The Escalating Musk-Trump Conflict and Tesla's Market Impact

The ongoing dispute between U.S. President Donald Trump and Elon Musk, CEO of Tesla and SpaceX, has taken an intense turn affecting Tesla’s stock valuation. What started as Musk’s public criticism of a government spending bill has escalated into mutual threats, including Trump warning to pull billions in government contracts from Musk's companies. In reaction, Musk threatened to retire SpaceX's Dragon spacecraft amid funding concerns.

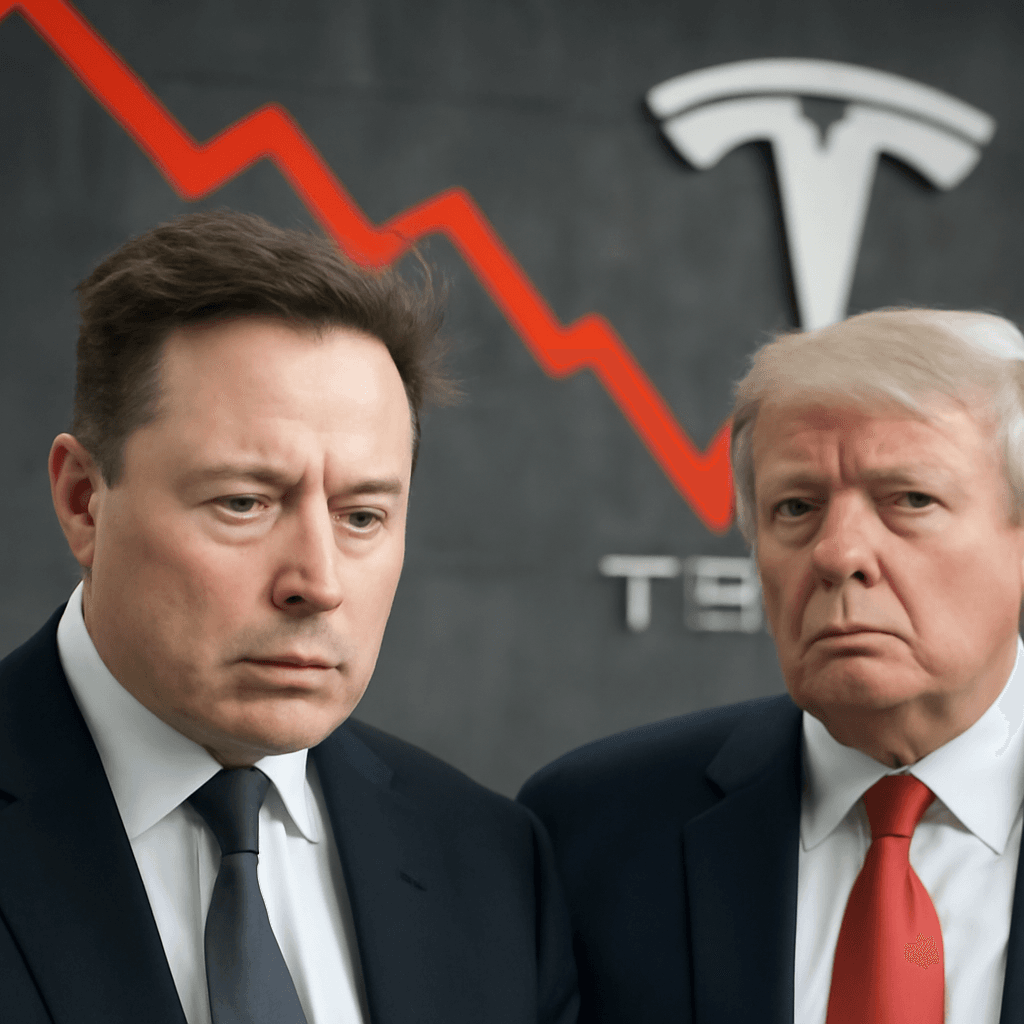

This confrontation has significantly impacted Tesla, with the company experiencing its largest market capitalization loss to date—

- $152 billion wiped out in a single trading day

- Nearly 30% decline in share value year-to-date

- 5% gain in pre-market trading following the drop

Market Analysts Weigh In on the Fallout

Despite the public feud, some market experts advise investors to focus on Tesla’s fundamentals rather than the personal conflict. Tom Hulick, CEO of Strategy Asset Managers, highlights the importance of monitoring Tesla’s operational progress, including earnings reports and developments in energy infrastructure, which provide a more accurate picture of the company’s long-term potential.

He suggests the spat is a temporary distraction, stating, "Tesla remains an industry leader in multiple sectors and the current pressures should ease as more concrete financial results emerge."

Challenges Beyond the Feud

Senior economist Rico Luman points out that Musk's political involvement has not benefited Tesla's fortunes, especially considering the company's recent underperformance in vehicle production and deliveries. Tesla’s first-quarter earnings revealed a:

- 20% decline in automotive revenue compared to the prior year

- Missed analyst expectations on both top and bottom lines

Global EV demand is slowing across key markets—including the U.S., Tesla’s largest region—which complicates the company’s growth targets. Furthermore, strained relations with the U.S. government may increase regulatory risks, potentially hindering future expansion.

Investor Sentiment and Leadership Concerns

Wedbush analyst Dan Ives characterizes the Musk-Trump discord as akin to a "high school friends feud," emphasizing the need for de-escalation. While maintaining a bullish outlook on Tesla’s autonomous technology prospects, he acknowledges uncertainty around regulatory support under the current political tension.

Investment director Russ Mould notes that last year, Musk’s cordial ties with Trump had boosted Tesla’s outlook due to expectations of favorable treatment. The current antagonism, however, places shareholders in a precarious position, as the CEO’s public conflicts increasingly influence Tesla’s stock price.

Mould warns that Musk's public statements could pose a liability for Tesla shareholders and flags the possibility that the company's board may reconsider his role if such controversies persist, despite Musk’s recent commitment to remain CEO for the next five years.

Conclusion

The Musk-Trump spat has escalated from a political disagreement to a significant factor affecting Tesla’s market performance and investor confidence. While industry experts urge focusing on Tesla’s core business fundamentals, the intertwined nature of Musk’s leadership and public persona continues to challenge the company’s stock stability and regulatory prospects.