Unpacking Trump's 30% Tariff Threat Against the European Union

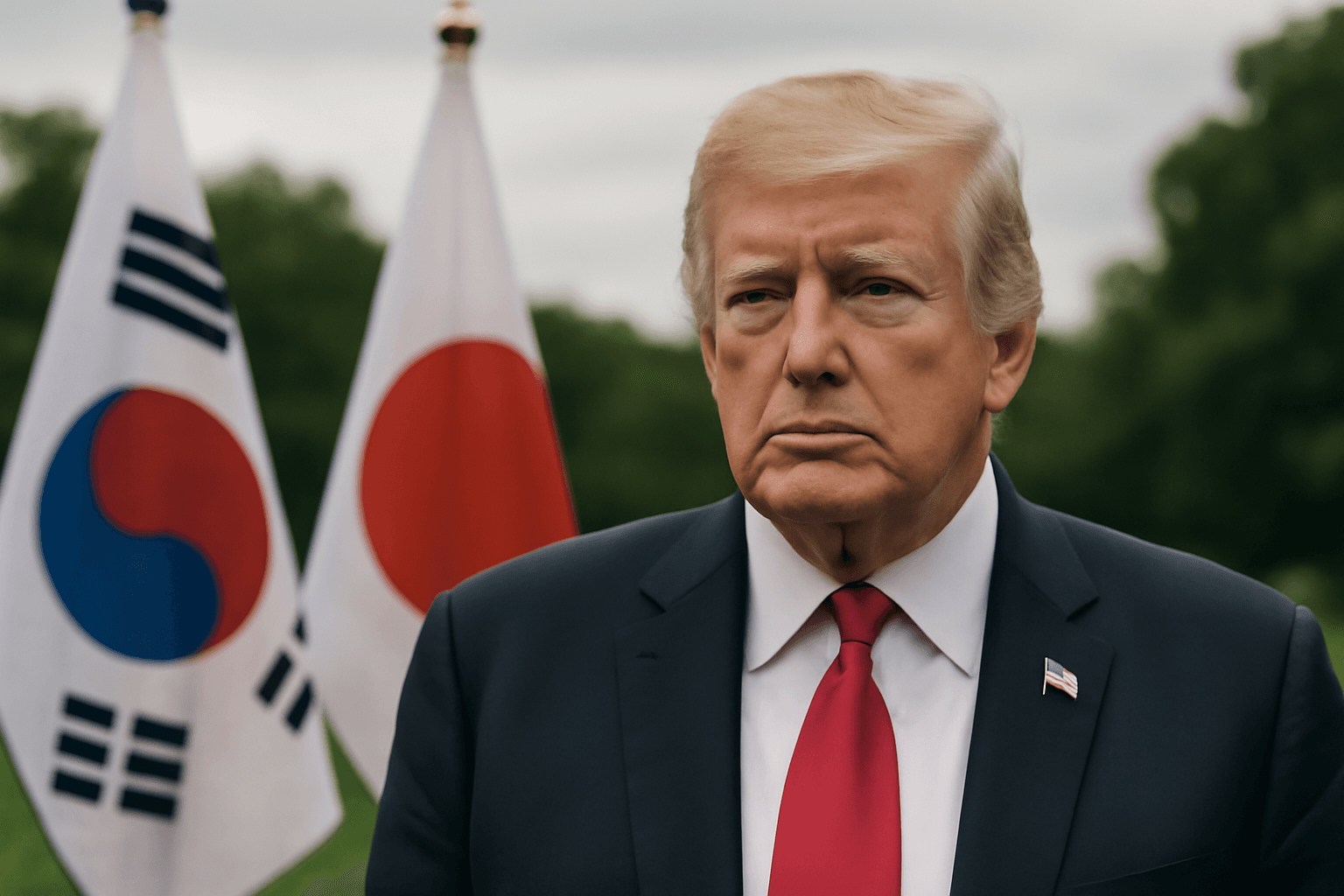

In a development that has sent ripples across global trade markets, U.S. President Donald Trump announced plans to impose a 30% tariff on imports from the European Union, starting August 1, 2025. This aggressive move escalates ongoing tensions between the world’s largest economic blocs and poses significant questions about the future of transatlantic commerce.

The Weight of EU-U.S. Economic Ties

The U.S. and the EU share the largest bilateral trade and investment relationship worldwide, accounting for nearly 30% of global trade in goods and services. According to EU statistics, their combined economic output represents a staggering 43% of global GDP. In 2024 alone, trade between these giants reached 1.68 trillion euros ($1.96 trillion), equivalent to roughly 4.6 billion euros exchanged daily.

This intense economic interdependence is why the threat of enhanced tariffs could have far-reaching consequences beyond simple price hikes.

Which Sectors Are Most Vulnerable?

The tariff threat puts several critical sectors in jeopardy. Particularly exposed are:

- Pharmaceuticals: With many drugs and medical products exported from EU countries like Denmark and Ireland, higher tariffs could lead to increased costs for American consumers.

- Automotive Industry: Germany and Italy—key automotive manufacturing hubs—could face major disruptions as U.S. tariffs inflate prices of vehicles and parts.

- Aircraft Manufacturing: Given the EU’s significant aerospace exports, particularly from countries like France, tariff-induced cost pressures could ripple through this high-tech sector.

Moreover, Trump has indicated this 30% tariff would be in addition to existing sector-specific tariffs: 50% on steel and aluminum and 25% on automobiles. Such overlapping tariffs risk piling up costs and complexities for companies reliant on global supply chains.

Political and Economic Implications

From a policy perspective, Trump’s announcement can be viewed through multiple lenses.

- U.S. Trade Deficit Concerns: Trump cites the longstanding U.S. trade deficit with the EU, where the bloc holds a substantial surplus in goods trade—about 198 billion euros. However, when services are included, the EU’s surplus narrows to roughly 50 billion euros—less than 3% of total bilateral trade.

- EU’s Response Strategy: The European Union has expressed willingness to narrow this trade imbalance by increasing imports of U.S. products, including defense equipment and liquefied natural gas (LNG). Still, talks remain delicate, with Brussels cautious about conceding too much.

- Negotiations and Deadlines: Ahead of the August 1 deadline, EU ministers gathered in Brussels to strategize a response. Analysts from UBS assess that while an agreement is still attainable, U.S. demands for full market access with zero tariffs across the board complicate negotiations, increasing the risk of mutual economic harm.

Regional Impact: Who Stands to Lose Most?

Within the EU, countries such as Germany, Italy, and Ireland are likely to absorb the brunt of these tariffs, given their heavy reliance on exports to the U.S. market in vulnerable sectors. For millions of workers and businesses tied to these industries, the threat translates into uncertain jobs, fluctuating prices, and disrupted supply chains.

Expert Insight: A Fragile Trade Balance in a Globalized Era

Trade experts emphasize that this tariff escalation comes at a delicate moment in global diplomacy. With supply chains already strained by recent geopolitical conflicts and pandemic-induced disruptions, additional costs imposed by border taxes could trigger inflationary pressures in both economies.

Moreover, the U.S.-EU relationship extends beyond economics. It’s a cornerstone of geopolitical stability and cooperation on challenges such as climate change, security, and technology governance. Elevated trade friction raises questions about whether economic protectionism might undermine broader transatlantic alliances.

What Lies Ahead?

Ahead of key moments in late July and early August, several scenarios remain possible:

- Negotiated Settlement: Both sides could reach a compromise involving tariff reductions and increased reciprocal purchases.

- Tariff Implementation: Should negotiations fail, steep tariffs may come into force, leading to market volatility and retaliatory EU measures.

- Extended Negotiations: The U.S. administration may choose to delay or phase in tariffs to allow more dialogue.

Whatever unfolds, businesses, consumers, and policymakers will need to stay alert and adaptive to the inevitable shifts this trade standoff will bring.

Editor’s Note

Trump’s tariff threat highlights the fragility of even the most robust international trade relationships when political and economic interests collide. While tariffs can serve as negotiation leverage, they carry the danger of unintended fallout affecting industries and consumers on both sides. This unfolding saga also raises broader questions about the future of globalization in an era marked by rising protectionism.

As readers, staying informed about these developments—from Europe’s manufacturing hubs to the shelves of American supermarkets—offers critical insights into how intertwined and vulnerable global trade remains. What does this mean for the average consumer’s wallet? How will it redefine U.S.-EU diplomacy? These questions remain open, demanding close watch as events progress.