Xiaomi Reports Record Quarterly Profit

Chinese smartphone manufacturer Xiaomi recently announced a record net profit for the second consecutive quarter, reinforcing positive outlooks from market analysts. Despite Xiaomi's earnings being significantly lower than Apple's in absolute terms, the company commands a larger smartphone market share within China and is aggressively expanding into the electric vehicle (EV) sector.

Stock Performance and Market Position

Year-to-date, Xiaomi's shares have surged over 45%, reaching 50.95 Hong Kong dollars (approximately $6.50) per share, while Apple's shares have declined roughly 20% to around $200. Following the earnings announcement, several analysts raised Xiaomi’s price targets, reflecting bullish sentiment on its growth prospects.

Key Drivers Behind Earnings Beat

Xiaomi's adjusted net income for Q1 stood at 10.68 billion yuan ($1.48 billion), exceeding analysts' expectations of 9.48 billion yuan. Total revenue also surpassed forecasts, amounting to 111.29 billion yuan versus an anticipated 108.49 billion yuan. The company’s outperforming segment was its AIoT (Artificial Intelligence of Things) product portfolio, which includes smart appliances integrated with AI for remote control via apps.

Smartphone Market and Technological Advances

About 40% of Xiaomi’s revenue is generated from smartphones. Though the company remains prudent regarding the global smartphone market outlook, it continues to increase its presence in China’s premium segment. Central to this strategy is the recently unveiled Xring O1 chip, designed to power Xiaomi’s 15S Pro smartphone. This device is competitively priced well below Apple’s iPhone 16 Pro and boasts performance advantages such as improved heat management during gaming.

Diversified Revenue Streams

Nearly 22% of Xiaomi’s revenue comes from appliances and other connected devices. Analysts project substantial growth potential in this segment over the next two years. Meanwhile, Xiaomi is accelerating its electric vehicle ambitions, which could become a major source of revenue and profit growth.

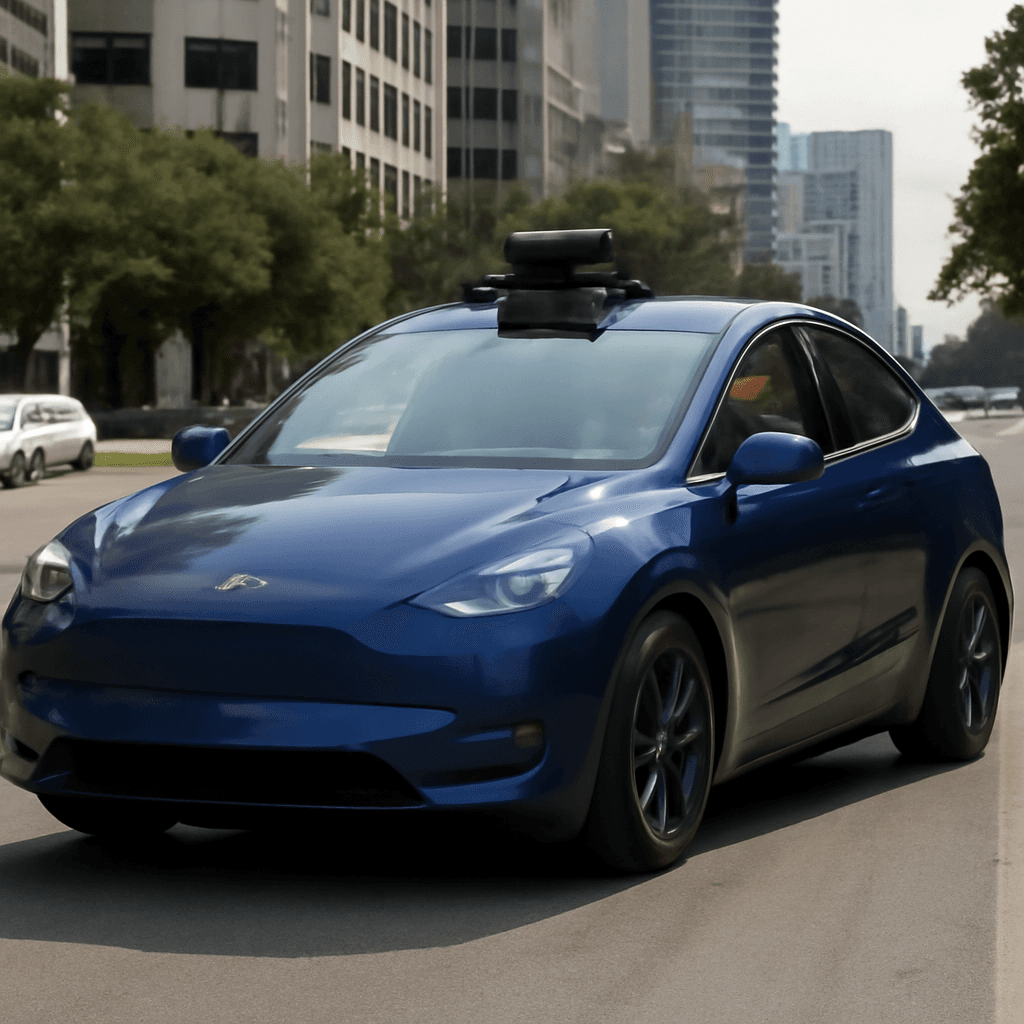

Electric Vehicle Launch as Catalyst

At a recent product event, Xiaomi introduced its YU7 electric SUV, scheduled for official launch in July 2025. Although pricing details remain undisclosed, the company claims the YU7 will offer a longer driving range than Tesla’s Model Y. Market analysts regard the YU7 launch as a critical catalyst that could enhance Xiaomi’s average selling prices (ASPs), margins, and earnings momentum. This follows the success of Xiaomi’s SU7 electric sedan, launched last year.

Analysts’ Outlook and Upcoming Events

Several investment firms have reaffirmed or increased their price targets and ratings on Xiaomi, citing the company’s expanding core product lineup, international growth initiatives, and disciplined cost management. For example:

- Jefferies raised its price target to 73 HKD, reflecting a 43% upside from recent closing prices.

- Morgan Stanley is optimistic about the YU7 SUV’s impact and maintains an overweight rating with a 62 HKD price target.

- Macquarie highlights Xiaomi’s benefits from rising electric vehicle demand and rates the stock as outperform with a 69.32 HKD target.

In contrast, some analysts remain cautious. JPMorgan maintains a neutral stance due to slower growth in Xiaomi’s ecosystem revenue related to services compared to hardware, limiting upward valuation potential despite expectations for stock appreciation.

Xiaomi's upcoming investor day on June 3 is anticipated to provide further insight into strategic developments and may serve as an additional catalyst for the stock.

Conclusion

With robust earnings, expansion into electric vehicles, and continued innovation in smart devices, Xiaomi appears well-positioned for growth in both domestic and international markets. Analysts generally remain optimistic about the company’s trajectory, albeit with varying perspectives on valuation and revenue mix.