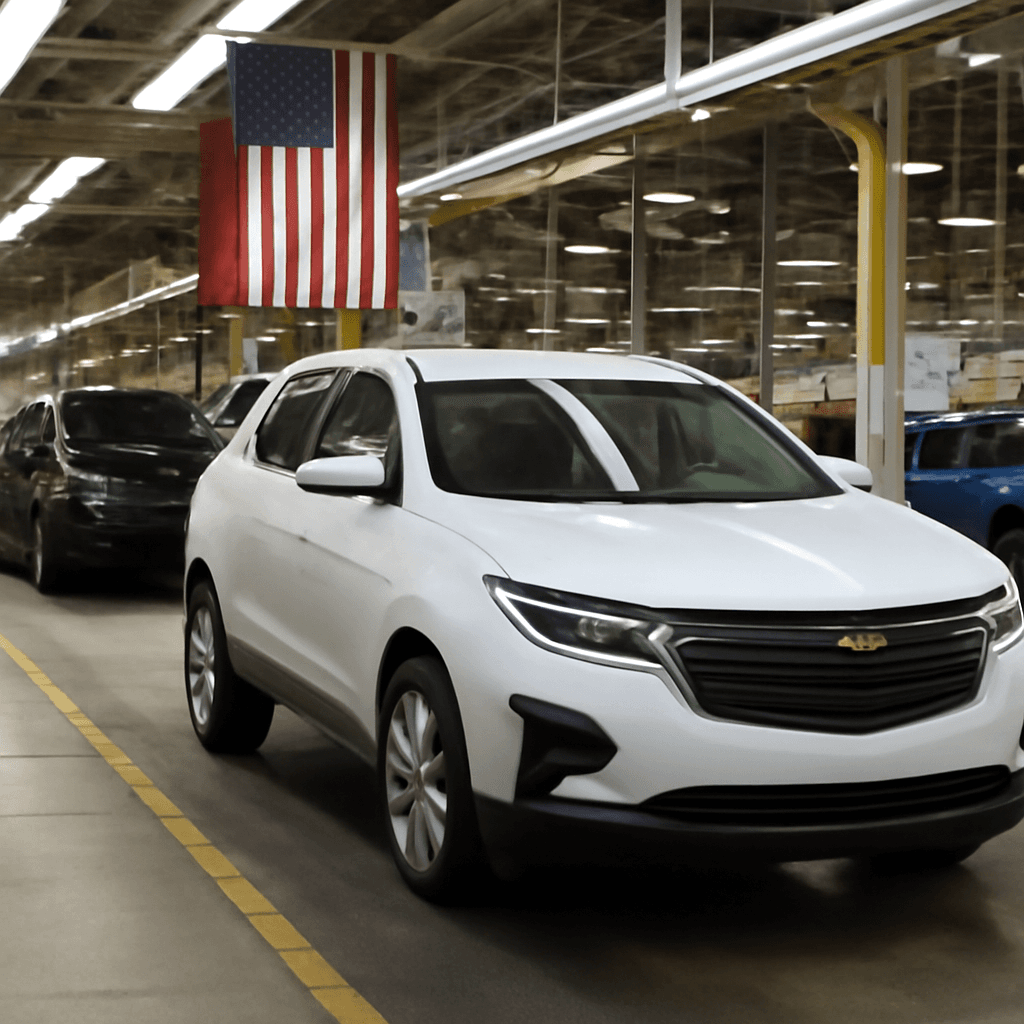

GM Unveils $4 Billion Investment in U.S. Manufacturing

General Motors has announced a significant $4 billion investment to expand production across multiple American assembly plants. This bold move includes relocating the manufacturing of two well-known Chevrolet models currently assembled in Mexico back to the U.S.

Redirecting Production to American Soil

The investment will facilitate adding the Chevrolet Blazer and Chevrolet Equinox assembly to two plants within the United States. Additionally, a large idled facility in Michigan, formerly known for electric vehicle production, will be repurposed to manufacture gas-powered vehicles. These efforts are expected to strengthen GM’s U.S. production capacity, allowing for over two million vehicles assembled domestically each year.

Context: Trade Tensions and Automotive Tariffs

This announcement comes amid escalating trade tensions and tariff impositions between the U.S. and Mexico. Earlier this year, the U.S. government enacted tariffs of 25% on several imported auto parts in May, and tariffs on imported vehicles took effect in April. Despite the lack of progress in trade negotiations, GM appears to be responding decisively by shifting more production to American plants.

Strategic Response to Evolving Market Conditions

GM leadership views this investment as a demonstration of commitment to American innovation and jobs. CEO Mary Barra emphasized the company’s intent to offer a diverse lineup of vehicles while bolstering domestic manufacturing. “We believe the future of transportation will be driven by American innovation and manufacturing expertise,” Barra stated.

Moreover, CFO Paul Jacobson has expressed optimism about the impact of tariffs, suggesting that their effect may be less severe than initially feared. GM plans to navigate the challenges ahead by capitalizing on emerging opportunities and adjusting its operations strategically.

Shifting Focus Amid Changing Priorities

An interesting dimension of this plan is retooling the Orion Assembly plant in suburban Detroit. Previously designated for electric vehicle production, this facility will now prioritize gas-powered vehicles, marking a shift in GM’s approach as they balance between electric and traditional vehicle markets.

What This Means for the Industry and Consumers

- GM’s investment signals confidence in the resilience of the U.S. automotive sector despite trade uncertainties.

- The move strengthens American job support and manufacturing presence.

- Consumers may benefit from a broader range of domestically made vehicles.

- It highlights the ongoing balancing act between tariffs, supply chain management, and production decisions within the automotive industry.

In the ever-evolving landscape of global trade and manufacturing, GM’s $4 billion commitment underscores a strategic pivot to fortify its footprint on home soil, while navigating tariff challenges and shifting consumer demands.