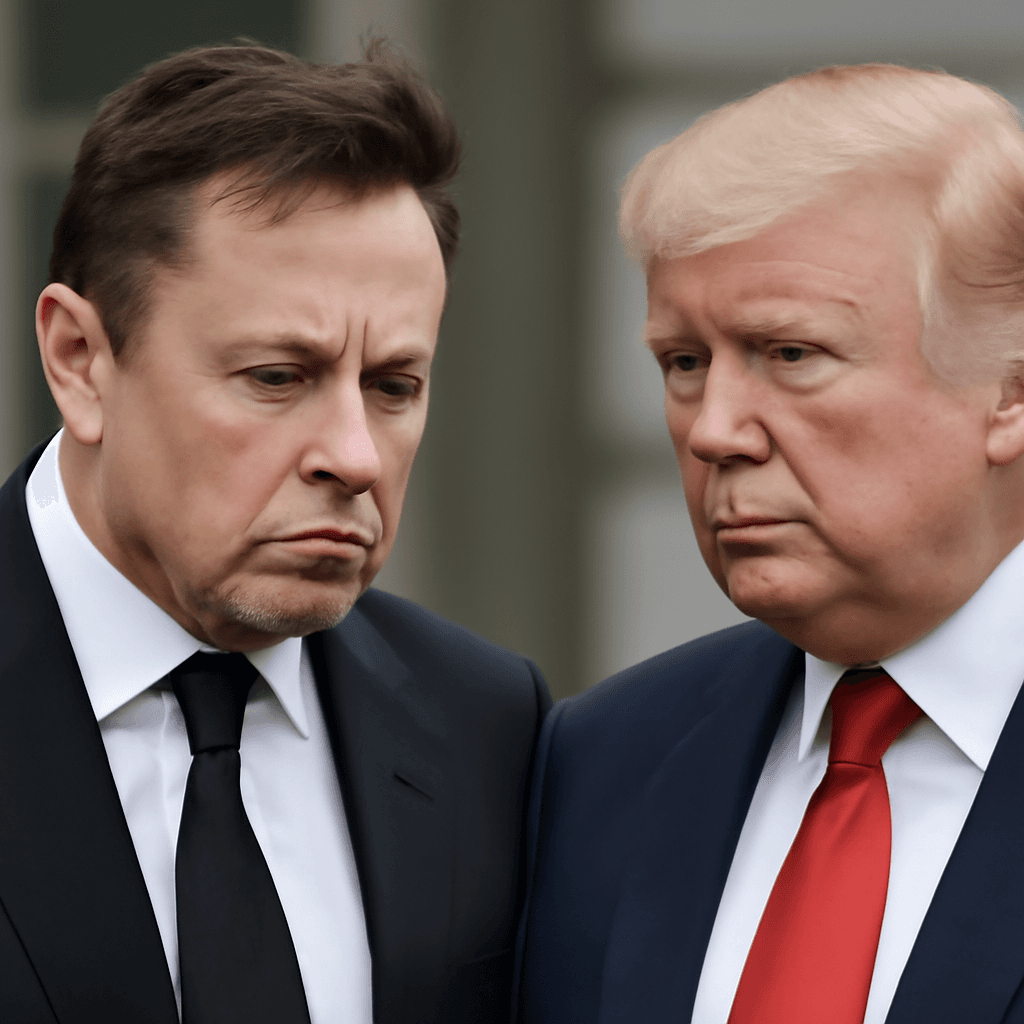

Shares of Tesla, the electric automaker led by Elon Musk, have gained more than 20% in May despite experiencing declining car sales in China and Europe. This rally coincides with Musk’s decision to reduce his involvement in political activities, particularly stepping down from his role in a government initiative aimed at cutting federal agency resources.

While Tesla's stock remains down approximately 12% for the year and trails behind other major-tech companies with a 21% decline year-to-date, May has marked a notable recovery. Tesla’s performance is bolstered by the anticipation surrounding its upcoming launch of an autonomous vehicle ride-hailing service and Musk's commitment to refocusing on his businesses.

Musk recently announced that he will significantly decrease the time spent leading his government special employee role by the end of May, dedicating only a few days per week to government work through the end of the current presidential term. He affirmed his intention to maintain an advisory role while prioritizing his companies.

Despite facing protests linked to Musk’s political ties and endorsements abroad, as well as shareholder demands for increased executive attention on Tesla, the company continues to pursue innovation in self-driving car technology. Tesla plans to launch its long-awaited robotaxi service in Austin, Texas, potentially starting with a limited fleet of Model Y vehicles equipped with the latest autonomous driving technology.

Meanwhile, Tesla's sales in Europe dropped by 50% year-over-year in April, and sales in China decreased by 25% in early 2025. These declines have not deterred investor enthusiasm, partly due to Tesla's competitive advantage in manufacturing, with two significant U.S. assembly plants and a high proportion of domestically sourced parts, aiding resilience amid ongoing trade tariffs.

As Tesla shifts focus back to core business priorities and innovative product launches, the company aims to regain momentum despite current challenges in international markets.