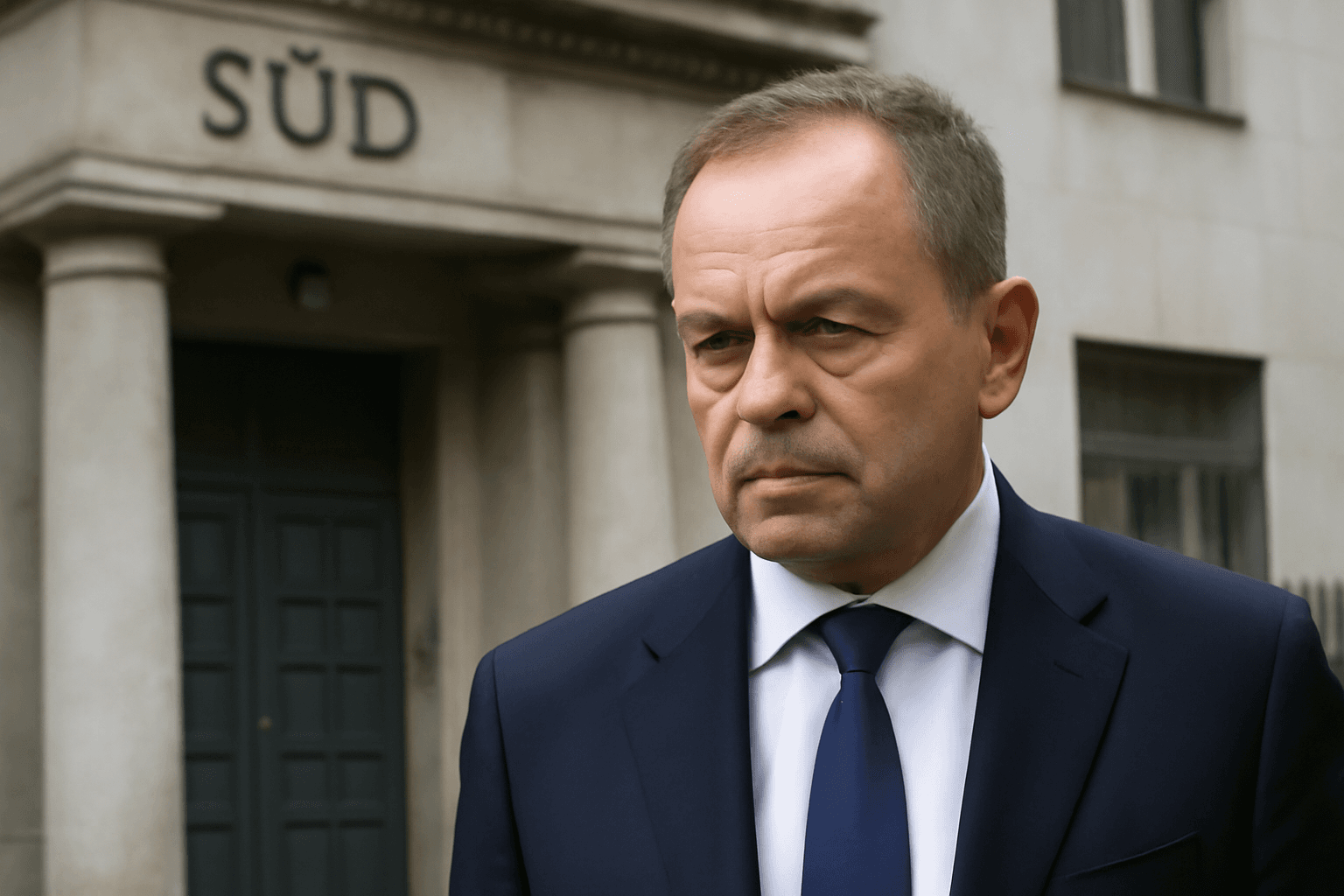

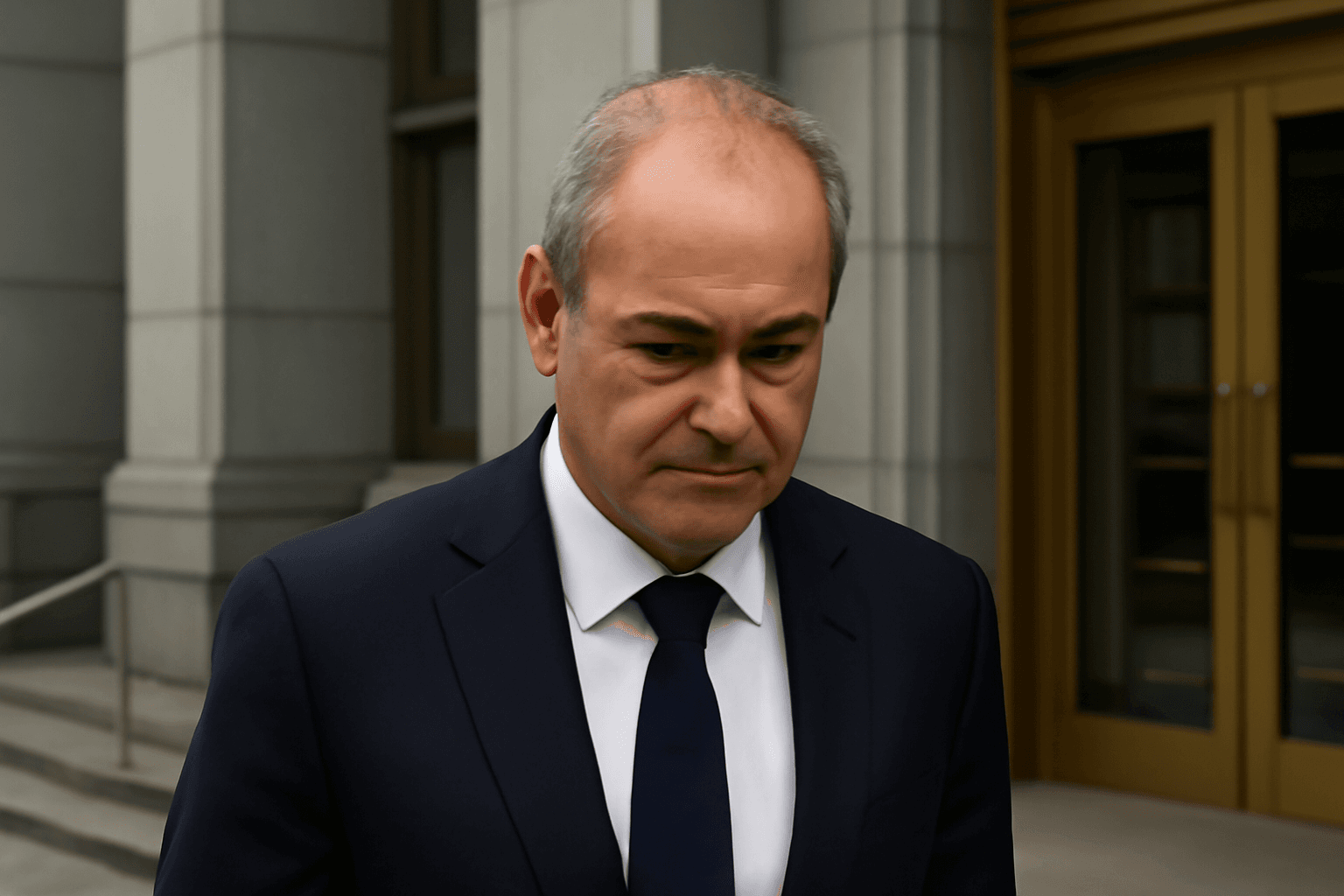

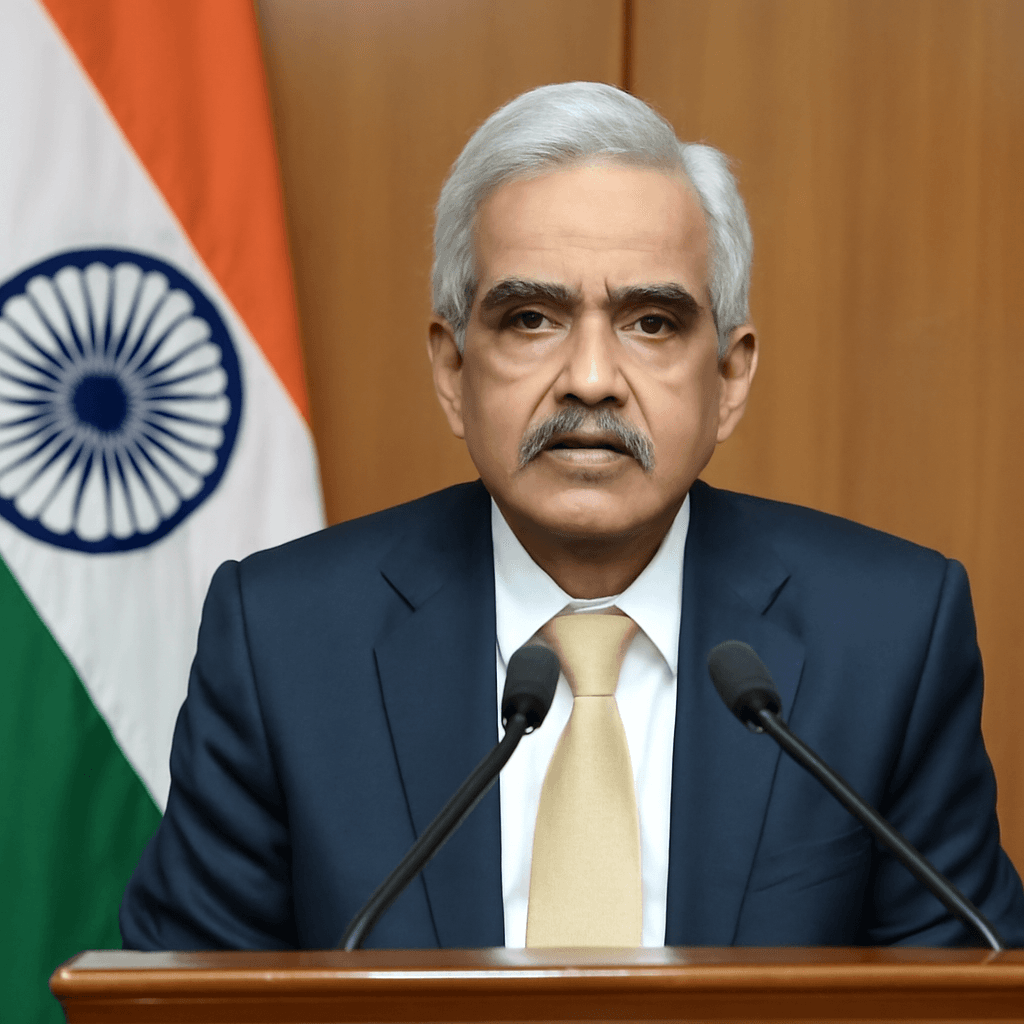

The Specialized Criminal Court in Slovakia has found Peter Kazimir, governor of the Slovak National Bank and member of the European Central Bank’s Governing Council, guilty of corruption. Judge Milan Cisarik announced that Kazimir must pay a €200,000 fine, or serve a one-year prison sentence.

Kazimir was not present at the ruling, as he was on a business trip to Hong Kong. Prior to the verdict, a pre-recorded message played on Slovak TA3 television had Kazimir declaring his innocence and asserting that the case should have been dismissed due to the statute of limitations. He also stated his intention to appeal if found guilty.

The case originated from Kazimir's tenure as Slovakia's finance minister between 2012 and 2019. Prosecutors allege that during this period, he delivered a €48,000 bribe to the then-head of the national tax administration to influence tax proceedings. Kazimir assumed office as central bank governor in 2019, and his current six-year term is set to expire on June 1, 2025.

Despite the guilty verdict, Kazimir remains in office, as the ruling can be appealed and does not require his removal. Slovak central bank governors are nominated by the government, confirmed by parliament, and appointed by the president. Kazimir is expected to remain until a decision is made regarding a potential new term or a replacement.