British neobank Starling Bank revealed a significant 26% decline in its annual profit before tax, attributing the drop to a regulatory fine and complications linked to Covid-era business loan fraud.

For the fiscal year ending March 31, 2025, Starling posted a profit before tax of £223.4 million ($301.9 million), down from the previous year. While revenue rose modestly by approximately 5% to £714 million, this growth paled compared to the more than 50% increase seen in the prior fiscal year.

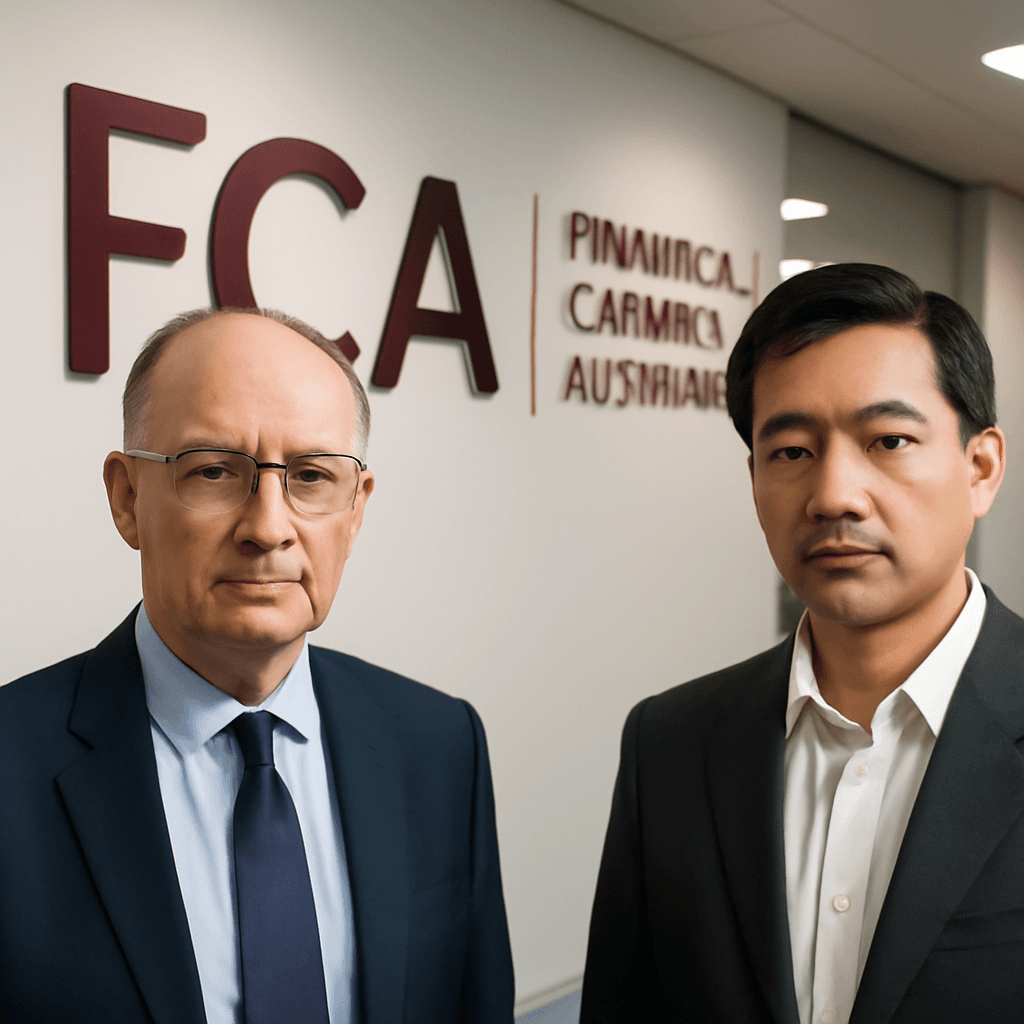

The bank absorbed a £29 million penalty from the UK Financial Conduct Authority (FCA) due to shortcomings in its financial crime prevention measures. In addition, Starling disclosed issues concerning the Bounce Back Loan Scheme (BBLS), a government-backed program launched during the coronavirus pandemic to provide businesses with accessible financing.

Starling was among the authorized lenders offering BBLS loans, which were guaranteed 100% by the government to protect lenders against defaults. However, the bank found a subset of BBLS loans that might not have met the required government guarantee criteria because of weaknesses in historical fraud detection processes.

In cooperation with the British Business Bank, Starling proactively reported these concerns and agreed to forfeit government guarantees on the identified loans, resulting in a £28.2 million provision recorded in its accounts. Additionally, the bank maintained an Expected Credit Loss provision of £800,000 related to loans where guarantees may no longer apply.

"This is a legacy issue which we dealt with transparently and in full cooperation with the British Business Bank," stated Declan Ferguson, Starling's Chief Financial Officer.

Established as a licensed UK bank in 2018, Starling counts Goldman Sachs, Fidelity Investments, and the Qatar Investment Authority among its investors. Despite its growth, the neobank continues to face intense competition from established banks and fintech rivals like Monzo and Revolut.