Tesla Shares Bounce Back Amid Robotaxi Breakthrough

Tesla's stock has climbed steadily over the past three trading days, almost erasing the sharp drop triggered by the recent public spat between CEO Elon Musk and former President Donald Trump. After losing nearly 14% in value in a single session, shares rose 5.7% on Tuesday, closing at $326.09, just shy of their pre-conflict level.

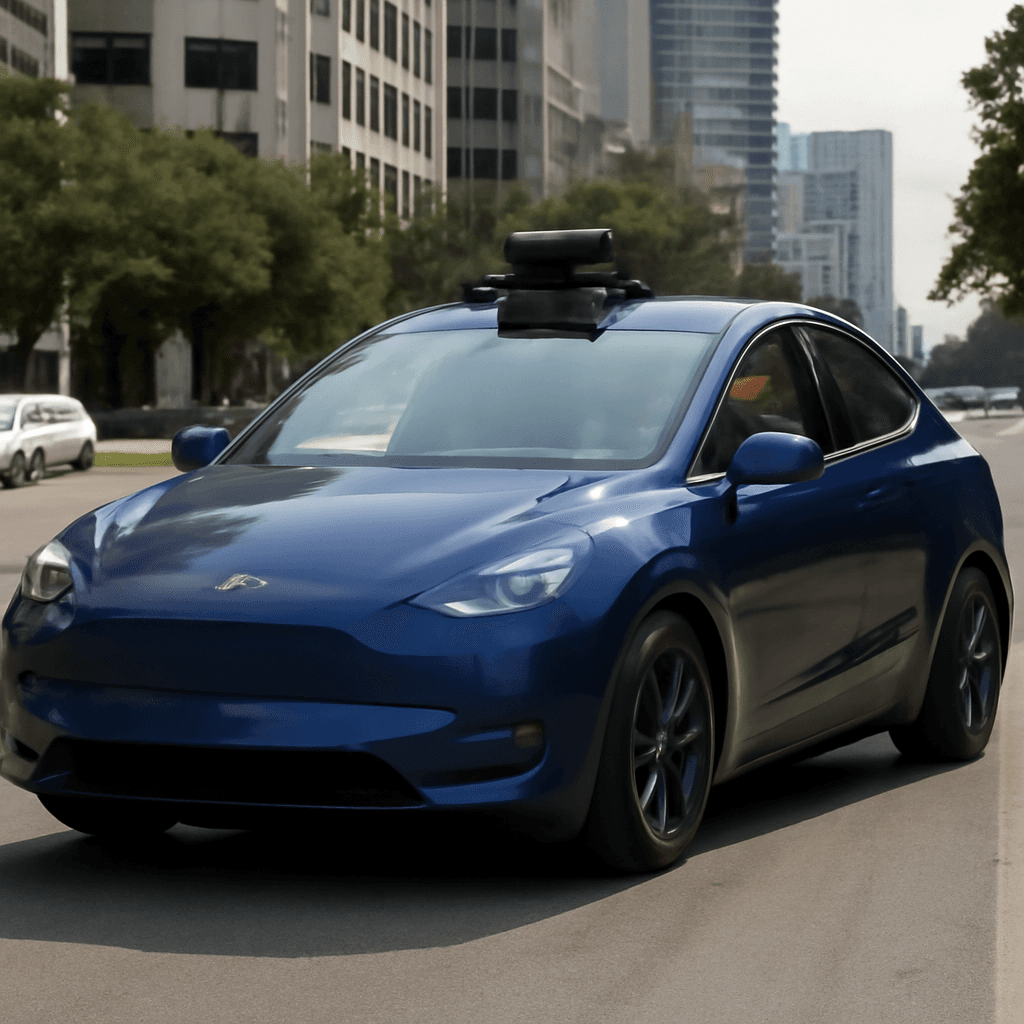

Testing Self-Driving Tesla Vehicles on Austin Streets

The latest surge comes after Elon Musk shared a compelling video on X, unveiling Tesla's driverless vehicles undergoing real-world tests in Austin, Texas. The clip showcased a black Model Y SUV, emblazoned with a graffiti-style “Robotaxi” logo, smoothly navigating intersections and yielding to pedestrians — all without a human safety driver behind the wheel.

This marks a significant milestone for Tesla, which has lagged behind competitors like Waymo in autonomous ride-hailing services. The company appears poised to roll out its self-driving technology on public roads, initially in a limited capacity. According to reports, Tesla plans to launch a pilot program for driverless ride-hailing in Austin as early as June 12, though official confirmation remains pending.

Scale and Scope of Tesla's Robotaxi Program

In a recent interview, Musk revealed that the initial rollout will be modest, involving around 10 to 20 robotaxis equipped with Tesla’s newly refined “unsupervised” Full Self-Driving (FSD) software. These vehicles, all Model Ys rather than the anticipated CyberCab, will be geographically limited—or “geofenced”—to specific areas in Austin, monitored remotely by Tesla employees who can intervene if necessary.

Competitive Landscape and Local Testing Scene

On the City of Austin’s official website, Tesla is now listed as conducting "testing" of autonomous vehicles. This list includes other players like Zoox and AVRide, the latter having roots in Russia’s Yandex technology giant. Meanwhile, Waymo remains the sole company classified under "deployment," operating commercial robotaxi fleets both in Austin and several major U.S. cities including San Francisco, Phoenix, and Los Angeles.

The milestone video first surfaced via Tesla enthusiast Sawyer Merritt, who excitedly hailed it as the first sighting of a Tesla Model Y robotaxi without a driver on public roads in Austin.

Context: Musk and Trump’s Heated Exchange

The recent friction between Musk and Trump began shortly after Musk’s stint leading a federal government initiative ended. Tensions flared when Trump criticized Musk publicly, labeling him "CRAZY" and threatening to withdraw government contracts and subsidies not just from Tesla but also Musk’s other ventures like SpaceX, Neuralink, and The Boring Company.

Following a volley of insults exchanged on social media, market jitters soon followed, pushing Tesla's shares downward. However, Musk appears to have tempered his tone since, deleting some of the antagonistic posts and even showing support for certain Trump policies, helping to ease investor concerns and stabilize the stock.

Investor Sentiment and Cautions Ahead

After a challenging period marked by a 20% drop in automotive revenue, worsened by rising competition from affordable Chinese EV makers and consumer skepticism toward Musk’s political controversies, investors eagerly await signs of a turnaround. Tesla’s sales in key markets have seen year-over-year declines in early 2025, amplifying pressure on the company.

Financial analysts remain cautiously optimistic. Piper Sandler has maintained its buy rating, viewing Tesla’s emerging robotaxi program as a promising development that aligns with their core investment thesis.

However, experts urge temperance. Auto safety specialist Philip Koopman highlights that these early tests don't guarantee immediate safety or scalability. He expects Tesla will rely heavily on remote operators to oversee the fleet and intervene if necessary, underscoring that the technology is still in its nascent stage.

Looking Ahead

While Tesla’s progress onto public roads with unsupervised vehicles marks a potential turning point, the company faces significant short-term challenges amid evolving market dynamics and regulatory scrutiny. Observers will be closely watching how these trials unfold and whether they can translate into a competitive edge in the rapidly advancing autonomous vehicle sector.