The Bank of Korea lowered its policy interest rate by 25 basis points to 2.5% on Thursday, marking the fourth reduction in its current easing cycle. This move reflects ongoing economic challenges, including political instability and external trade pressures.

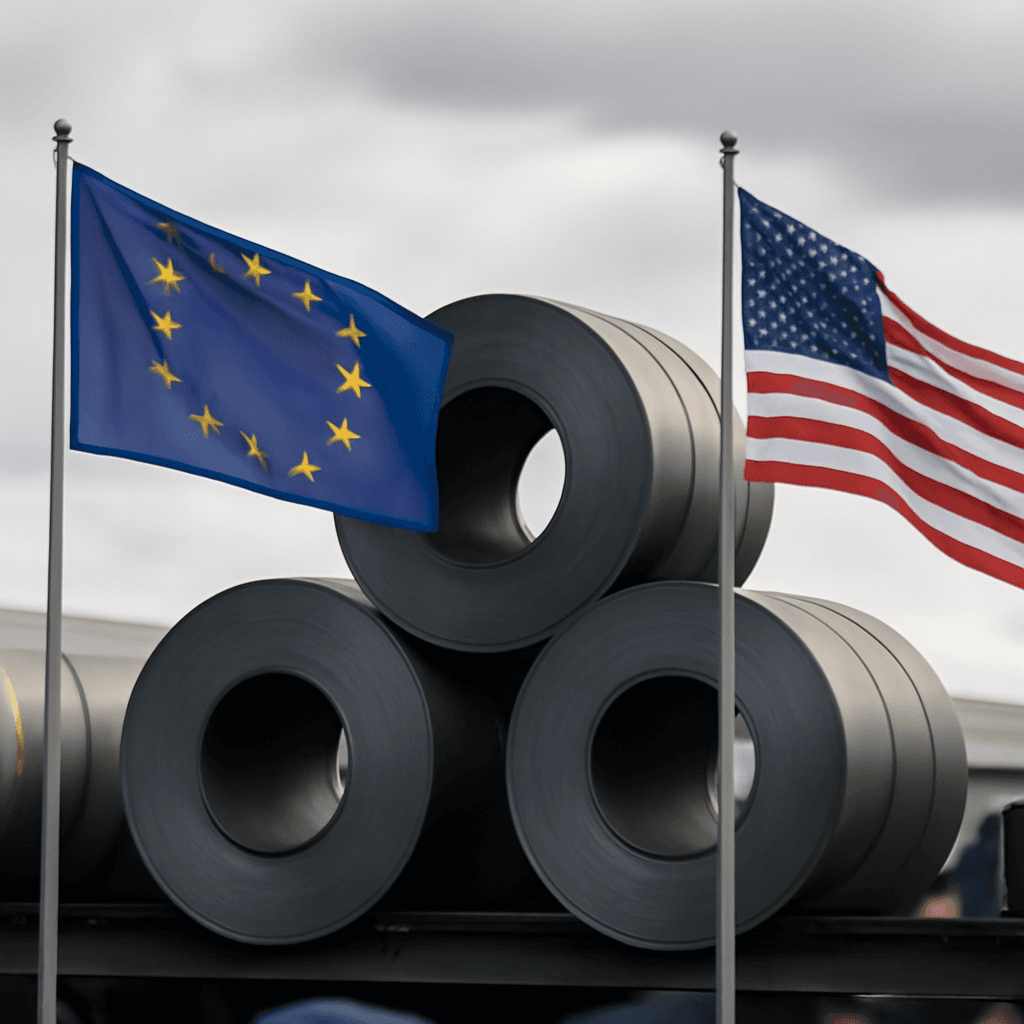

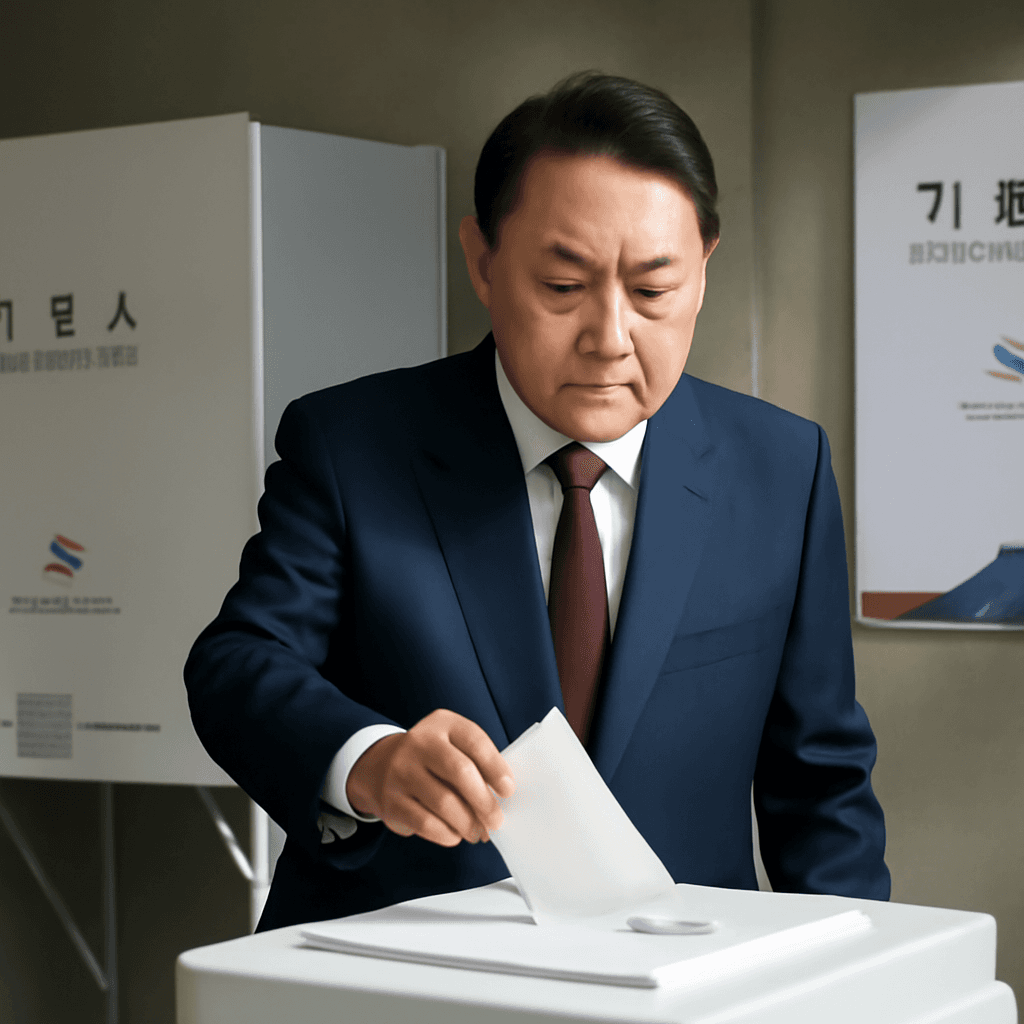

Amid heightened political uncertainty following the impeachment of former President Yoon Suk Yeol and an upcoming presidential election, the central bank aims to support growth amid a tenuous economic outlook. The rate cut is also influenced by trade tensions with the United States, notably the 25% reciprocal tariffs imposed during the Trump administration, which remain unresolved.

South Korea's economy contracted unexpectedly in Q1 2025, its first decline since late 2020, prompting the Bank of Korea to revise its full-year GDP growth forecast downward from 1.5% to 0.8%. The central bank indicated it will continue to monitor domestic and external developments closely and is prepared to adjust the pace of further rate cuts to mitigate downside risks.

Economists anticipate that the incoming presidential administration could introduce fiscal stimulus to bolster consumer spending; however, challenges such as the sluggish property market and export disruptions may limit recovery, with some forecasts suggesting growth could stagnate near 0.5% for the year.

Following the announcement, South Korea’s Kospi index rose by 1.25%, while the Korean won weakened against the US dollar to 1,383.40.