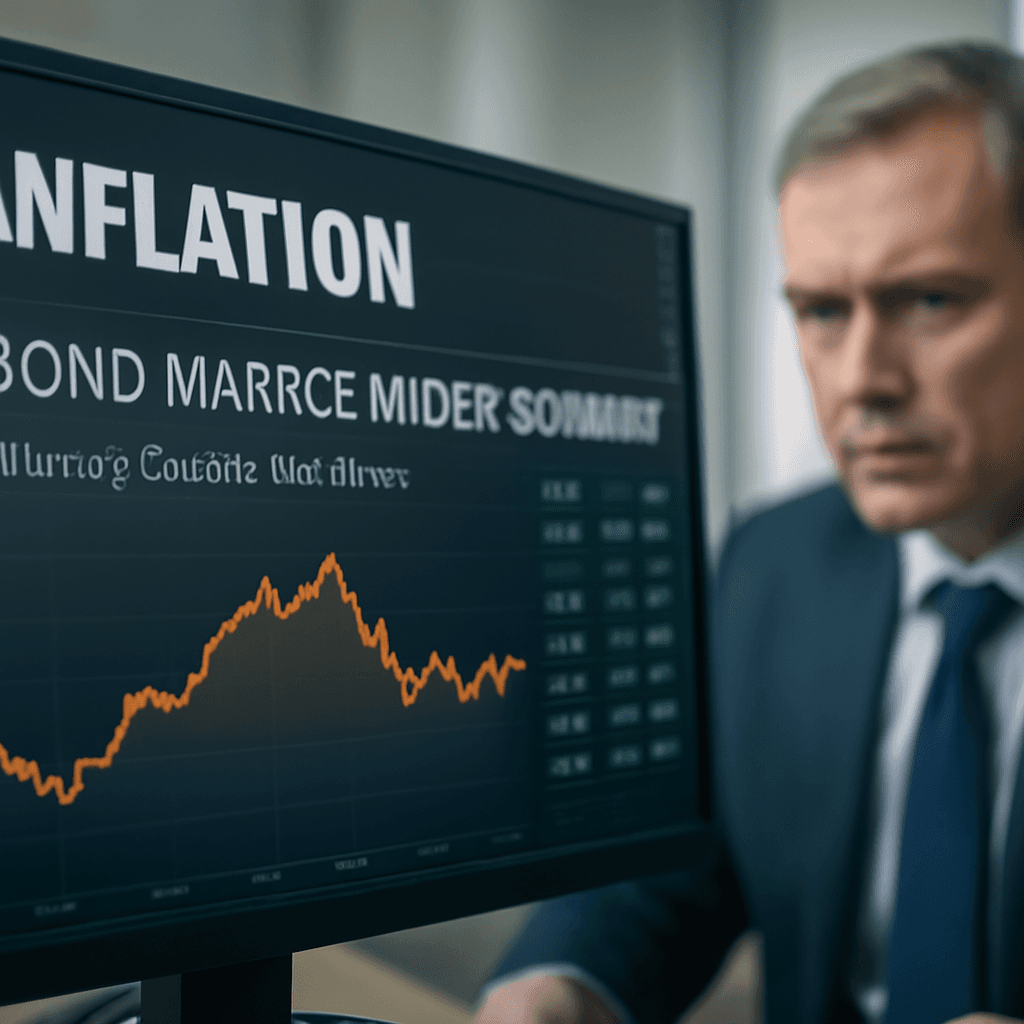

ECB Poised for Rate Cut Amid Economic Uncertainty

The European Central Bank (ECB) is widely anticipated to reduce its key interest rate by 25 basis points, lowering the deposit facility rate to 2% from its mid-2023 high of 4%. This expected decision reflects ongoing challenges facing the eurozone's economy and monetary policy adjustments.

Current Economic Context

Inflation across the eurozone has eased back to the ECB's 2% target, with consumer prices rising just 1.9% in May 2025. Despite this, economic growth remains moderate. The eurozone's gross domestic product increased by only 0.3% in the first quarter of 2025, signaling subdued momentum.

Adding complexity, the region confronts external and internal uncertainties, including the impact of international trade tensions stemming from U.S. tariff policies and potential retaliatory measures. Additionally, significant EU initiatives such as defense spending reforms and energy transition plans introduce further variables to economic forecasts.

Future Monetary Policy Trajectory

Market participants expect additional rate cuts throughout the year, though the ECB is unlikely to provide clear forward guidance, opting instead to maintain flexibility through a meeting-by-meeting approach.

- A 25-basis-point cut at this week's meeting is considered almost certain.

- Further reductions are possible in July, September, and December, possibly totaling three cuts this year.

- The ECB will release updated staff projections on inflation and economic growth during this meeting, which are key to assessing the policy direction.

Recent economic outlooks forecast around 1% GDP growth and inflation near 2.2% in the euro area for 2025, adding nuanced guidance for policymakers.

Implications for Consumers

Lower ECB rates will primarily influence borrowing costs and savings returns across the eurozone. The effects vary depending on financial products:

- Short-term deposits: Rates on savings accounts and demand deposits tend to adjust quickly to changes in the deposit facility rate. Banks receiving lower interest from the ECB may reduce the interest they pay to depositors accordingly.

- Long-term fixed-rate loans: Rates such as 10-year mortgages are determined by future expectations and market conditions alongside current ECB policy. Since markets anticipate rate cuts, long-term rates may already reflect these changes and are less immediately impacted by the ECB’s decision.

Consumers should consider the nature of their financial products and market conditions when evaluating the potential benefits or risks arising from ECB rate adjustments.