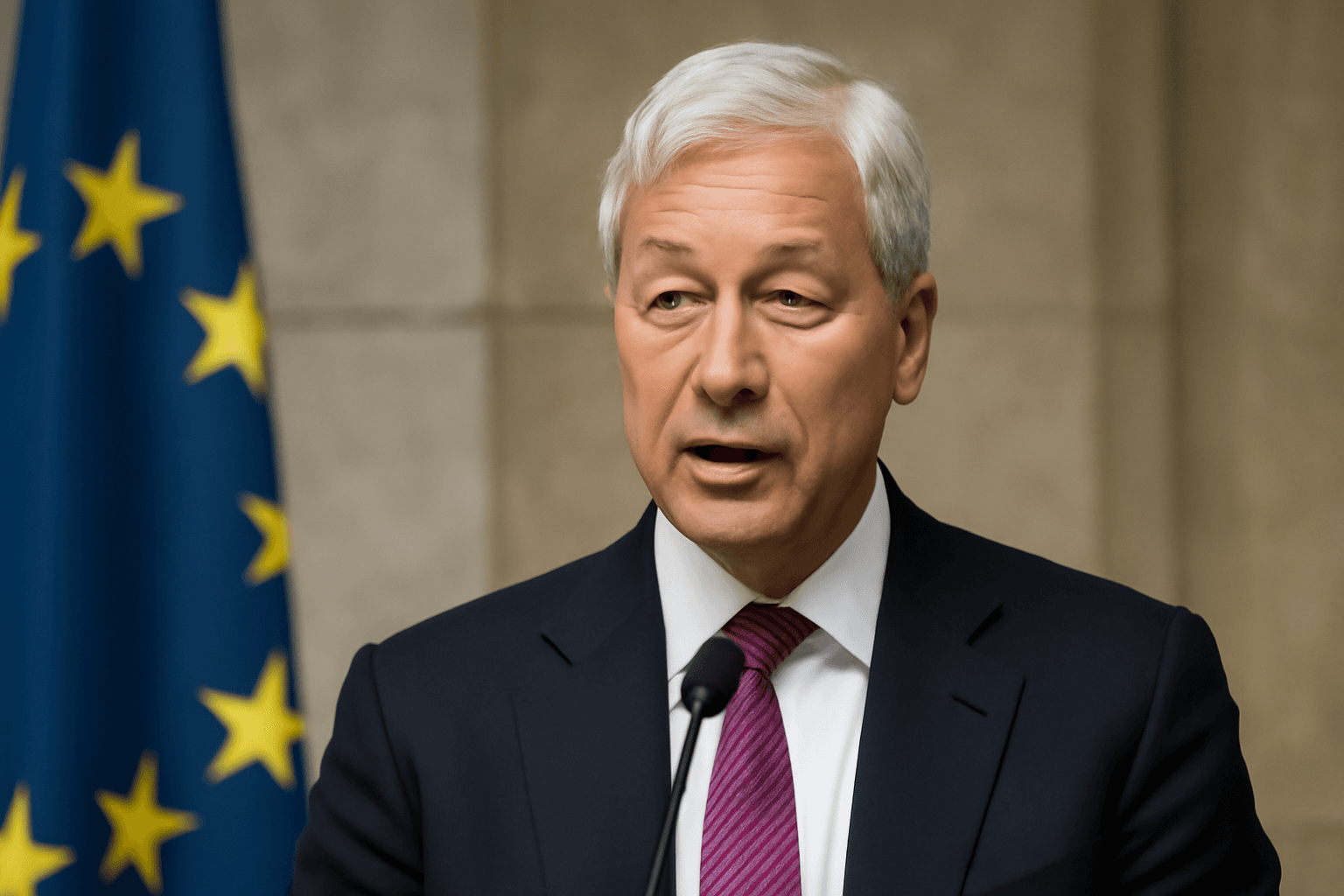

JPMorgan CEO Jamie Dimon Issues Cautious Outlook on U.S. Economy

Jamie Dimon, the CEO of JPMorgan Chase since 2006, has signaled that the U.S. economy could face deterioration in the near future. Speaking at a recent Morgan Stanley conference, Dimon expressed concern that the post-pandemic fiscal stimulus and monetary support powering the economy are now fading, leaving the country vulnerable to a downturn.

Signs Point Toward a Softer Landing

Dimon remarked, "I think there's a chance real numbers will deteriorate soon," underscoring his cautious stance despite continued employment and consumer spending growth in 2025. While surveys highlight declining business and consumer confidence amid trade tensions, Dimon noted that inflection points seldom coincide neatly with sentiment indicators.

He envisions the anticipated ‘soft landing’ to be less robust going forward, expecting slight declines in employment coupled with a modest rise in inflation. Dimon also emphasized the added complication of reduced immigration, which could influence labor market dynamics.

Economic Data Reflects Growth Slowdown

Recent statistics for May confirm the cooling trend, showing both job growth and inflation have decelerated compared to previous months. This slowdown aligns with Dimon’s guarded predictions for the coming quarters.

Private Credit: An Emerging Risk Area

Dimon also highlighted concerns surrounding the expanding private credit market on Wall Street. Unlike banks that facilitate and then offload many private credit deals, long-term investors fully shoulder associated risks. As such, Dimon warned fund managers against aggressively buying credit assets at current prices and spreads.

"Do I think now is a good time to buy credit? No, I wouldn’t be buying credit today at these prices," he stated, cautioning investors to tread carefully amid growing economic uncertainty.

Looking Ahead

While Dimon’s assessment is cautious, it’s far from overtly pessimistic. It serves as a prudent reminder of the unpredictable terrain the U.S. economy navigates post-pandemic. As government support subsides and external factors such as immigration and global trade continue to influence the outlook, stakeholders will be closely monitoring upcoming economic signals for clearer direction.