HP Inc. reported its second-quarter financial results on May 28, 2025, revealing an increase in revenue but disappointing earnings and future guidance, largely attributed to elevated costs driven by U.S. tariffs.

Though HP's revenue of $13.22 billion exceeded analysts' expectations of $13.14 billion, representing a 3.3% gain compared to the same quarter last year, adjusted earnings per share (EPS) fell short at 71 cents versus the anticipated 80 cents. The company's net income decreased to $406 million (42 cents per share) from $607 million (61 cents per share) in the prior year.

Looking ahead to the third quarter, HP projects adjusted EPS between 68 and 80 cents, below the analyst consensus of 90 cents. For the full year, projected adjusted EPS ranges from $3.00 to $3.30, underperforming analyst estimates of $3.49.

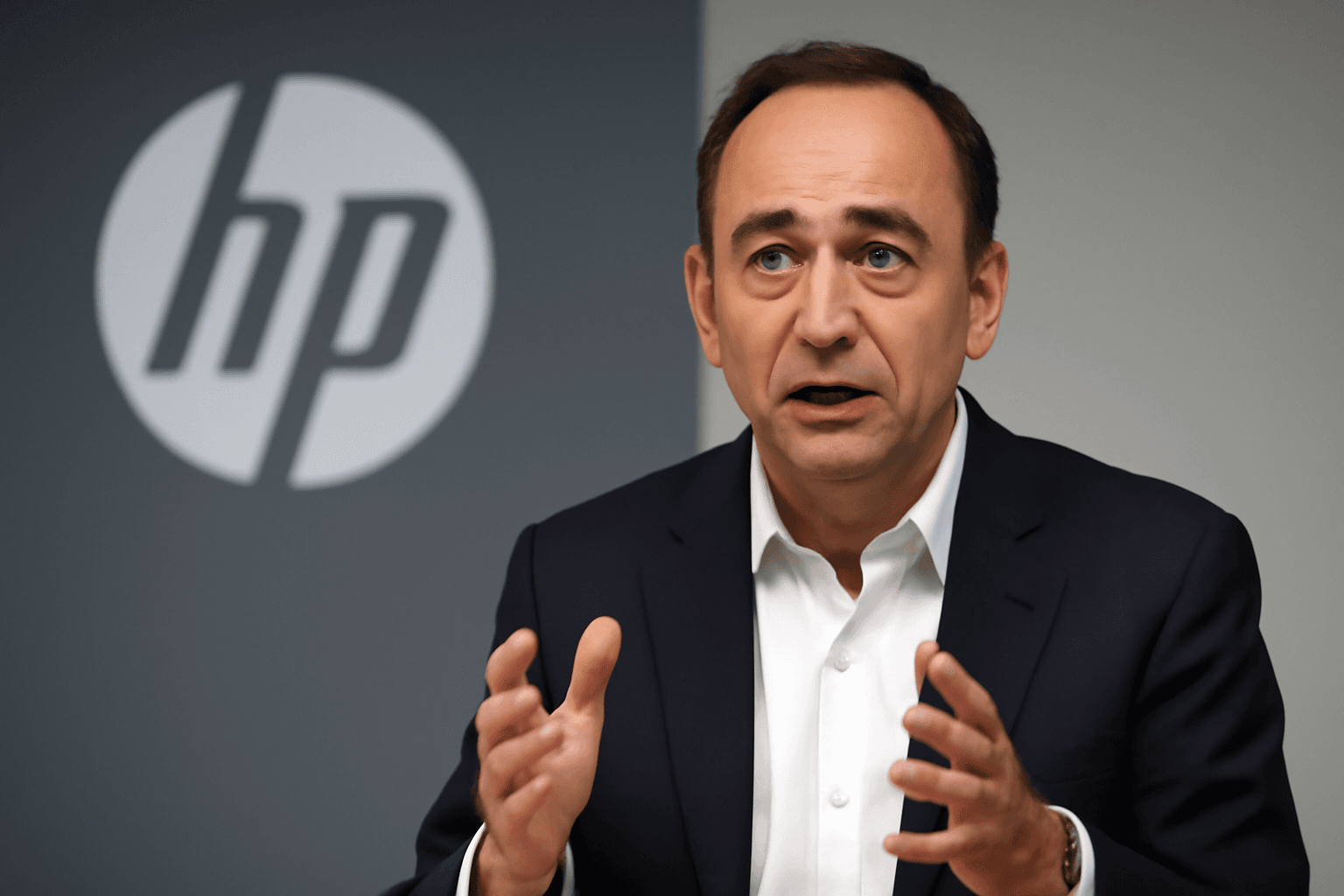

HP highlighted that its current outlook incorporates increased expenses resulting from the prevailing U.S. tariffs and corresponding mitigation efforts. CEO Enrique Lores emphasized swift actions to expand manufacturing capacity outside China, boosting production in Vietnam, Thailand, India, Mexico, and the United States.

"By the end of June, we expect nearly all products sold in North America to be manufactured outside of China," Lores stated. "We anticipate completely offsetting the elevated trade-related costs by the fourth quarter."

Following the earnings announcement, HP's stock price declined approximately 15%. The company also scheduled a quarterly earnings call with investors for 5 p.m. ET on the reporting day.