The US inflation rate, measured by the Federal Reserve's preferred gauge, the personal consumption expenditures (PCE) price index, rose by only 0.1% in April, resulting in an annual inflation rate of 2.1%. This rate is slightly lower than anticipated and marks a modest cooling in inflation pressures.

Core inflation, which excludes volatile food and energy prices and is closely monitored by policymakers, also increased by 0.1% for the month, with an annual rise of 2.5%. This core figure remains an important indicator of underlying inflation trends.

Consumer spending growth decelerated significantly in April, with a 0.2% increase compared to a 0.7% rise in March. This slowdown reflects cautious consumer sentiment amid economic uncertainties. The personal savings rate surged to 4.9%, its highest level in nearly a year, indicating a shift towards saving over spending.

Personal income rose by 0.8% during April, exceeding expectations and signaling continued wage growth. Food prices declined by 0.3%, while energy prices increased by 0.5%, and shelter costs, a key inflation component, rose by 0.4%.

The impact of recently implemented tariffs has not yet fully materialized in consumer prices. There are concerns that as tariff costs are passed on, core goods inflation may intensify, potentially peaking later in the year between 3.0% and 3.5%, should the tariff structure remain unchanged.

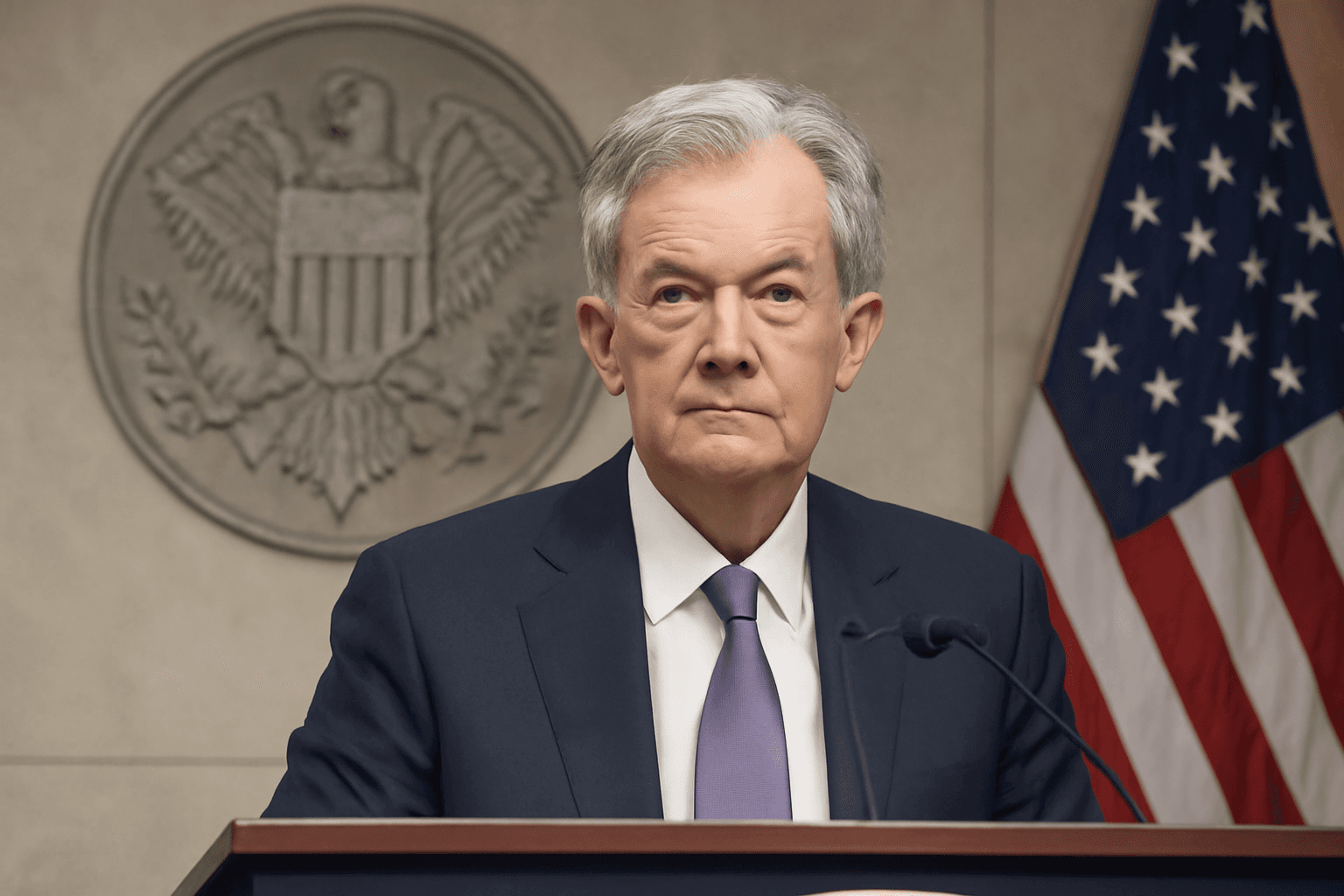

Recent discussions between the President and Federal Reserve Chair reiterated the Fed's commitment to policy decisions free from political influence, despite external pressures to cut interest rates to support economic growth.

While tariffs were introduced to address the growing trade deficit, these measures have prompted debate among economists about their inflationary effect. Traditionally, tariffs have had a limited direct impact on inflation, but ongoing trade tensions and higher prices pose risks to economic stability.

Overall, the data suggests a mixed economic environment with moderate inflation, subdued consumer spending, and heightened saving behavior amid uncertainty over trade policies and their long-term implications.