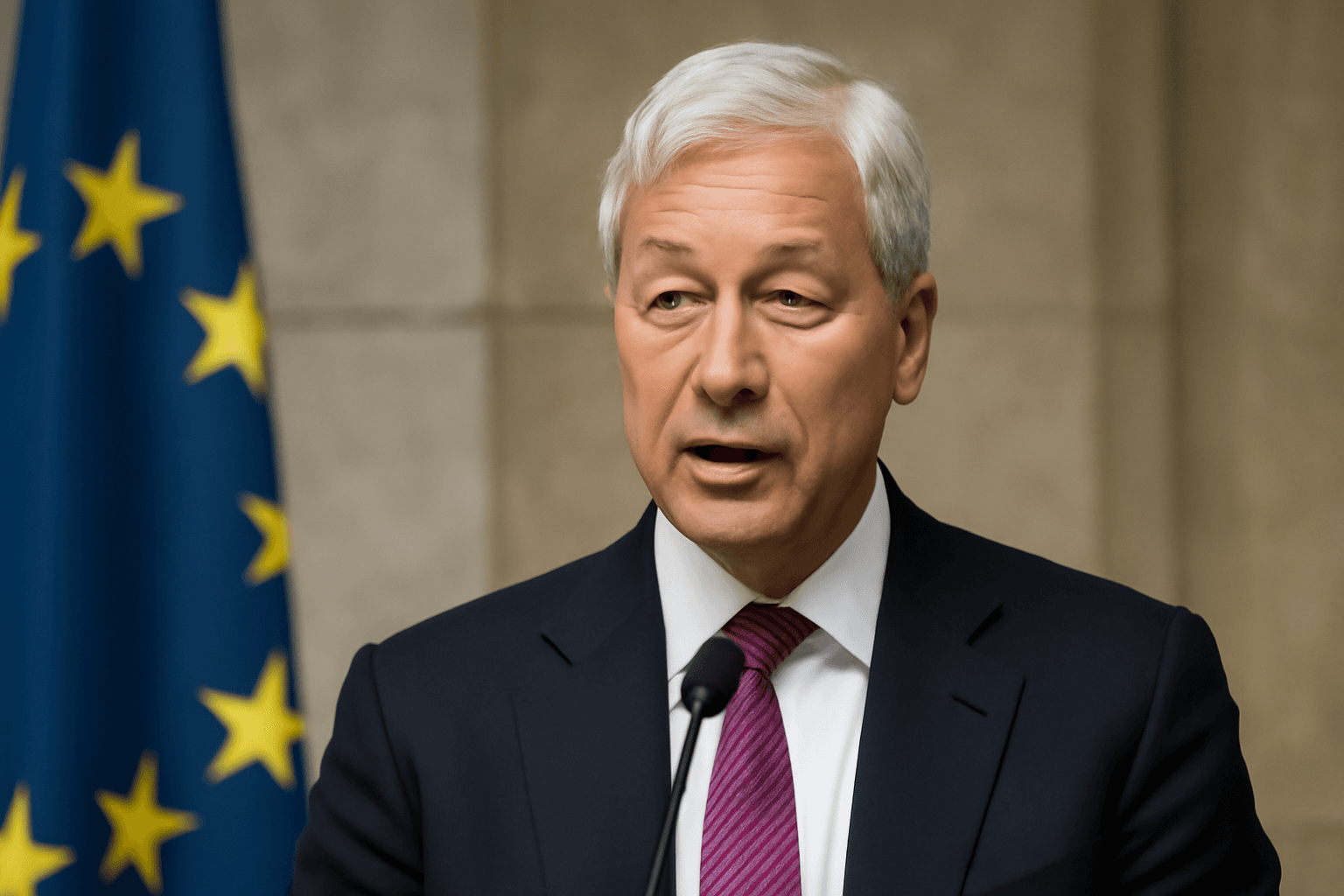

Jamie Dimon Candidly Addresses Europe's Declining Competitiveness

At an event held by Ireland’s Department of Foreign Affairs, JPMorgan Chase CEO Jamie Dimon delivered a stark reality check to Europe’s economic leaders, bluntly stating that the continent is "losing" its competitive edge on the world stage. Speaking on Thursday, Dimon highlighted that Europe's share of global GDP has shrunk dramatically—from 90% of U.S. GDP equivalence down to around 65% in the past decade and a half. This decline contrasts with the U.S. and Asia, where large, globally influential corporations continue to dominate.

"Europe once boasted huge, powerful corporations enjoying vast scale and influence across global markets," Dimon remarked. "While you still have these assets, their prominence and competitiveness are diminishing."

Context: Europe's Structural Challenges Undermining Growth

Dimon’s sharp critique taps into long-debated structural hurdles facing the European Union. Despite Europe's substantial economic potential, persistent fragmentation in trade rules, capital markets, banking regulations, and tax regimes hinder the region's ability to rival the dynamic corporate environments in the U.S. and Asia.

Moreover, geopolitical tensions and shifting global trade relationships—particularly between the U.S. and China—have exposed Europe's risks related to strategic sovereignty in areas such as energy independence, critical minerals supply chains, satellite infrastructure, and digital services.

A Call for a Truly Unified Single Market

Dimon emphasized the need for the EU to integrate further by completing its single market vision. "Everything should be a single market," he urged, envisioning a future with common banking regulations, disclosure standards, stock exchange rules, transparency laws, and uniform climate policies.

This harmonization would not only facilitate investment but could ultimately foster the scale and innovation necessary for Europe's corporations to flourish globally.

Investor Sentiment and Economic Outlook in 2025

The first half of 2025 saw increased investor optimism towards Europe, sparked by expectations of significant fiscal stimulus in Germany, rising defense budgets, more favorable interest rates, and a relatively stable political climate compared to the volatility seen in the U.S. market.

This optimism has led to notable outperformance in European equity markets and attracted private equity interest seeking undervalued opportunities.

Yet, significant uncertainties remain—especially regarding the long-awaited EU-U.S. tariff agreement, whose status remains uncertain as of this writing, threatening to undermine trade prospects.

Dimon's Perspective on U.S. Markets and Inflation Risks

Dimon's insights also covered the U.S. economic landscape, where he identified a troubling complacency among investors concerning recent tariff escalations announced by the White House, including a 50% tariff on Brazilian imports, high duties on copper, and threats of dramatically increased pharmaceutical tariffs.

Despite these shocks, stock indices like the S&P 500 and Nasdaq Composite recently recorded new highs, a scenario Dimon described as "complacency in the markets" with participants becoming "desensitized" to policy volatility.

Of particular concern to Dimon is inflation’s stubbornness. He puts the probability of future Federal Reserve interest rate hikes at 40-50%, double the market's current 20% estimate, warning that inflationary pressures could force the Fed’s hand to tighten policies further.

Echoing his previous comments from June, Dimon said the U.S. economy faces risks of a downturn in the coming months, with economic data potentially worsening.

Expert Insights: What This Means for Policymakers and Investors

- For Europe: Dimon’s remarks underscore urgent conversations needed among EU policymakers about deepening integration and reforming fractured regulatory frameworks. Without decisive action, Europe's economic influence risks further erosion.

- For the U.S. and Global Markets: The perceived market complacency around tariffs and inflation could expose investors to sudden shocks if inflation escalates or geopolitical tensions worsen, and if the Federal Reserve opts for more aggressive rate hikes.

- For Businesses and Investors: Companies with global supply chains and investors should brace for volatility driven by trade disputes and changing monetary policies. Prudent risk management and strategic diversification are paramount.

Conclusion: Europe's Crossroads and the Global Economic Balancing Act

Jamie Dimon's candid assessment reveals the challenges and inflection points facing both Europe and the broader global economy. Europe's ambition to reclaim competitiveness will hinge on policy unity and bold reforms, while U.S. markets must navigate inflationary risks and geopolitical uncertainty carefully.

These dynamics highlight a larger narrative: in an interconnected world, economic leadership depends as much on adaptability and integration as on size and wealth.