European Markets Poised for Gains as U.S.-China Trade Talks Kick Off

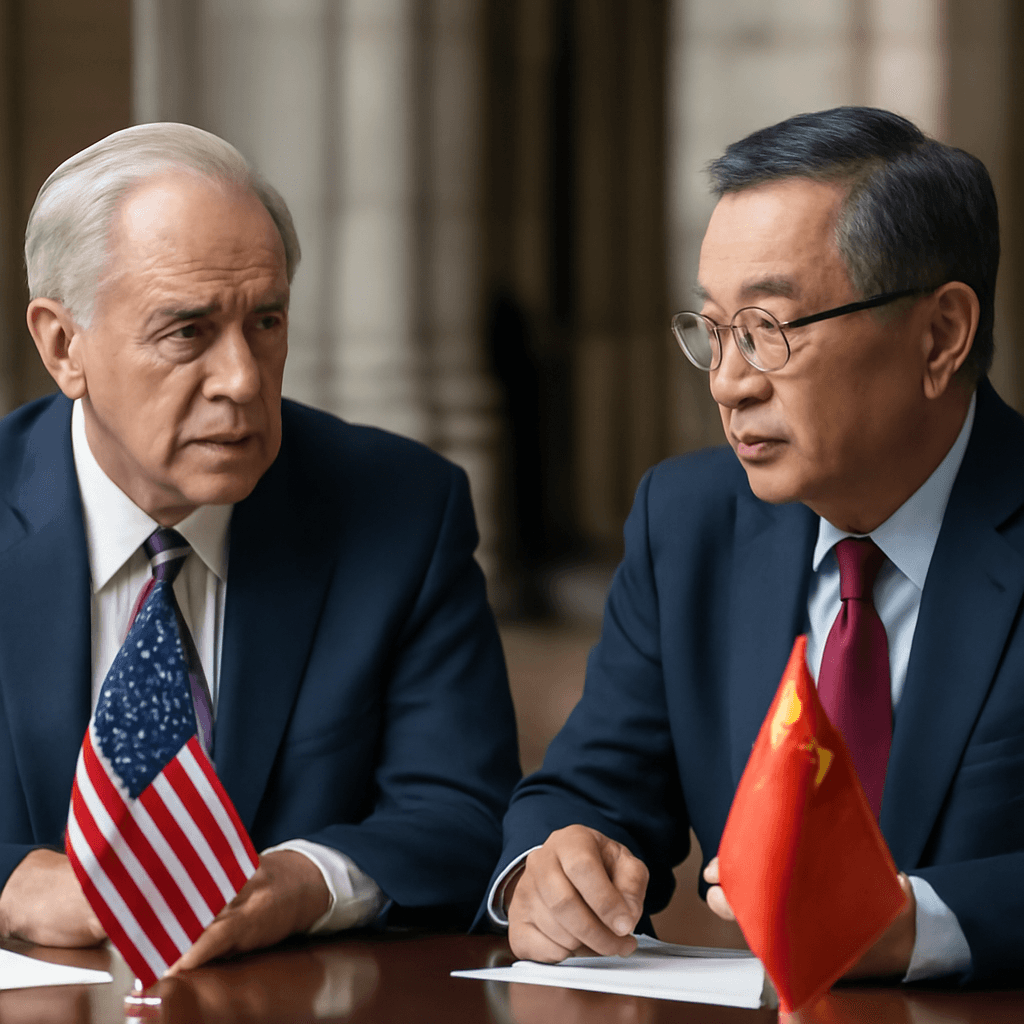

Good morning from London! As the new trading week begins, European markets are gearing up for a positive start, fueled by heightened anticipation surrounding critical U.S.-China trade negotiations scheduled for today in London.

Market Openings Signal Optimism

- London's FTSE 100 is expected to open 7 points higher at 8,836.

- Germany's DAX looks set to rise 3 points to 24,296.

- France's CAC 40 is anticipated to gain 5 points reaching 7,801.

- Italy's FTSE MIB could climb 13 points to 40,595.

The global market spotlight centers on the trade talks between the world’s two largest economies. Earlier announcements revealed that U.S. Treasury Secretary Scott and two senior officials will join their Chinese counterparts in London to further dialogue aimed at crafting a trade deal.

Trade Developments Fuel Positive Sentiment

Investor sentiment improved overnight as easing trade tensions offered renewed hope. China appears to have relaxed restrictions on exports of rare earth elements, a vital component in technology manufacturing, while the U.S. has loosened certain jetliner restrictions to China.

Meanwhile, U.S. equity futures remain mostly flat, with the S&P 500 hovering near record highs, signaling cautious optimism ahead of a potentially news-packed week. Market watchers are closely monitoring upcoming U.S. inflation data — the Consumer Price Index is due Wednesday, followed by the Producer Price Index on Friday — looking for clues on how tariffs may be impacting the broader economy.

London Tech Week Highlights

Adding extra buzz to the week is London Tech Week, where tech giant Nvidia’s CEO, Jensen Huang, is set to deliver a keynote address on Monday morning, spotlighting innovation and industry trends amidst this dynamic market backdrop.

What’s Ahead?

With no other significant earnings reports or major data releases on the horizon today, all eyes will remain on the outcomes of the trade negotiations. The developments from London could set the tone for global markets in the days to come.

Stay tuned as we continue to track market movements and key economic indicators throughout the week.