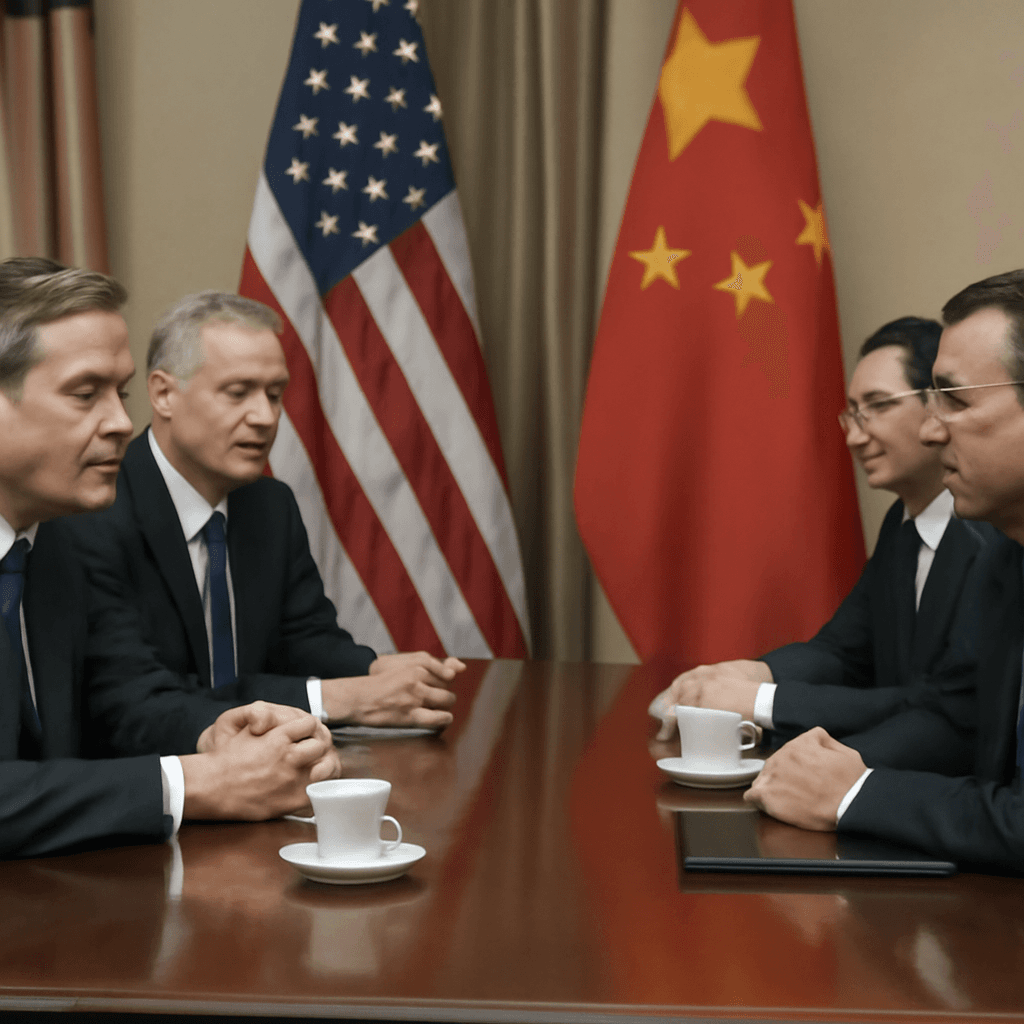

U.S.-China Trade Talks Enter Second Day Amid Optimism

Trade negotiations between the United States and China have resumed in London, signaling potential progress on key issues, particularly the easing of China's rare earth export restrictions. Following Monday’s initial discussions, expectations are high for continued dialogue to unlock greater trade cooperation.

This development comes after China appeared to extend concessions to Western automakers last week, hinting at a willingness to relax export controls. The U.S. side aims to capitalize on this momentum to persuade China to further open its rare earths market, a vital sector underpinning advanced manufacturing and tech industries.

Meanwhile, the world’s second-largest economy has insisted on reciprocal actions, pushing Washington to reconsider some of its own export curbs. Officials have indicated that the U.S. may respond in kind by easing restrictions soon after the talks conclude, reflecting a more conciliatory approach from both capitals.

Stock Markets Show Cautious Gains, South Korea Eyes Bull Market

Global markets have responded tentatively to the evolving trade scenario. U.S. stocks nudged upward on Monday, with major indexes slowly approaching prior highs. The S&P 500 remains about 2% below its February peak, and analysts believe that successful trade talks could provide the catalyst for the index to break new ground.

Across the Pacific, South Korea’s Kospi index gained 0.38%, bolstered by expansionary fiscal policies. Experts from Macquarie Group forecast that South Korea’s market is on the brink of entering a bull phase, driven by supportive government spending and economic momentum.

Apple Unveils 'Liquid Glass' iOS Redesign Amid Tepid Market Reaction

At its annual Worldwide Developers Conference, Apple revealed a major overhaul of its iOS operating system dubbed “Liquid Glass.” This visually striking redesign draws inspiration from the company’s Vision Pro technology and reflects the most significant changes since 2013.

Despite the innovation, the event disappointed some investors due to the absence of notable artificial intelligence announcements, sending Apple’s shares down by 1.2%. Still, the new interface promises a fresh user experience that could pave the way for future tech advancements.

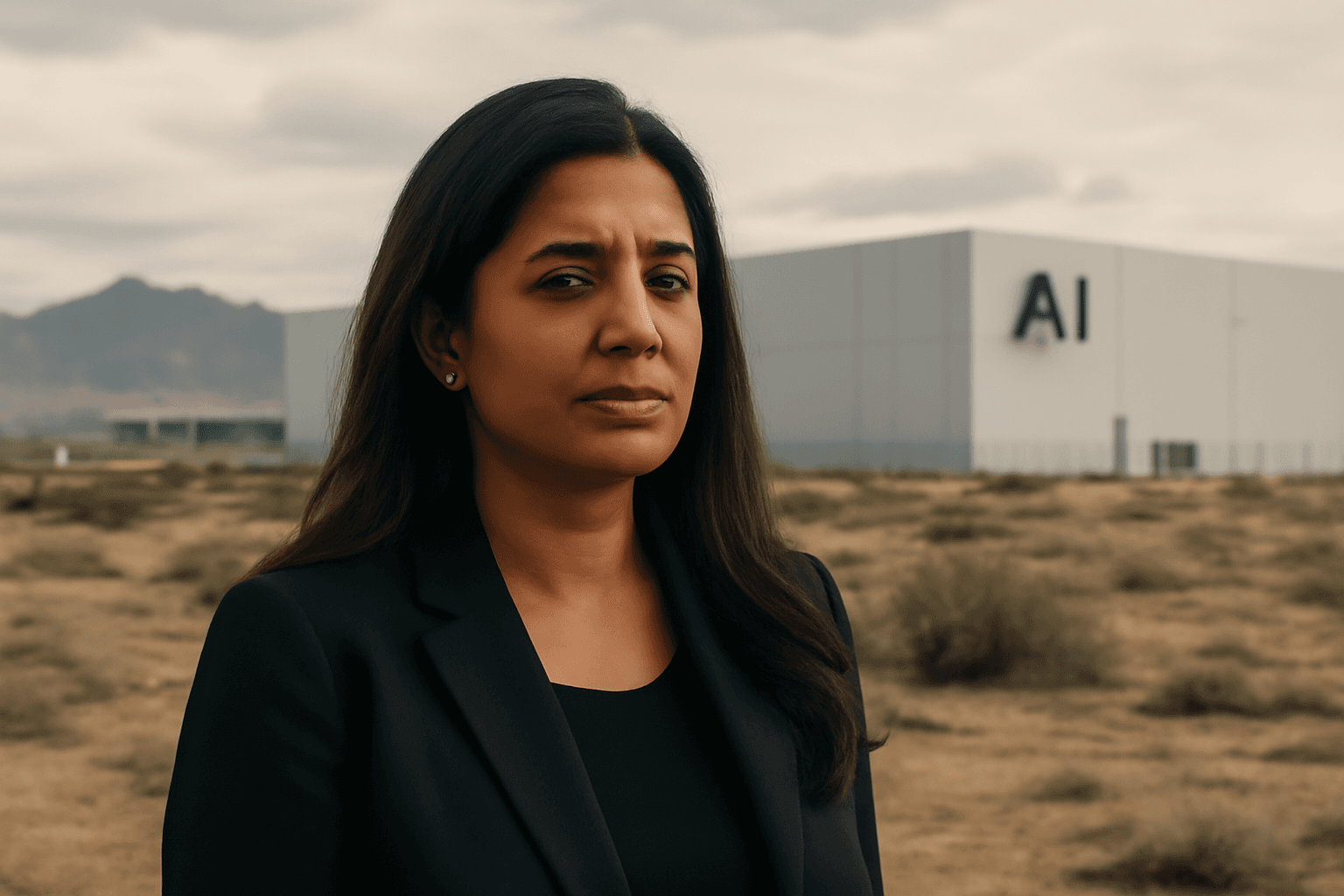

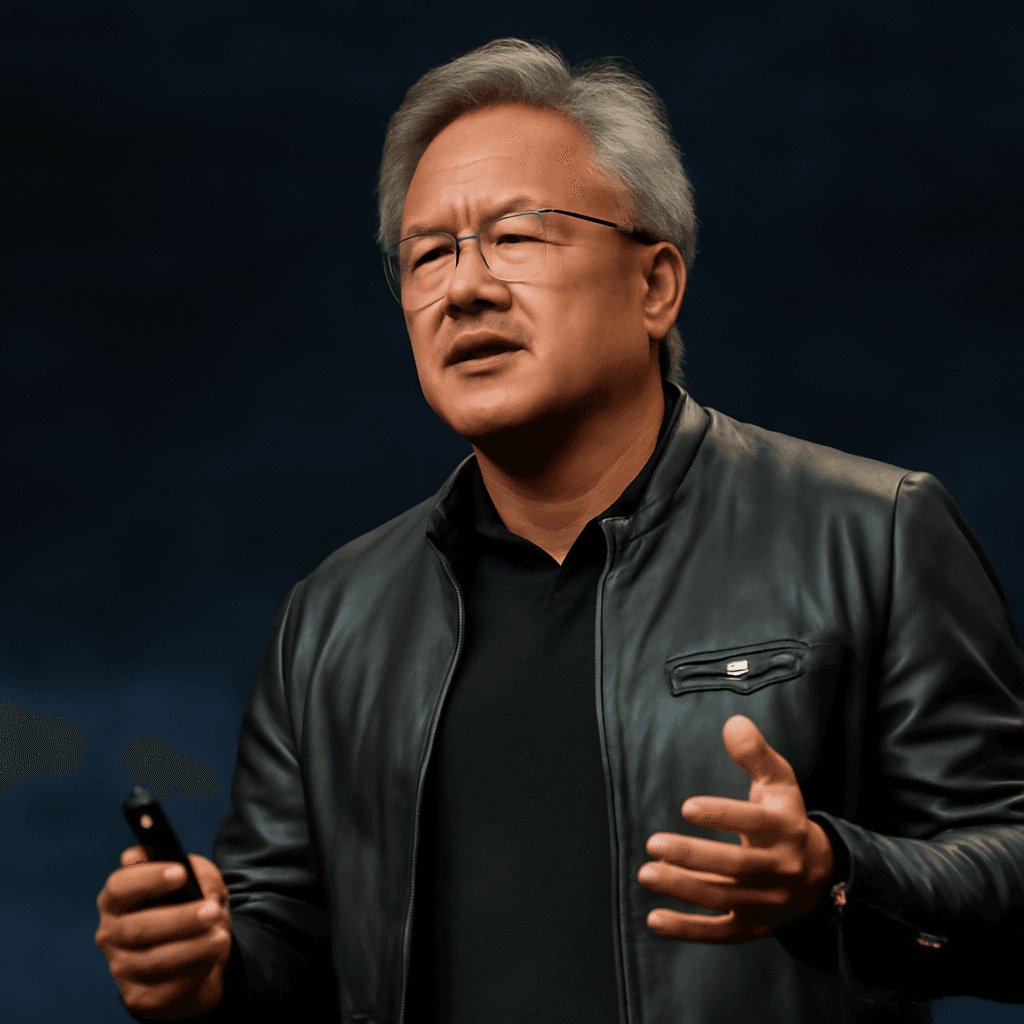

U.K. Embraces AI Potential in ‘Goldilocks’ Moment, Says Nvidia CEO

Nvidia’s CEO Jensen Huang praised the U.K.’s current climate as “Goldilocks,” striking a perfect balance for AI innovation. Speaking alongside British leaders, Huang emphasized the importance of local hardware infrastructure to support AI development, noting that the ability to build AI supercomputers on British soil will spark entrepreneurship and attract startups.

While the U.K. excels in machine learning talent, Huang acknowledged the need to develop more homegrown AI infrastructure to maintain competitiveness globally.

S&P 500 Poised for New Record With Positive Trade Momentum

Market strategists from JPMorgan foresee that the S&P 500 could soon surpass its previous all-time high, contingent on successful outcomes from the ongoing U.S.-China trade discussions. The index’s current proximity to its peak indicates strong underlying resilience despite earlier trade tensions.

Had trade policies been more cooperative earlier this year, the S&P might have already soared to fresh highs. Now, with diplomacy back on track, a stronger rally appears within reach.

Chinese Coffee Chains Brew Ambitions Beyond Asia

In an intriguing twist, Chinese beverage companies are redefining coffee culture domestically and setting sights beyond Asia. Luckin Coffee, China’s largest chain, has expanded rapidly—surpassing Starbucks in outlet numbers on the mainland.

Building on its success in Singapore, Hong Kong, and Malaysia, Luckin plans to open a flagship location in lower Manhattan, marking its boldest move into the U.S. market. Industry analysts highlight New York City’s diverse and young population as an ideal proving ground, albeit one of the most competitive markets worldwide.

Looking Ahead

- Continued monitoring of U.S.-China trade talks will be critical to assessing market trajectories.

- Investors should watch global markets’ responses as more economic data unfolds.

- Tech innovations and infrastructure developments, especially in AI, remain central to longer-term growth narratives.