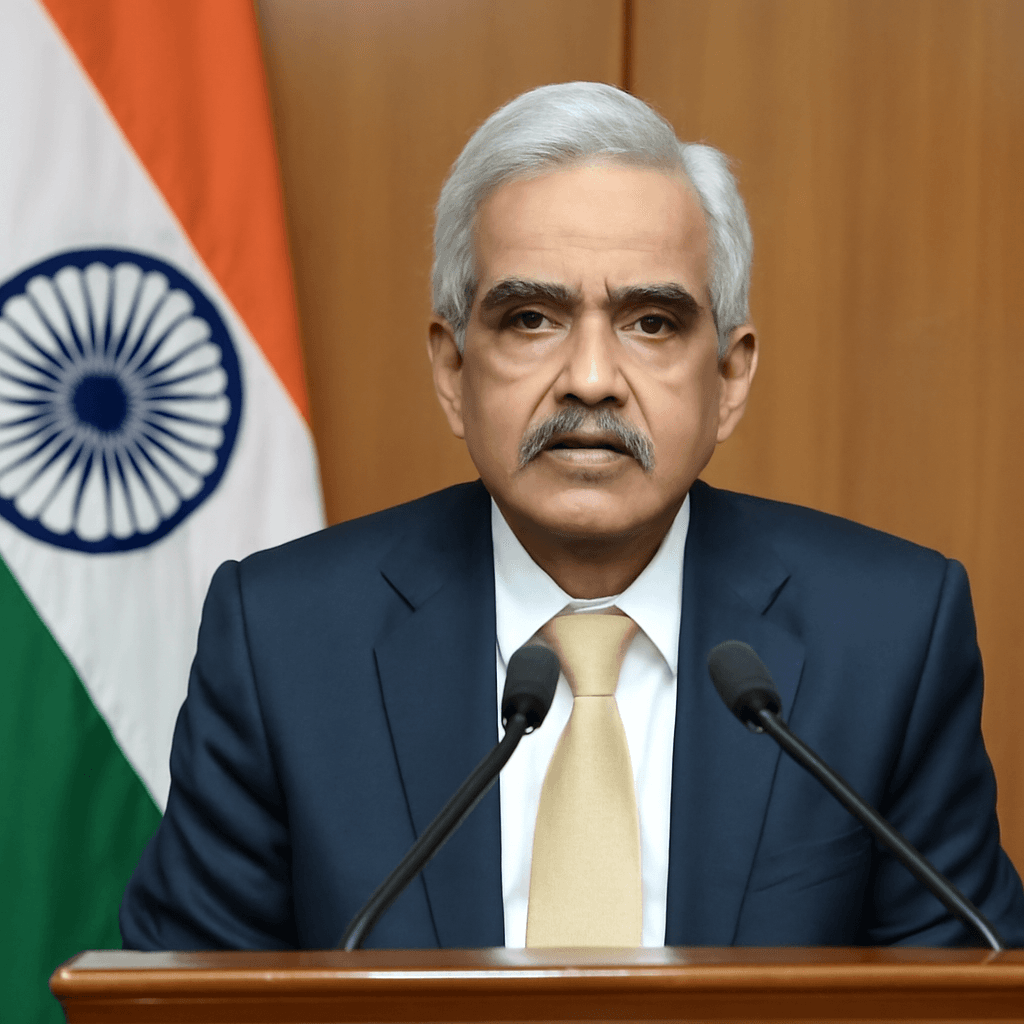

India's Central Bank Implements Significant Rate Cut

India's central bank has announced a substantial reduction in its benchmark policy rate, decreasing it by 50 basis points from 6% to 5.5%. This adjustment marks the lowest interest rate level since August 2022 and represents the third consecutive rate cut since February 2025.

Context Behind the Rate Reduction

The decision to lower the policy rate below the median market expectation of 5.75% comes amid robust economic growth and favorable inflation trends. India’s economy expanded at a year-on-year rate of 7.4% during the fiscal fourth quarter, exceeding economists' projections of 6.7%. Despite this growth, the central bank maintained its full-year GDP forecast at 6.5%, indicating a notable slowdown from the 9.2% growth recorded in the previous financial year ending in March 2024.

Inflation and Currency Trends Support Monetary Easing

Inflation dynamics have created a conducive environment for easing monetary policy. The latest inflation figure for April stood at 3.16%, the lowest since July 2019, suggesting contained price pressures.

Additionally, the Indian rupee has experienced a general weakening trend recently, which gives the central bank additional flexibility to implement rate cuts without risking excessive currency depreciation.

Implications and Outlook

This policy adjustment follows earlier cautious stances during periods of external uncertainties, such as trade tensions. The current rate cut aims to support continued economic momentum while balancing inflation control.

Market participants and policymakers will closely monitor forthcoming economic indicators and inflation readings to assess the trajectory of monetary policy in the coming months.