European leaders are increasingly vocal about their ambition for the euro to capitalize on declining confidence in the US dollar amid current geopolitical and economic shifts. European Central Bank President Christine Lagarde recently stated that the evolving global landscape presents an opportunity for the euro to enhance its international role.

The US dollar remains the world's leading reserve currency, accounting for nearly 60% of global foreign exchange reserves. It plays a critical role in the trading of commodities such as oil and gold, and many currencies, including the Hong Kong dollar and the Saudi Riyal, are pegged to it. By comparison, the euro holds the second position, comprising roughly 20% of international reserves.

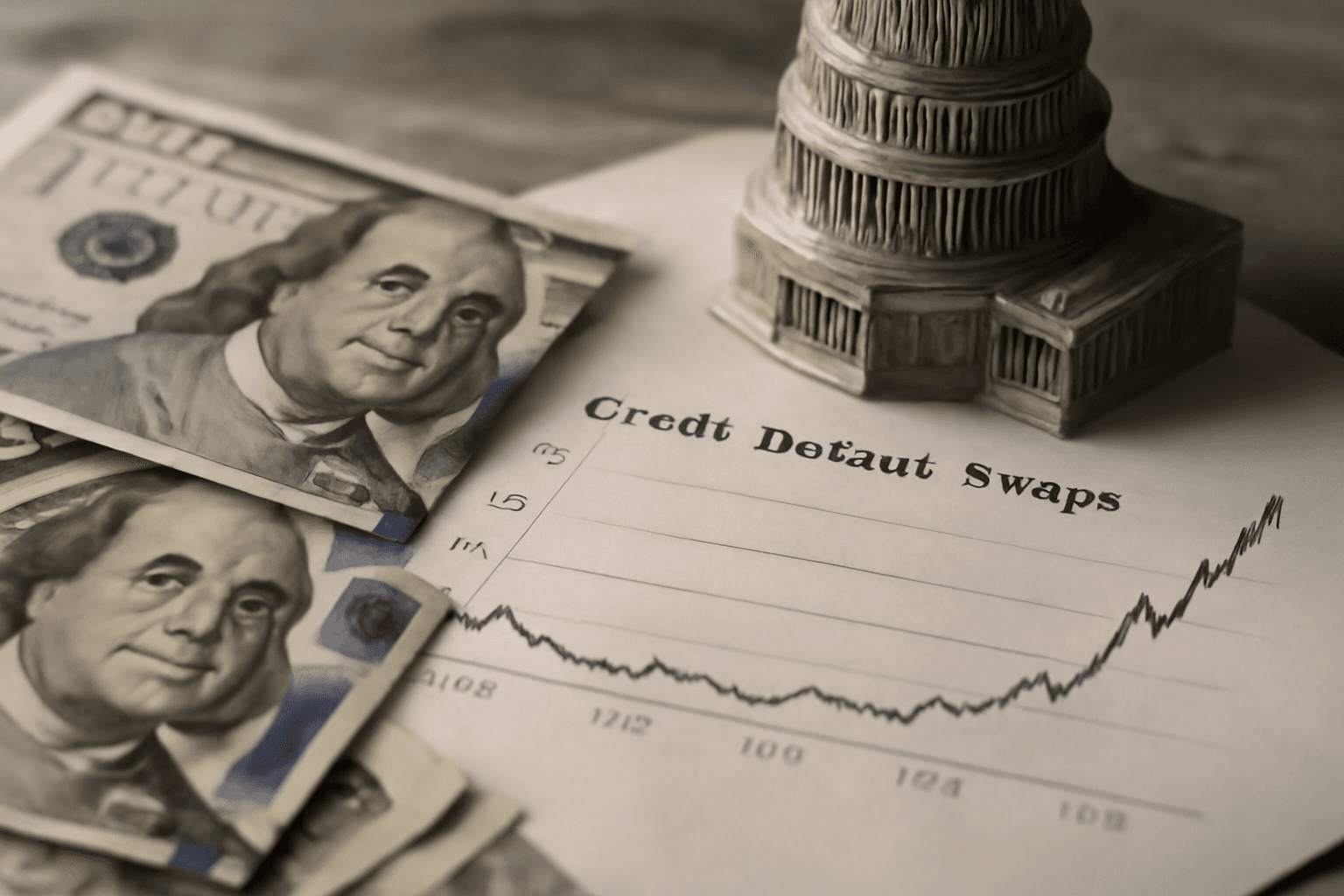

Since the start of the year, the dollar index — which tracks the US dollar against a basket of major currencies — has declined more than 8%. Christine Lagarde highlighted at Berlin's Hertie School that the current shift from multilateral cooperation toward zero-sum geopolitical tactics and bilateral power plays is creating uncertainty about the US dollar's preeminence.

Lagarde emphasized that this uncertainty could open avenues for the euro to attain a larger role on the global stage. However, she acknowledged that closing the gap between the two currencies is not guaranteed. Success would require Europe to implement a robust set of policies, including:

- Establishing a credible geopolitical foundation anchored in open trade and enhanced security capabilities.

- Strengthening the economic base by fostering deeper, more liquid capital markets to attract global investment.

- Reinforcing legal frameworks by upholding the rule of law and political unity to resist external pressures.

A stronger euro with elevated reserve currency status would yield numerous benefits for Europe, such as lower borrowing costs, reduced exposure to exchange rate volatility, and protection against sanctions or coercive external measures. Lagarde summarized this as granting Europe greater control over its own economic destiny.

Other ECB officials also see potential for the euro. Isabel Schnabel, Executive Board member, recently described the euro area as a potential safe haven amid US tariff tensions, offering the region a historic opportunity to boost the euro's international standing.

Market analysts remain divided on the euro's capacity to diminish the dollar's share of global foreign exchange reserves. George Buckley, chief European economist at Nomura, expressed optimism, suggesting that investors seeking to diversify from the dollar may increasingly turn to the euro. He projected the euro could rise to around $1.20 by year-end, up from approximately $1.13 at present—a promising gain fueled by the bloc’s economic heft.

Conversely, Aaron Hill, chief market analyst at FP Markets, underscored the enduring dominance of the US dollar. He cited challenges to the euro, including political fragmentation and dependence on US security alliances, which constrain its global influence. Hill argued that despite mounting US debt and geopolitical shifts, the euro lacks the cohesion required to challenge the dollar’s supremacy in the near term.

John Plassard, senior investment specialist at Mirabaud Group, echoed this view, noting that the US dollar's commanding 60% share of global foreign exchange reserves leaves little room for rivals currently.

As geopolitical uncertainties continue, the ongoing debate over the euro's potential to threaten the 'King Dollar' will remain a focal point for policymakers and investors alike.