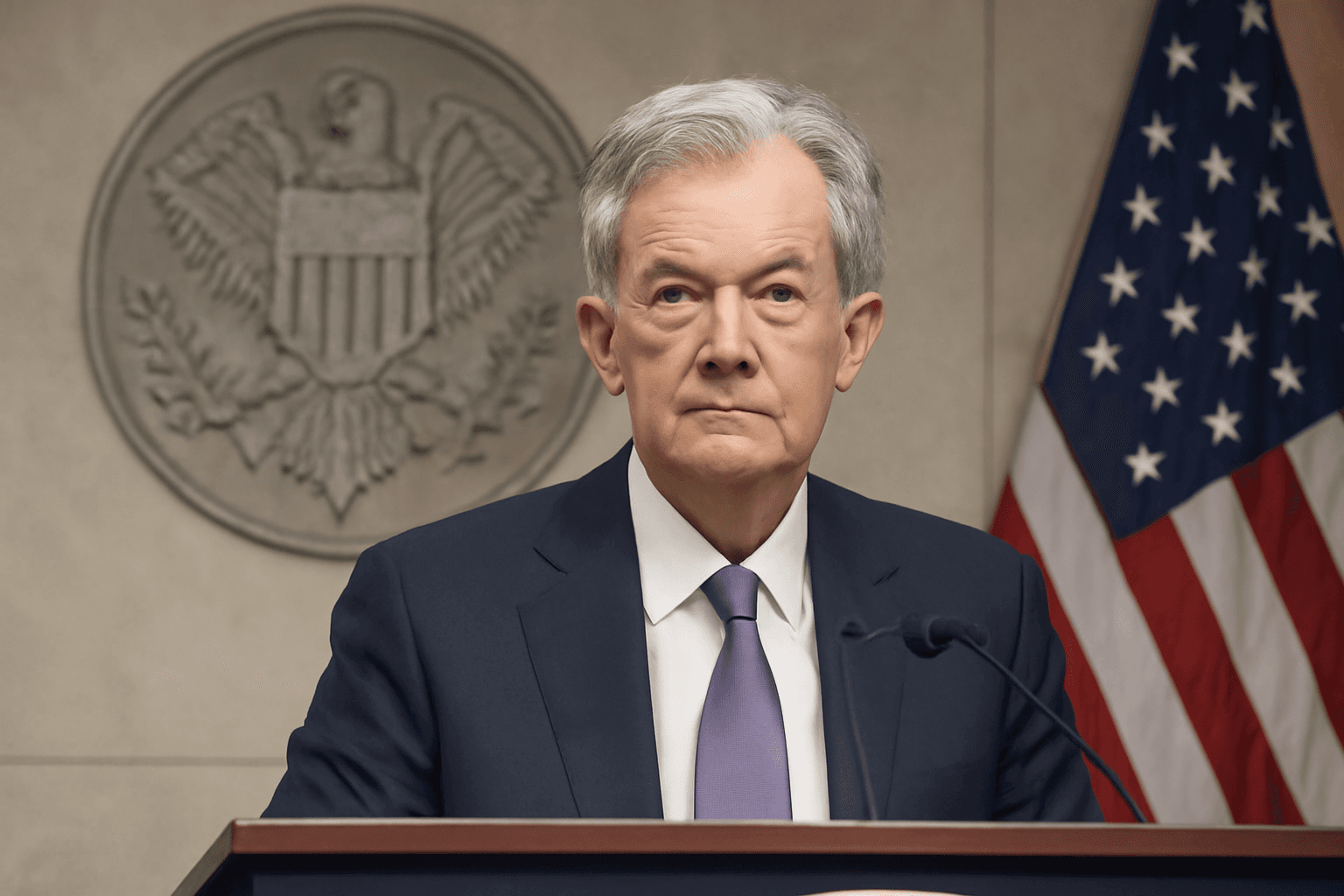

JPMorgan Chase CEO Jamie Dimon has consistently expressed a cautious and often gloomy view of the U.S. economy, even as his bank continues to post record profits and outperform competitors. A review of his two decades at the helm reveals a notable pattern: as JPMorgan’s dominance and profitability have grown, so have his warnings about potential economic threats.

Dimon’s tenure as CEO, beginning in 2006, has spanned periods of intense financial upheaval including the 2008 crisis and its aftermath. Throughout these years, he has guided JPMorgan through acquisitions of troubled banks and positioned the institution as a resilient financial giant. By 2015, Dimon began issuing more frequent cautions about looming financial risks, referring to market volatility and rising U.S. debt levels as clear warning signals.

Under his leadership, JPMorgan has generated multiple record profits, with seven consecutive record years from 2015 to 2024. The bank has expanded its presence across consumer banking, trading, and investment banking, handling over $10 trillion in daily payment volume globally. This growth has propelled JPMorgan to become the most valuable publicly traded financial firm worldwide, backed by heavy investment in technology to sustain its competitive edge.

Despite Dimon’s often stark assessments—such as his warnings in 2022 about an impending economic storm and statements describing current global conditions as among the most dangerous in decades—the broader economy has demonstrated resilience. Consumer spending and employment have remained robust, allowing JPMorgan to maintain strong financial results.

Experts attribute Dimon’s cautious messaging to several factors. Some see it as a strategic effort to manage expectations and protect the bank’s reputation, noting that it is safer for bankers to err on the side of caution than to be overly optimistic. Others believe Dimon’s warnings serve a deeper purpose: to keep his management team vigilant and prevent complacency within the institution’s culture.

Banking inherently involves managing risk, and Dimon’s outlook reflects an awareness of the precarious nature of financial institutions. History has shown that many large banks have faltered due to mismanagement or overconfidence. Dimon has highlighted this reality by referencing firms like Bear Stearns, Washington Mutual, and Lehman Brothers, all of which JPMorgan absorbed during its rise.

While Dimon’s predictions do not always come to pass, analysts acknowledge the wisdom in preparing for adverse scenarios. His foresight regarding rising interest rates, dismissed by many at the time, ultimately proved prudent.

In summary, Jamie Dimon’s persistently cautious perspective stems from a recognition of the volatile and fragile nature of the financial landscape. His approach blends strategic risk management with leadership designed to safeguard JPMorgan’s long-term success amid ongoing geopolitical and economic uncertainties.