Introduction to the 'Anywhere But USA' Investment Trend

Emerging concerns about the stability of the U.S. economy, coupled with fluctuating trade policies and fiscal uncertainties, have sparked a new investment movement known as the "Anywhere But USA" (ABUSA) trade. This trend signifies investors' growing preference for diversifying beyond traditional U.S. markets in search of balanced, global growth opportunities.

Factors Driving the Shift Away from U.S. Assets

Several key developments have influenced investor sentiment:

- The unpredictability of U.S. trade policies, including rapid changes and reversals.

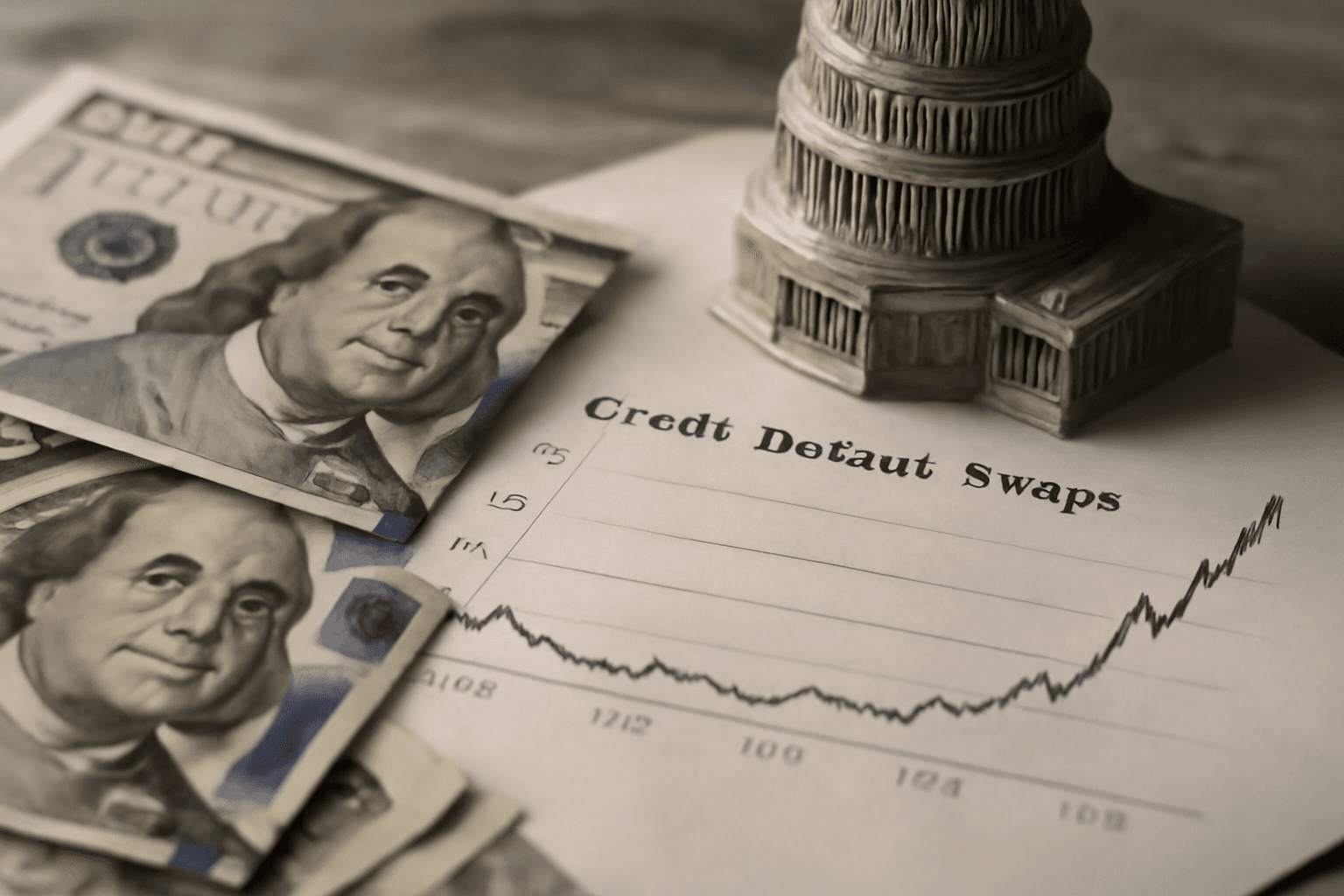

- Concerns over escalating U.S. fiscal deficits and government spending.

- Declining confidence in the U.S. dollar, which has lost over 8% since the start of the year, heading for its fifth consecutive month of losses.

- Political and ideological factors affecting the investment climate under the current administration.

- International consumer boycotts and reduced tourism to the U.S. due to policy controversies.

Expert Perspectives on Global Market Recalibration

Investment professionals highlight that the ABUSA movement is less about contrarian positioning and more about recalibrating portfolios for global diversification. Key insights include:

- Global balance and multi-polar growth: Markets such as emerging economies, Europe, and Japan are offering improving fundamentals and attractive risk/reward profiles.

- Global diversification importance: The era of exclusive reliance on U.S. assets, supported historically by the dollar's strength, is diminishing.

- Emotional and ideological influences: Investment decisions are increasingly affected by perceptions of policy unpredictability and government behavior.

Promising Alternative Markets Beyond the United States

Europe's Renewed Appeal

Europe is emerging as a compelling destination for investors, buoyed by:

- A broad decline in inflation rates.

- Historic shifts in fiscal policies, especially in Germany.

- Ambitious plans to increase defense spending across the region.

- Strong market performance, with the pan-European Stoxx 600 index up approximately 7.7% year-to-date.

- The euro rising over 10% against the U.S. dollar in 2025.

- Exceptional growth in sectors like aerospace and defense, nearly 50% gains this year.

Emerging Markets and Asia

Emerging economies, notably India, are attracting increased capital inflows due to vibrant economic activity and supportive foreign capital policies. India, the world's fifth-largest economy, posted robust growth of 7.4% in Q1, highlighting its appeal. Additionally, emerging market debt—both sovereign and corporate—is gaining attention as a valuable asset class in a softening dollar environment.

United Kingdom and Safe-Haven Assets

UK equities and government bonds, known as gilts, are also drawing investor interest, especially after earlier sell-offs created potential buying opportunities. These assets trade at significant discounts compared to U.S. markets, adding to their attractiveness.

Investor Outlook and Strategic Recommendations

Financial planners report increased client demand for asset allocation outside U.S. borders, driven by factors such as market volatility, policy uncertainty, and comparatively weaker U.S. stock performance. However, experts caution that the trend could reverse if U.S. stock valuations become more favorable, noting that a weakening dollar has improved the relative cost of U.S. equity for foreign investors by up to 10%.

The consensus encourages investors to recognize the emerging multi-polar global growth landscape and to evaluate whether diversified international holdings could offer superior long-term returns compared to concentrated U.S. exposure.