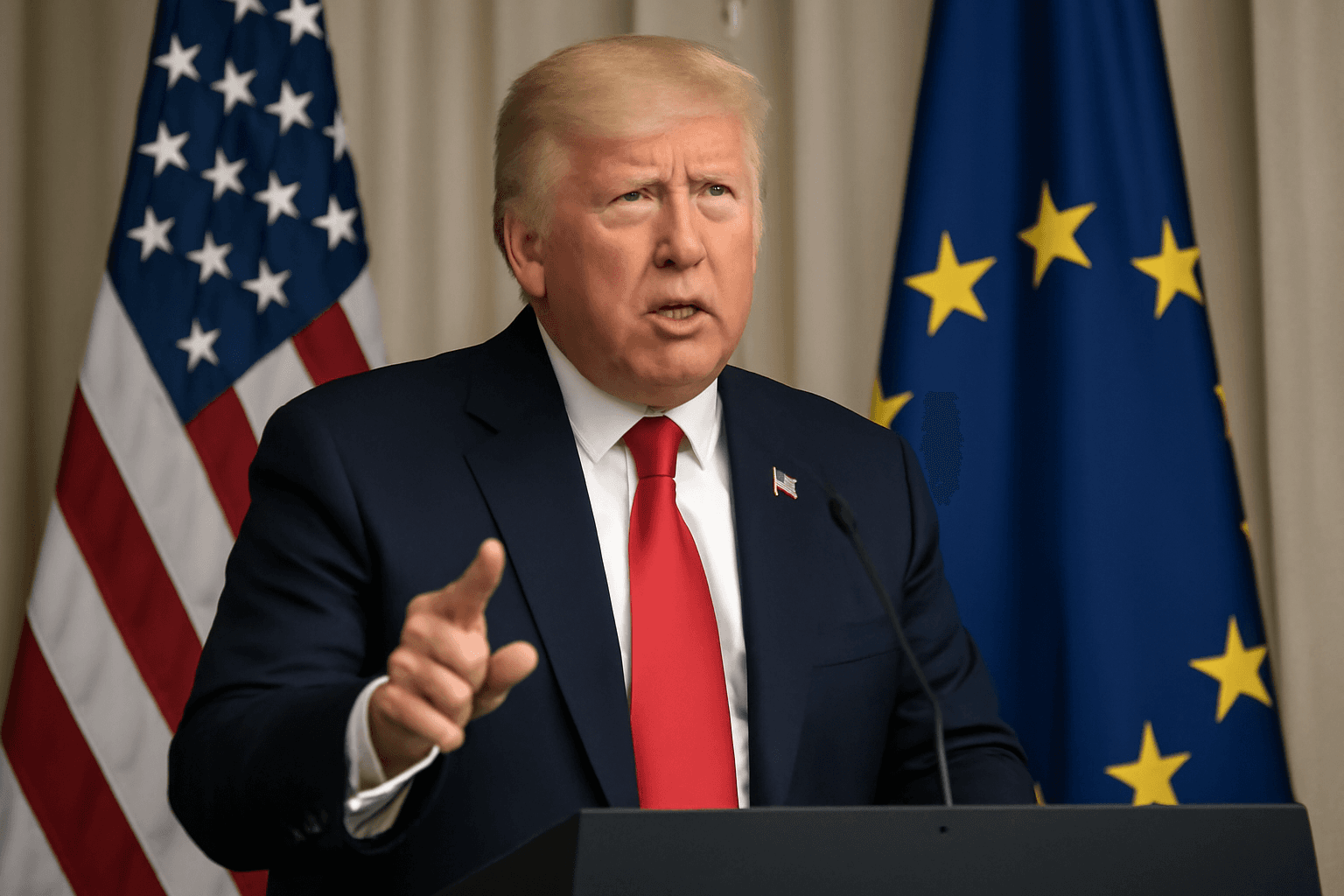

Trump Sets Sights on EU Trade Talks Following U.S.-Japan Agreement

After clinching a significant trade framework deal with Japan, U.S. President Donald Trump has turned his attention to the European Union, signaling a new phase in his administration's international trade strategy. Speaking on the evening of July 22, 2025, Trump remarked, "We have Europe coming in tomorrow, and the next day, we have some other ones coming in," although he did not divulge further specifics.

This pivot comes with the clock ticking toward an August 1 deadline for the imposition of 30% tariffs on imports arriving in the U.S. from the European Union. The looming tariffs have escalated tensions, leaving both sides grappling with the potential economic fallout.

Tariff Deadline and Rising Stakes for U.S.-EU Relations

The Trump administration has maintained a firm stance, refusing to amend the timetable for implementing these punitive levies. On the EU’s side, retaliatory tariffs targeting American goods worth €21 billion remain on hold until August 6, as Brussels prepares additional countermeasures. These tit-for-tat tariffs have intimate ties to broader geopolitical frictions, complicating efforts for a mutually beneficial agreement.

Positive Momentum From U.S.-Japan Trade Deal

The recently announced deal with Japan has buoyed optimism among economists and trade analysts. Deutsche Bank Research highlighted this sentiment in a note published Wednesday, stating that "the Japan deal has significantly raised hopes that the EU might also be able to reach a trade deal." This optimism stems largely from the approach to automobile tariffs.

Katsuhiko Aiba, an economist at Citi, emphasized that the deal’s auto tariff reduction—from 25% to 15%—without export caps for Japan could serve as a blueprint for European negotiations. Considering autos are among the top three U.S. import categories from the EU, this could be a critical area of compromise.

EU’s Trade Priorities and Challenges

The EU has long sought exemptions or preferential tariffs on select sectors within any trade deal, particularly in automobiles—a cornerstone export. The Biden administration’s willingness to reduce automotive tariffs with Japan underlines a potential path forward, suggesting the EU might accept a baseline tariff rate in exchange for sector-specific concessions.

Market reactions follow this trajectory: the Stoxx Europe 600 index edged up 1% on Wednesday morning, with the auto sector surging around 3.5%, reflecting investor hopes of easing trade frictions.

Diplomatic Engagements and Broader Geopolitical Concerns

While Europe awaits tangible progress in trade talks, European Commission President Ursula von der Leyen and European Council President Antonio Costa are en route to Asia to engage directly with Japanese officials and prepare for the upcoming EU-China summit. These meetings underscore the EU’s delicate balancing act amidst U.S. protectionism and intensifying Sino-Western tensions.

Experts warn that Trump’s aggressive trade policies could inadvertently drive a wedge between the EU and China, pressuring Brussels to adopt a more confrontational stance toward Beijing. Recent communications between EU Trade Commissioner Maros Sefcovic and Chinese Commerce Minister Wang Wentao—reportedly an important video call—reflect ongoing sensitivities and dialogues but have yet to yield public outcomes.

Expert Insights: What Lies Ahead?

- Potential Trade Model: The U.S.-Japan deal’s structure — particularly in automotives — could be the template for resolving tariff disputes with the EU.

- Tariff Deadlines as Catalysts: The August 1 deadline creates high stakes, forcing negotiators toward a resolution or risking escalated trade warfare.

- Economic Impact: Both U.S. consumers and European exporters face heightened uncertainty, with possible price hikes, supply chain disruptions, and market volatility looming.

- Geopolitical Dimensions: U.S. pressure might realign EU-China relations, influencing global trade policies beyond the Atlantic.

Editor’s Note

The unfolding trade negotiations between the U.S. and EU at such a critical juncture encapsulate broader themes of global economic recalibration, national sovereignty, and diplomatic strategy. While the U.S.-Japan agreement offers a promising precedent, the complexity of automotive tariffs and retaliatory measures requires nuanced dialogue and political will. Observers should watch closely how economic interests, political posturing, and transatlantic alliances evolve in the shadow of looming deadlines—each with profound consequences for global markets and international relations.

For policymakers and stakeholders alike, the question remains: can these two economic giants craft a deal that balances protectionism with cooperation in an increasingly interconnected world economy?