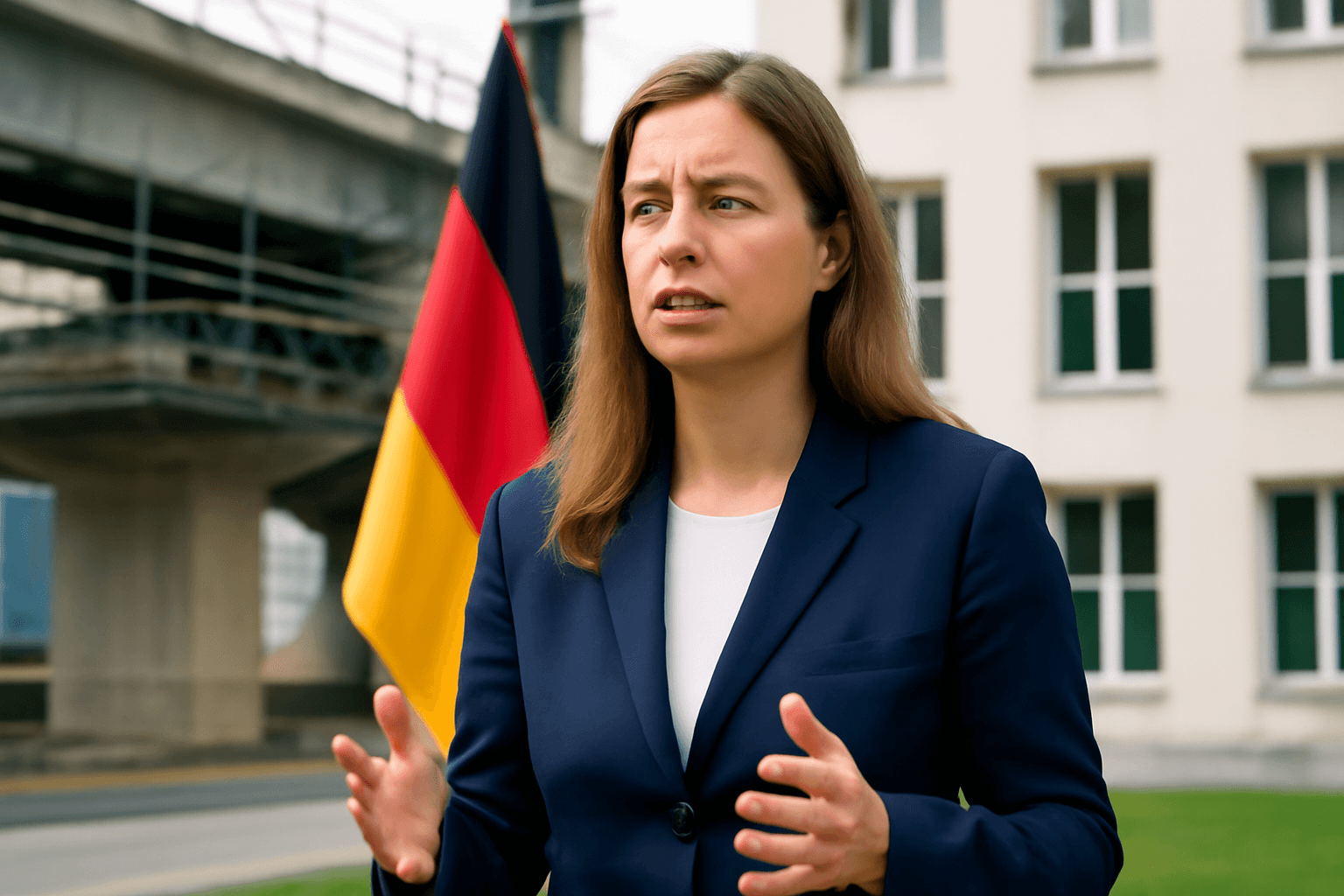

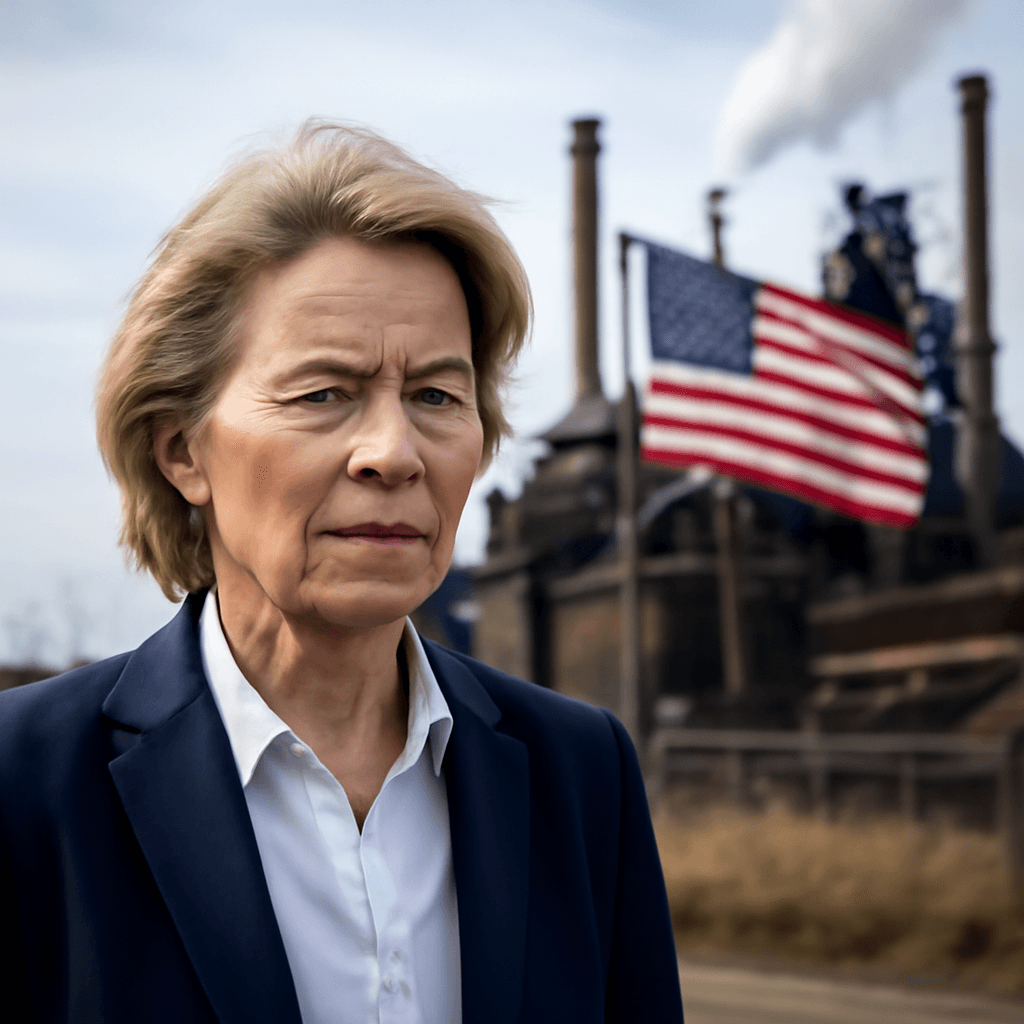

Germany's newly formed government is prioritizing the revitalization of the nation's infrastructure by actively seeking increased participation from private investors. Earlier this month, Economy Minister Katherina Reiche emphasized the need for rapid investment and highlighted that while public funds will cover approximately 10% of infrastructure initiatives, the remaining 90% should stem from private capital.

Decades of underinvestment compounded by stringent fiscal policies have left Germany grappling with deteriorating bridges, outdated train systems, and slow digital transformation. Recognizing these critical challenges, the government enshrined a €500 billion infrastructure and climate special investment fund into the constitution earlier this year. Additionally, fiscal amendments aimed at boosting defense spending further signal a strategic economic pivot.

Experts see significant prospects arising from these developments. Greg Fuzesi, euro area economist at J.P. Morgan, identifies infrastructure and defense as key growth areas. Echoing this optimism, Stefan Wintels, CEO of KfW, highlighted robust international interest, particularly from financial hubs like New York, London, and Zurich, as investors express strong enthusiasm for German projects.

Robin Winkler, Deutsche Bank's chief German economist, noted that recent political initiatives could catalyze a substantial private investment wave. He pointed out that easing bureaucratic and regulatory barriers would be crucial to unlocking private sector participation; these reforms are anticipated to accelerate project approvals and attract capital to stalled infrastructure ventures.

Scope of Investment Required

The pressing need for infrastructure repair is well illustrated by incidents such as the partial collapse of Dresden's Carola Bridge in September 2024. Transport & Environment estimates that thousands of bridges across Germany require approximately €100 billion for restoration and upgrade. Deutsche Bahn forecasts a demand of around €150 billion by 2034 for modernizing, maintaining, and digitizing its rail network.

More broadly, the Cologne Institute for Economic Research estimates a €600 billion investment over the next decade is necessary to substantially advance the nation's infrastructure.

Challenges Ahead

Despite the encouraging financial commitment, industry specialists highlight ongoing uncertainties. Jens Thiele of Hamburg Commercial Bank raises concerns about the duration of approval processes and the capacity to initiate projects swiftly within a compressed timeframe.

Similarly, J.P. Morgan's Greg Fuzesi underscores timing as a critical factor, noting investor inquiries regarding delivery speed. He stresses that political will and streamlined planning procedures will ultimately determine the success of these infrastructure initiatives.

As Germany looks to balance ambitious public funding with private sector engagement, the government's ability to enact promised reforms and attract substantial investment remains under close scrutiny.

Watch CNBC’s full interview with German Economy Minister Katherina Reiche for more insights on these initiatives.