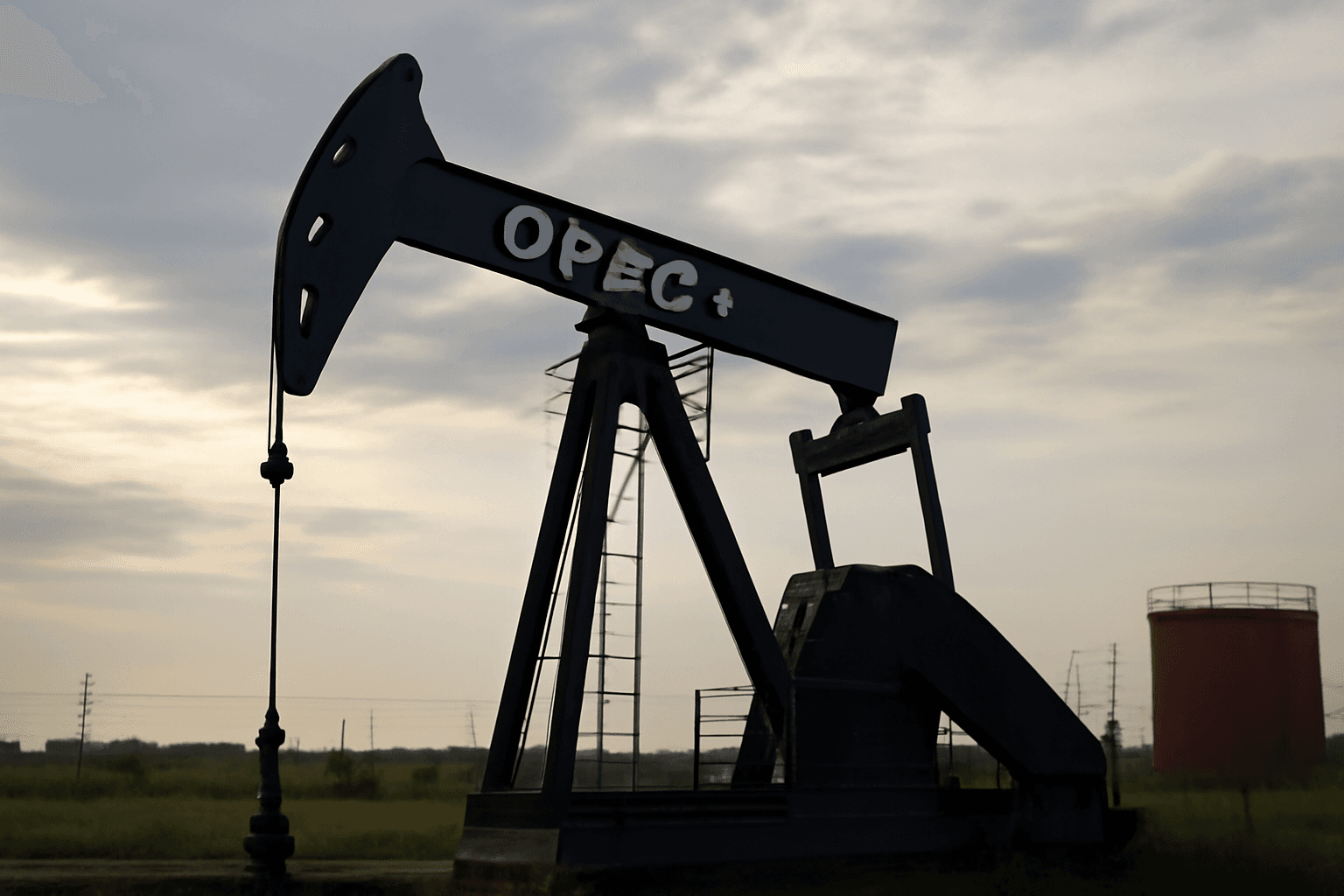

OPEC+ has confirmed a planned increase in oil production by 411,000 barrels per day (bpd) for July, matching the increments made in May and June. This decision reflects the group's ongoing strategy to restore oil supply at a faster pace than initially anticipated.

The move comes as eight OPEC+ member countries continue to boost output more rapidly than scheduled, despite this additional supply exerting downward pressure on oil prices. Leading producers Saudi Arabia and Russia are driving this approach, aiming to penalize members exceeding their quotas and recapture market share.

The commitment to increase output in July was finalized during an online meeting attended by the eight nations. Various options were deliberated, including the possibility of a larger output hike, although the decision remained consistent with prior months.

In an official statement, OPEC+ cited a "steady global economic outlook and healthy market fundamentals," particularly low oil inventories, as justification for the output increase.

The OPEC+ alliance, which controls approximately half of global oil production, comprises OPEC member states alongside ally countries such as Russia. While some members are expanding output, others have been instructed to moderate their increases to address prior overproduction.

Notably, Kazakhstan announced it would maintain its current production levels, fueling speculation about a potential larger increase for July. However, the group adhered to the 411,000 bpd figure.

Oil prices recently reached a four-year low in April, falling below $60 per barrel due to the substantial output hikes and global economic concerns tied to international trade tensions. Prices have since recovered slightly, closing just under $63 per barrel recently.

Analysts project global oil demand to increase by approximately 775,000 bpd in 2025, aligning closely with estimates from international energy organizations forecasting a 740,000 bpd rise.

The phased output increases starting in April aim to reverse about 2.2 million bpd of voluntary production cuts implemented by the eight participating countries. Additional production cuts negotiated among other members are expected to continue through the end of 2026.