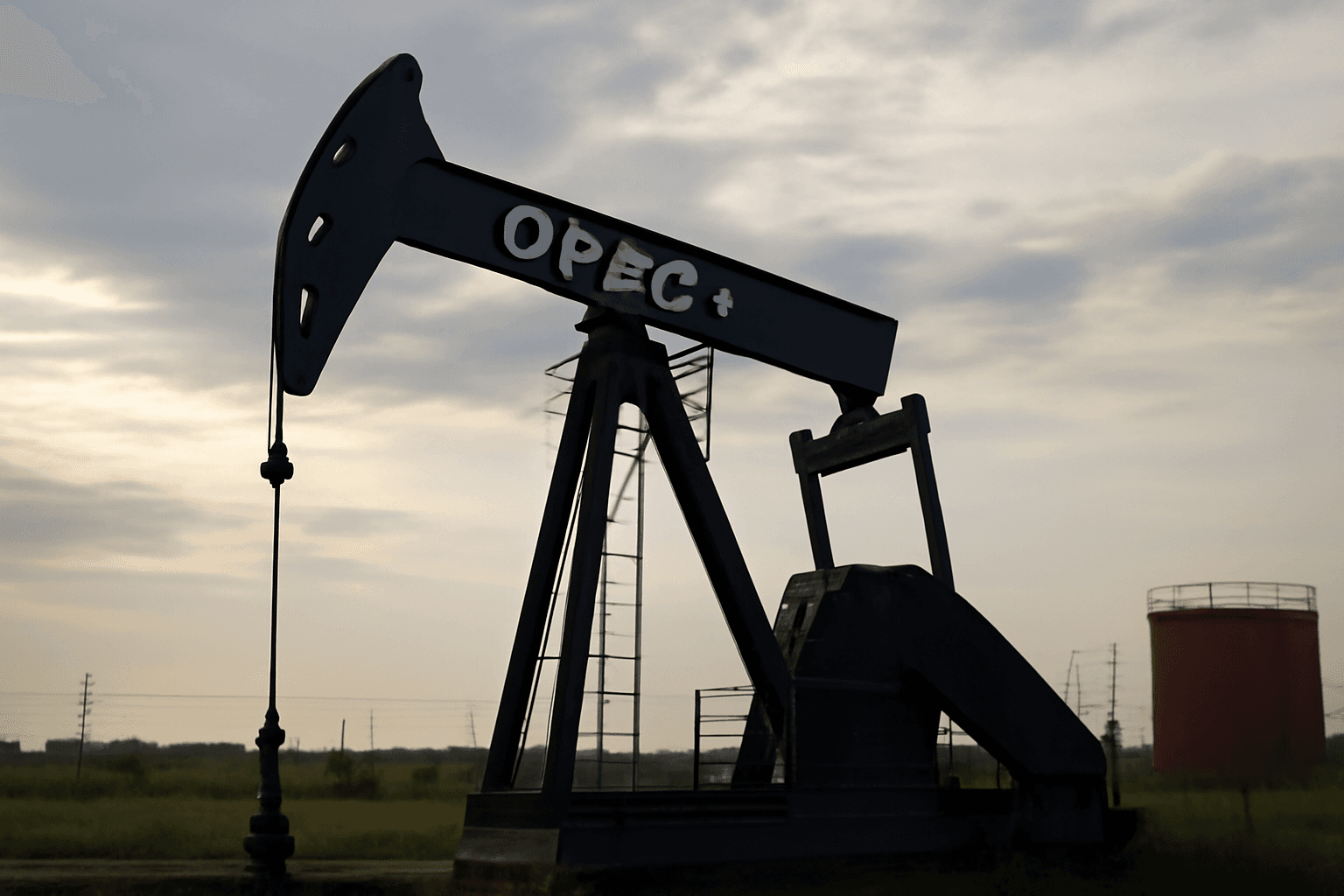

Eight members of the OPEC+ alliance are expected to increase their oil production by up to 411,000 barrels per day in July, continuing a recent trend of scaling back voluntary output cuts. This information was disclosed by two OPEC+ delegates speaking on condition of anonymity due to the sensitivity of ongoing talks.

The eight nations involved include major producers Russia and Saudi Arabia, along with Algeria, Iraq, Kazakhstan, Kuwait, Oman, and the United Arab Emirates. They are scheduled to finalize their decision at a meeting on May 31, where they will assess current market conditions and determine production adjustments for the coming months.

These countries have managed two layers of voluntary production reductions. The first, amounting to 1.66 million barrels per day, is planned to remain in place until the end of 2025. The second included an additional cut of 2.2 million barrels per day through the first quarter of the year, followed by a gradual restoration of output by one million barrels per day from April to June. The recent increments included increases of 411,000 barrels per day in both April and May, with another similar rise anticipated for July.

Market focus has increasingly shifted from OPEC+'s official, group-wide production quotas to these voluntary reductions and their subsequent easing. Typically, oil demand rises during summer months due to increased consumption of jet fuel and gasoline for travel, as well as higher crude usage in power generation across several Middle Eastern countries to meet air-conditioning needs. This seasonal demand could provide underlying support to oil prices, which have faced pressure amid broader economic uncertainties and trade tensions.

As of midday London time, ICE Brent crude futures for July delivery were trading at $65.31 per barrel, up 0.63% from the previous close, while the front-month Nymex West Texas Intermediate (WTI) contract stood at $62.22 per barrel, gaining 0.61%.