Rising Treasury Yields Signal Opportunity for Select Stocks

Recent increases in U.S. Treasury yields have caught the attention of investors and analysts alike. The 10-year Treasury yield recently approached 4.43%, nearing the key 4.5% threshold, up from 4.01% in early April 2025. Meanwhile, the 30-year bond yield has climbed to just below 5%, marking a significant rise from 4.41% earlier in the year. These shifts reflect concerns surrounding the U.S. economy, government debt levels, and fluctuations in the dollar’s value.

Economic and Policy Context Affecting Treasury Yields

Investor sentiment has been shaped by domestic and international events, including uncertainties in U.S. trade policy. Notably, a recent ruling by the Court of International Trade struck down several tariffs imposed on imported goods, but the White House promptly appealed, emphasizing the administration’s stance on addressing what it considers a national emergency. This legal back-and-forth has added volatility and contributed to shifting market dynamics. Despite these challenges, risk appetite among investors has increased over the past two months, reducing demand for Treasury securities.

Identifying Stocks Poised to Outperform Amid Rising Yields

Against this backdrop, financial analysts have analyzed stock performance relative to month-over-month changes in the 10-year Treasury yield since 2014. Financial sector stocks dominate those demonstrating strong positive correlations with rising yields, representing six of the top ten performers.

Leading Stocks Benefiting from Higher Yields

- Prudential Financial leads with a 48% correlation to 10-year Treasury yield movements. Despite a 12% decline in 2025, Prudential offers a compelling dividend yield of 5.2%. Nearly two-thirds of analysts maintain a hold rating, with median price targets suggesting a potential 9% upside. The company also exceeded earnings expectations in its first-quarter 2025 report.

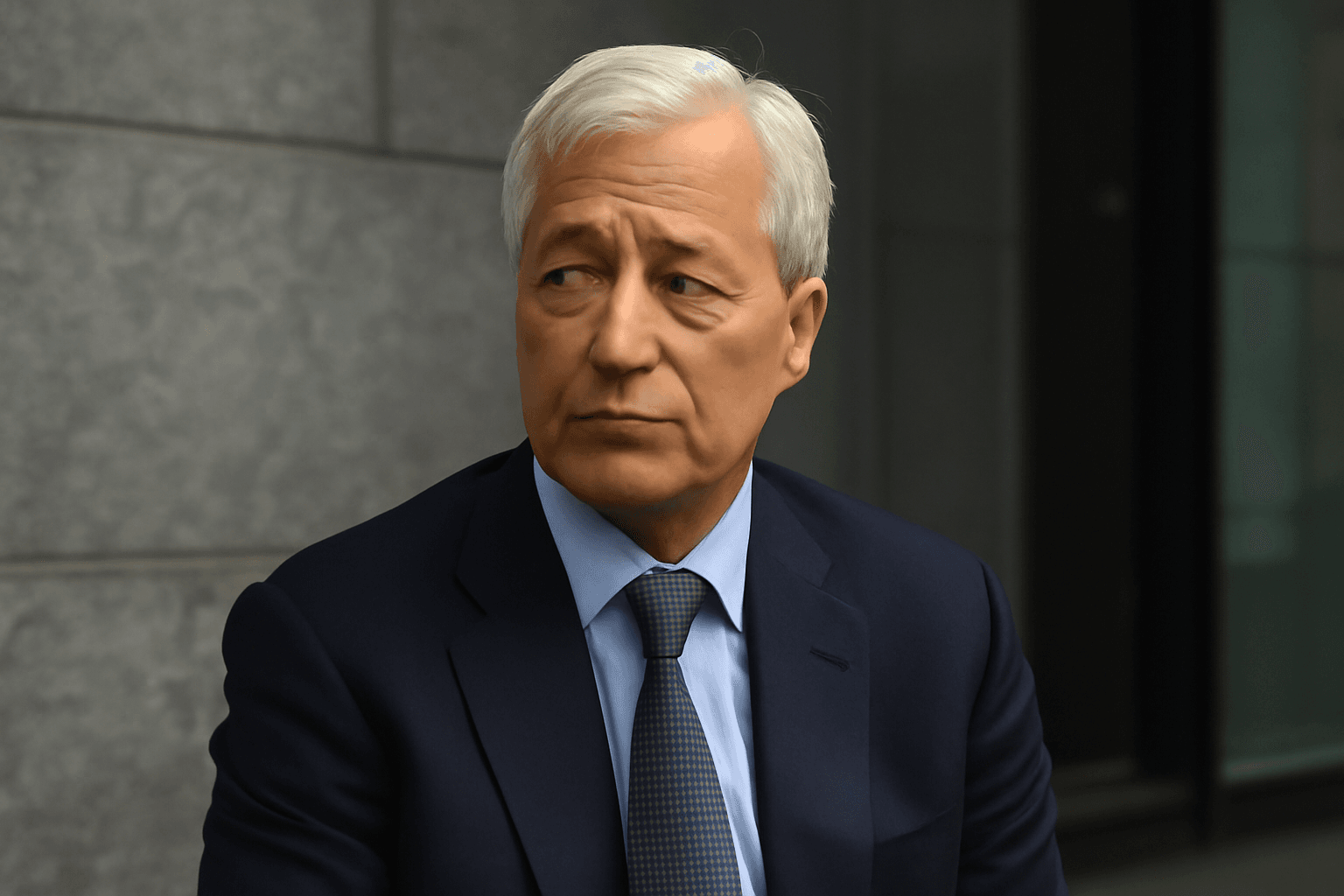

- JPMorgan Chase shows a 35% correlation with rising Treasury yields. The bank’s shares have appreciated more than 10% this year, outpacing the broader S&P 500's under 1% gain. With a dividend yield of 2.1%, JPMorgan has consistently delivered strong trading profits and beat analyst estimates in the first quarter. Approximately 59% of market analysts rate JPMorgan shares as a buy, forecasting an additional 3% gain.

- Other notable performers include Charles Schwab and MetLife, both demonstrating resilience amid shifting interest rates.

Conclusion

With Treasury yields climbing, select financial stocks appear strategically positioned to benefit. Investors seeking opportunities amidst changing interest rate environments should consider companies with proven correlations to yield movements, solid dividend returns, and positive earnings momentum.