U.S. Stock Market Defies Economic Headwinds

Despite looming uncertainties and economic headwinds, the U.S. stock market showed resilience on Wednesday, with all three major indexes extending their winning streak for the third consecutive day. The S&P 500 climbed by 0.55%, while the Nasdaq Composite advanced 0.63%, inching the S&P within 2% of its all-time high set earlier this year in February.

This optimism comes amid ongoing concerns over recurring tariffs and tentative international trade agreements, signaling an intriguing divergence between market sentiment and underlying economic challenges.

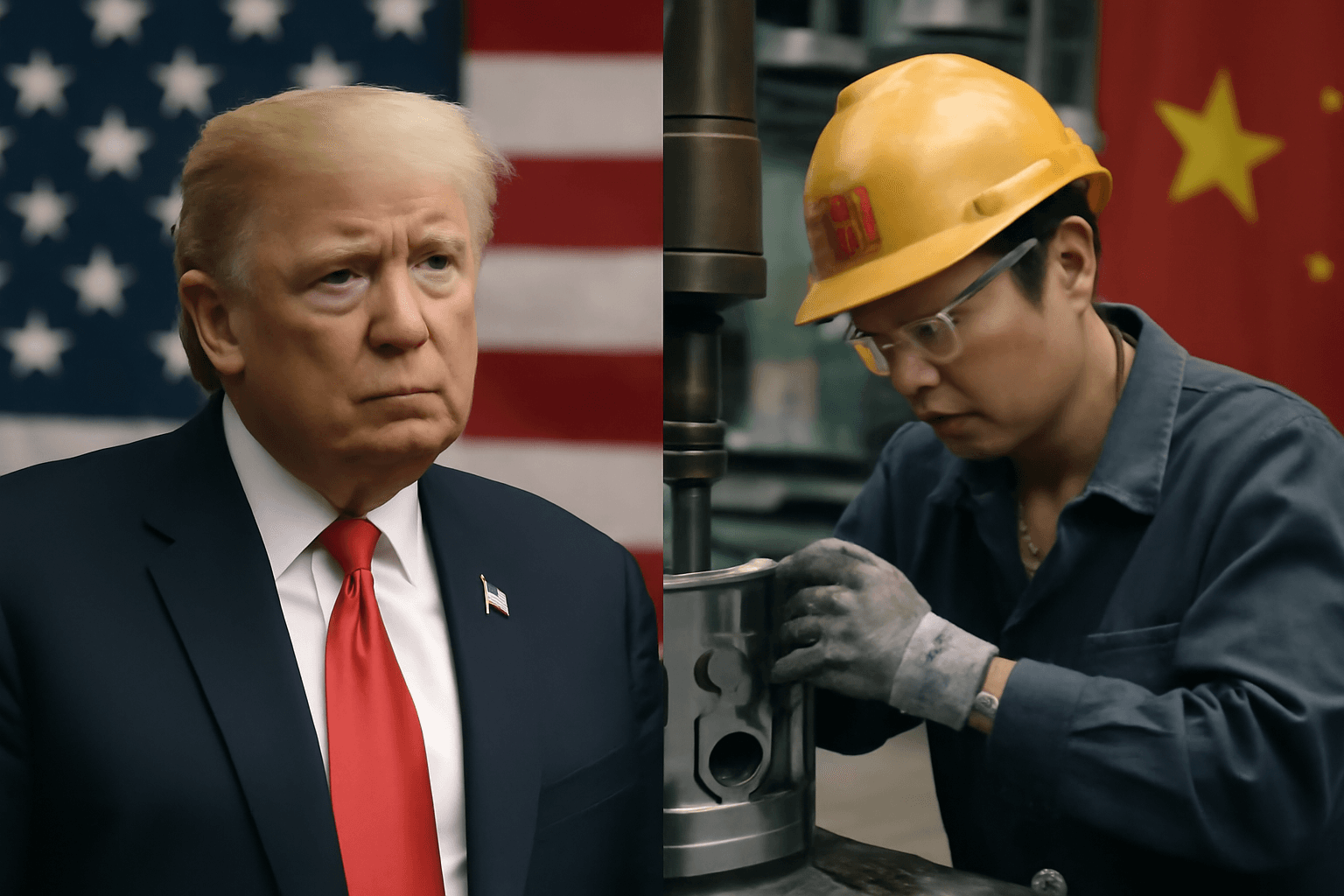

Trade Talks Between the U.S. and China Show Promising Signs

High-level trade negotiations between the United States and China wrapped up their second day in London with representatives from both sides announcing a preliminary framework agreed upon. Although the arrangement still awaits formal approval from the top leaders, indications suggest that U.S. restrictions on advanced technology exports to China may ease, complemented by Beijing’s agreement to allow rare-earth exports.

This development has sparked cautious optimism across markets, feeding hopes of smoother trade relations after a turbulent period marked by tariff disputes.

Corporate Moves and Market Impacts

- Tesla's Robotaxi Service Launch: Elon Musk announced a tentative launch date of June 22 for Tesla’s robotaxi service in Austin, Texas. Tesla’s shares responded with a 5.7% surge, closing at $326.09, recovering from recent volatility driven by Musk’s public disagreements.

- Wells Fargo's Tesla Outlook: Despite the hype, Wells Fargo analysts predict Tesla shares could face a sharp decline of around 63% from Tuesday’s close, citing concerns over worsening sales trends that the new robotaxi service is unlikely to offset.

Major Companies Trim Workforce Amid Economic Uncertainty

Corporate America continues to address economic pressures through workforce reductions. Recent layoffs announced by technology giants and financial institutions, including Microsoft, Citigroup, and Disney, signal caution. Ironically, these cost-cutting measures often buoy stock prices in the short term, as investors see improving profit margins.

Bond Market Brace for Inflation and Treasury Auctions

The bond market, often the more conservative barometer, faces a critical test this week. The U.S. Bureau of Labor Statistics is set to release May’s consumer and producer price indexes, alongside two long-duration Treasury auctions. The convergence of these events could drive bond yields higher, exerting pressure on stocks and raising borrowing costs for the broader economy if inflation signals worsen.

Meta’s Bold Move into AI Data and Google’s Strategic Buyouts

- Meta’s $14 Billion Investment: Mark Zuckerberg is finalizing a deal to invest $14 billion in Scale AI, a leading company helping tech firms train advanced AI models. This partnership also brings Scale AI’s CEO, Alexandr Wang, into Meta’s leadership circle, signaling intensified focus on artificial intelligence innovation.

- Google's Workforce Optimization: Google has initiated buyout offers across several departments, including search, ads, commerce, and engineering divisions. This recurring strategy aims to streamline operations amid shifting business priorities.

The Growing Impact of AI on Jobs in China

China is aggressively integrating artificial intelligence even as its economic growth slows down, which poses risks to millions of routine jobs. A stark example emerged when Zhou Hongyi, founder of 360 Security Technology, publicly revealed plans to eliminate the entire marketing department to save millions annually. The message resonated widely, highlighting a broader trend of companies leveraging AI to cut costs amid economic pressures.

Looking Ahead

While optimism about trade deal progress and AI investments propels stock markets upward, caution prevails beneath the surface. Rising bond yields, inflation reports, and cautious corporate outlooks suggest that investors should brace for volatility. Nonetheless, as markets continue to navigate this complex economic landscape, key developments in trade, technology, and inflation will remain central themes shaping the near-term trajectory.