European Markets Set to Gain on Positive China-U.S. Trade Talks

European stock markets are poised to open higher, fueled by optimism stemming from ongoing trade negotiations between China and the United States in London. Investors are closely watching the talks, hopeful that the two economic giants will avoid escalating tariffs and resolve tensions amicably.

U.K. Jobless Rate Edges Up to 4.6% as Expected

According to recent figures, the U.K. unemployment rate increased slightly to 4.6% for the three months ending in April, aligning with economists’ forecasts. This marks a small rise from the previous quarter’s 4.5% unemployment rate. Meanwhile, the country’s economic inactivity rate — which tracks those aged 16 to 64 who are not working and not actively seeking or able to start employment — climbed to 21.3%.

What Today Holds for Investors

Market participants can expect additional economic data from Europe today, notably the U.K.'s average earnings figures and Italy’s industrial production report. Meanwhile, several British companies are scheduled to release their earnings updates, offering fresh insight into the region's corporate health.

Morning Market Outlook: Gains Anticipated Across Major European Indexes

Futures indicate London’s stock index will open approximately 11 points higher, while Germany’s DAX may rise by 62 points. France’s CAC 40 is expected to gain 23 points, and Italy's FTSE MIB looks set to climb by 83 points. These upward moves reflect the positive mood generated by progressing trade discussions between U.S. and Chinese officials meeting in the UK capital.

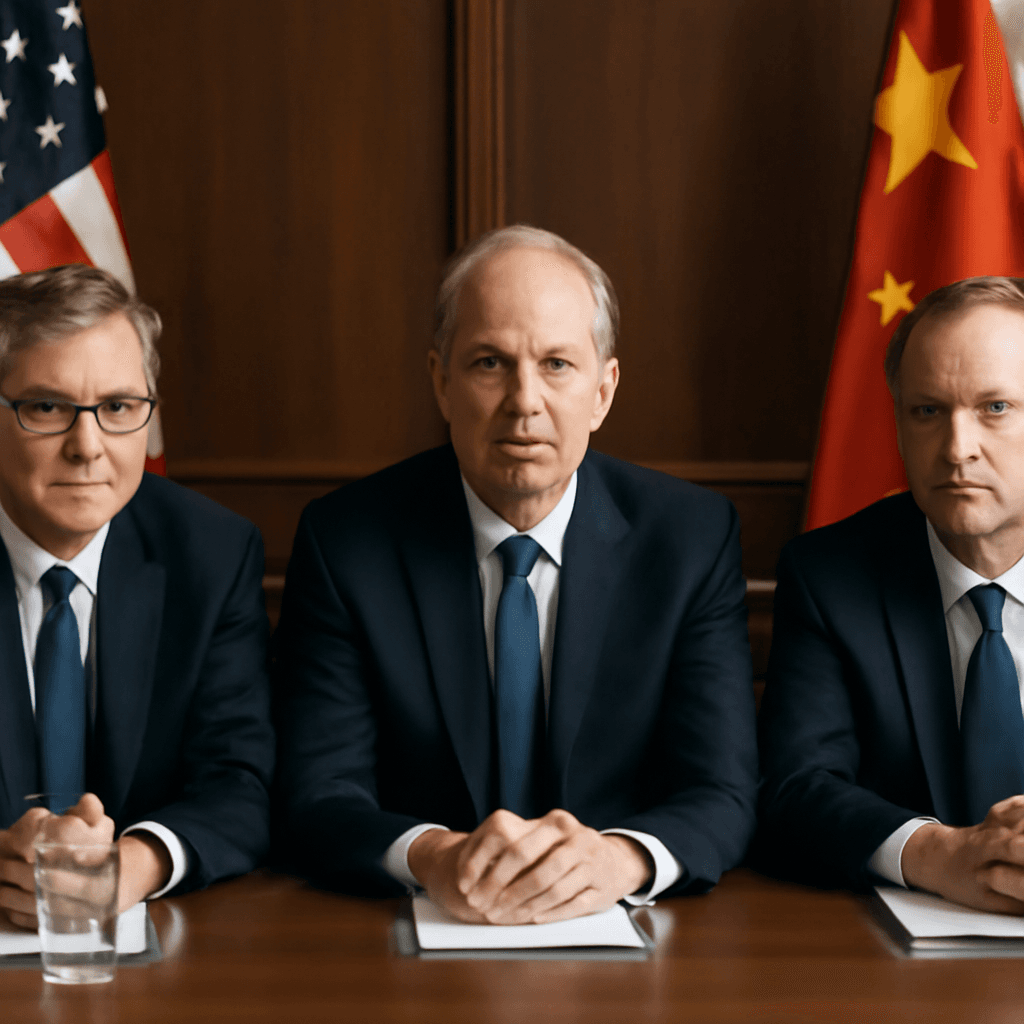

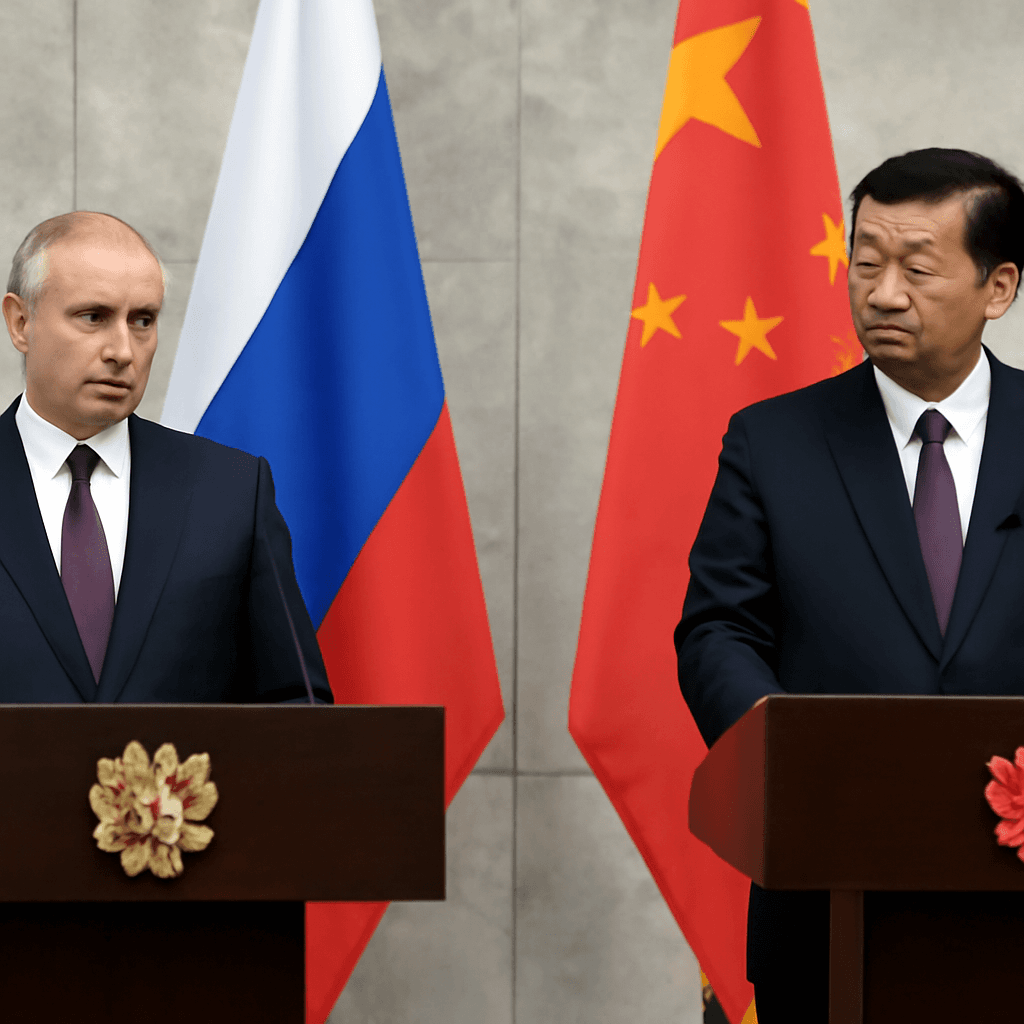

Trade Talks Driving Global Market Confidence

Overnight, major global markets advanced as hopes grew that diplomatic efforts would prevent a sharp escalation in trade restrictions. U.S. stock futures climbed alongside their global counterparts as traders searched for hints that a deal could be reached without further heavy tariffs.

Leading the U.S. delegation in London is Treasury Secretary Scott Bessent, alongside Commerce Secretary Howard Lutnick and Trade Representative Jamieson Greer. The White House has reportedly authorized potential easing of restrictions on exports such as chipmaking software, jet engine components, and ethane.

Statements from the President have been cautiously optimistic, with reports indicating favorable progress and positive sentiment surrounding the negotiations.

Looking Ahead

Markets will maintain a close watch on developments from the London trade discussions as they continue throughout Tuesday. The broader economic environment remains sensitive to these talks, which could define the trajectory of global commerce in the coming months.