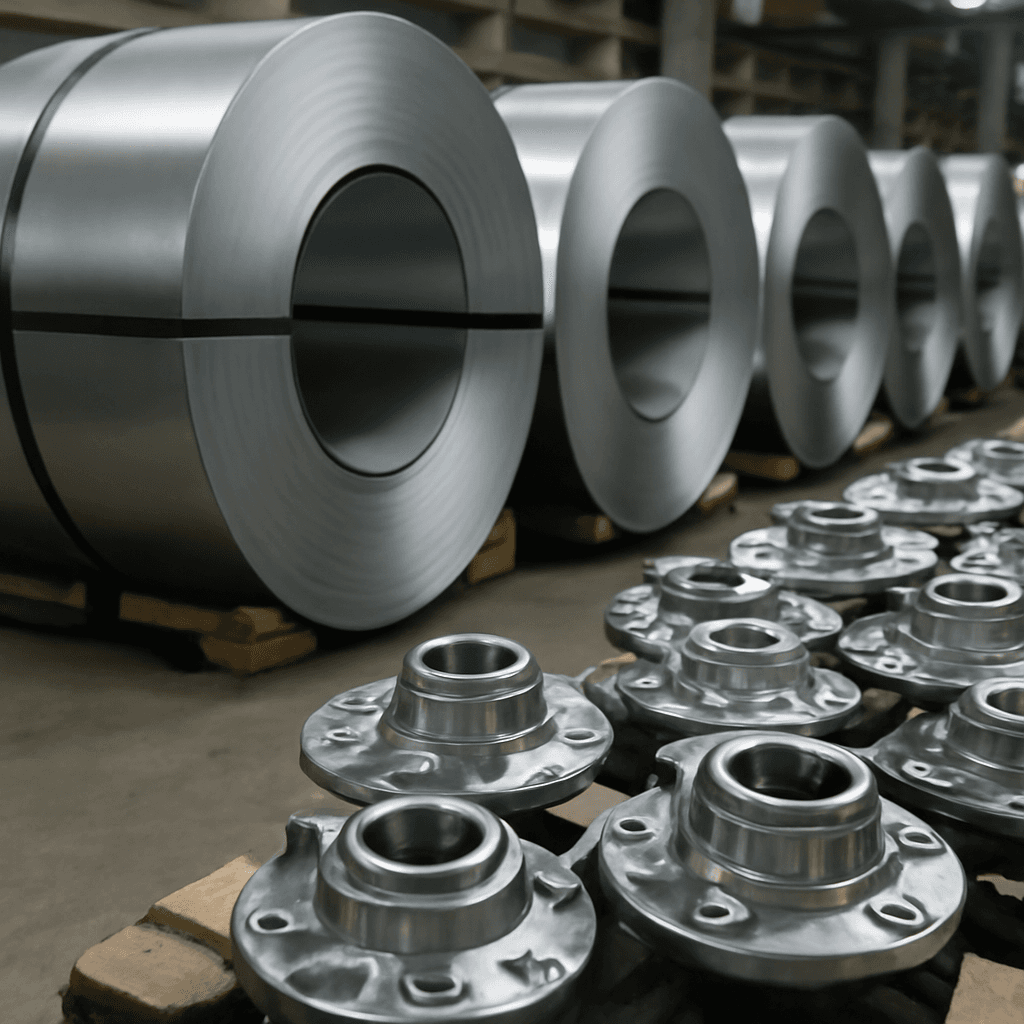

Domestically, South Korea’s economic activity remained weak in April following a contraction in the first quarter, primarily due to lower consumption and business investment. The bank also highlighted slow job creation in manufacturing and other sectors as a concern.

The rate cut spurred a positive market response, with the Kospi index rising 1.7% post-announcement. However, underlying challenges persist. The trade-dependent economy faces potential additional hurdles from US trade policies, including possible reciprocal tariffs and targeted duties on key exports such as semiconductors and automobiles.

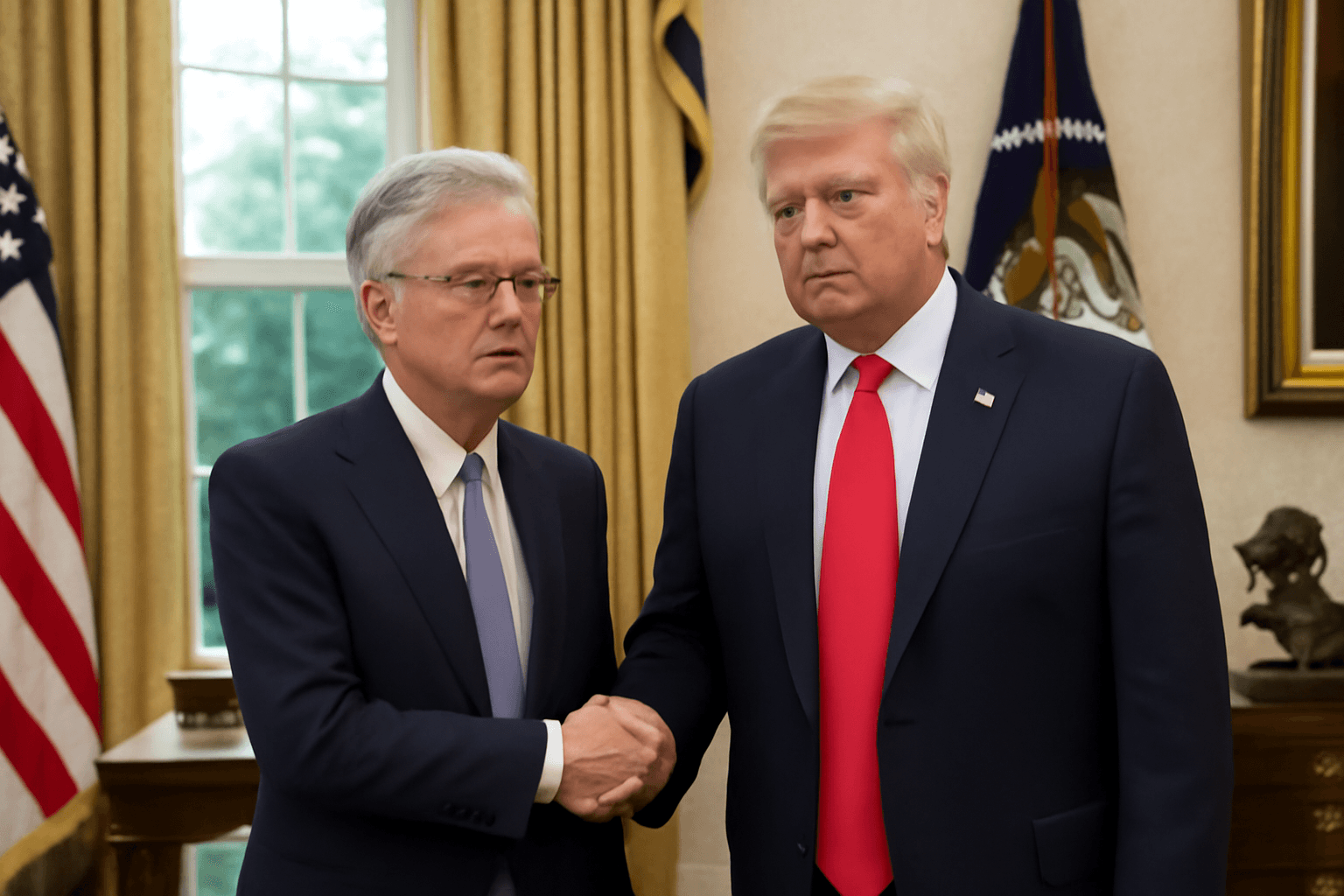

South Korea has actively engaged with US trade officials to address these concerns, while a recent US federal court ruling questioned the legal basis of some tariff impositions under the Trump administration. The White House is currently appealing this verdict, leaving the future trade environment uncertain.

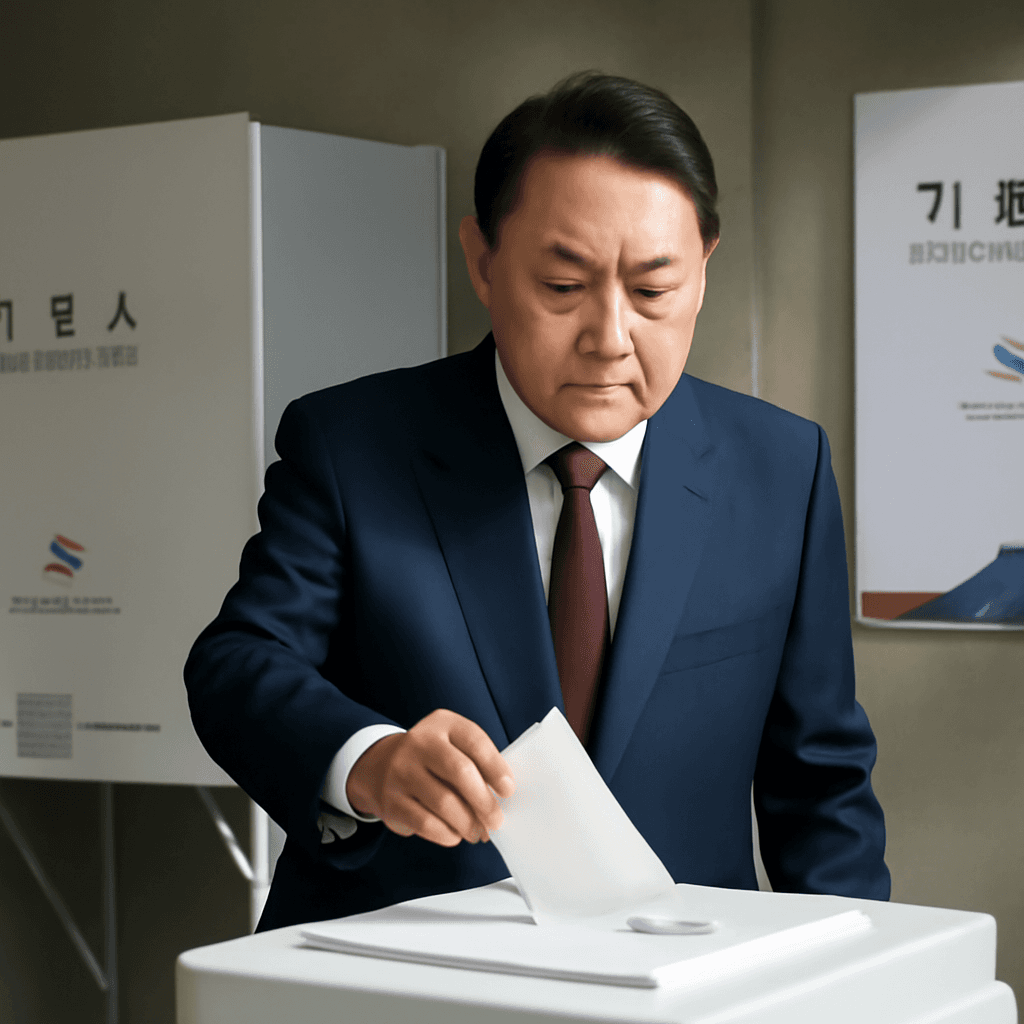

Political instability following the ousting of former President Yoon Suk Yeol, who imposed martial law last December, has further complicated South Korea’s economic recovery and trade negotiations. The upcoming snap presidential election is expected to impact the country’s policy direction amid these challenges.