Nvidia reported strong fiscal first-quarter results, with sales growth reaching 69%. Despite robust demand, the company faced significant setbacks due to U.S. export restrictions impacting its China market prospects.

China Market Impacted by Export Controls

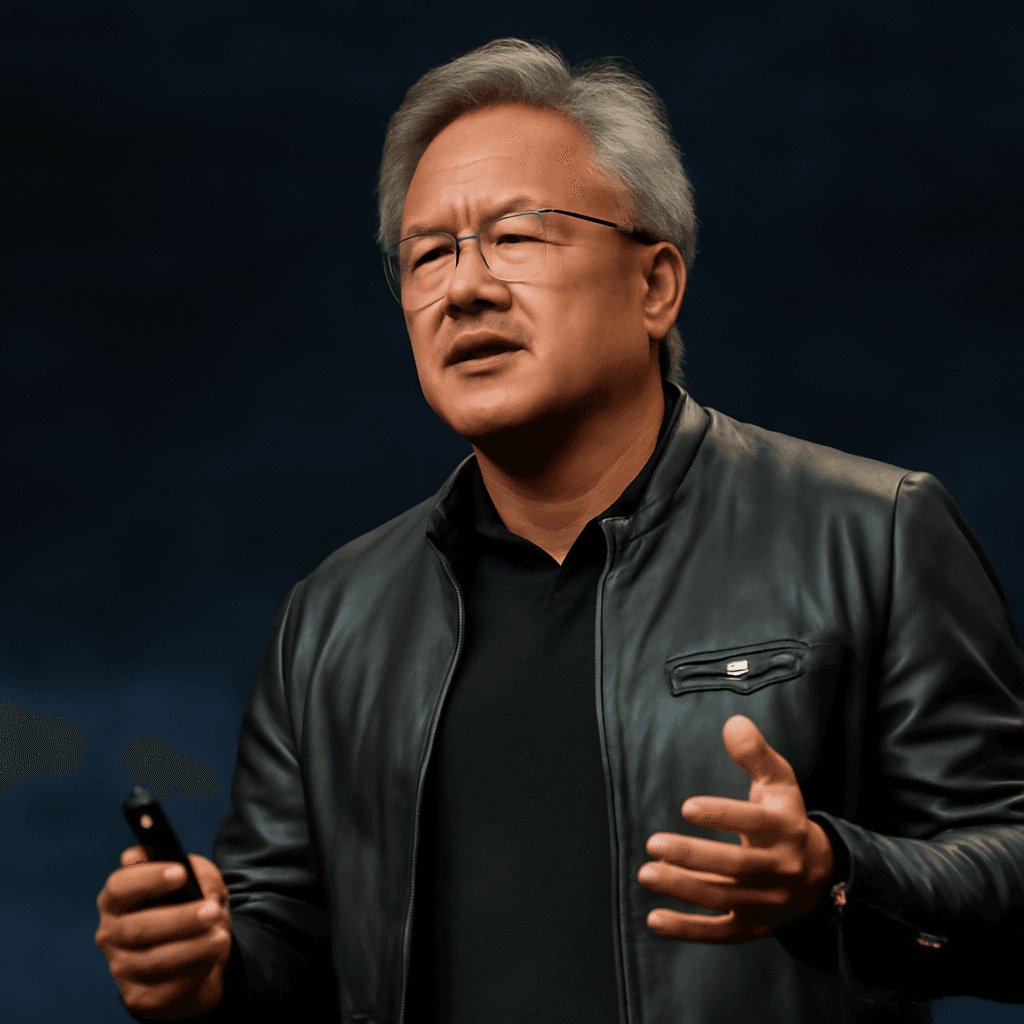

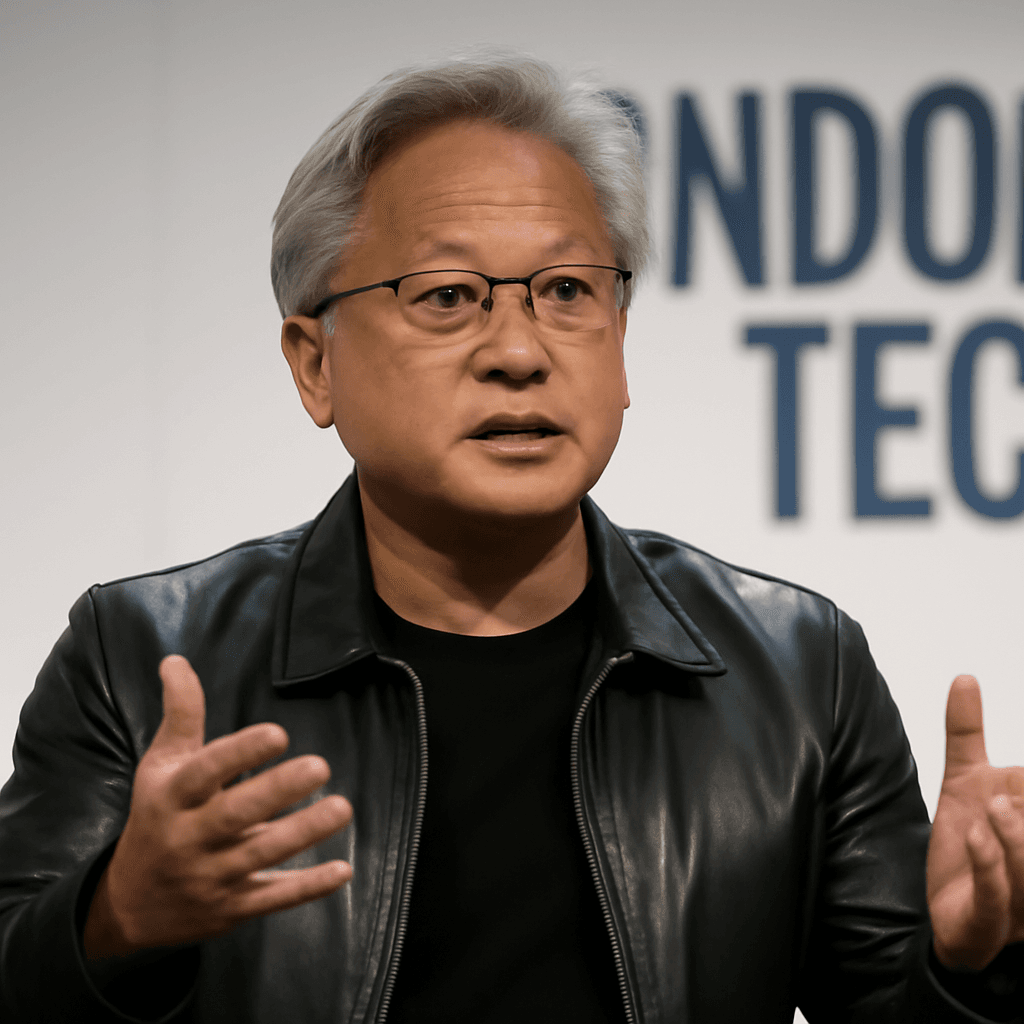

Nvidia revealed that U.S. export controls on its H100 GPU, specifically the H20 variant, have restricted approximately $2.5 billion in sales for the April quarter. The company estimates it could miss out on up to $8 billion in the upcoming quarter due to these limitations. CEO Jensen Huang described China as a potential $50 billion market that is effectively closed off because of these regulations.

Huang criticized the export controls, arguing they are based on outdated assumptions about China's AI chip capabilities and ultimately encourage the development of domestic alternatives such as those from Huawei. Nvidia is currently exploring options to develop products compliant with export rules but without compromising performance expectations.

Cloud Providers Remain Core Customers

Approximately half of Nvidia's data center revenue, which totaled $39.1 billion in the quarter, is generated by major cloud service providers including Microsoft Azure, Google Cloud, Oracle Cloud Infrastructure, and Amazon Web Services. These customers primarily deploy Nvidia's latest Blackwell GPUs, which accounted for 70% of data center sales this quarter.

Notably, Microsoft has already deployed tens of thousands of Blackwell GPUs, processing over 100 trillion AI tokens in the quarter. Nvidia plans to begin shipments of Blackwell Ultra, an enhanced version with increased memory and performance, within the current quarter.

AI Inference Driving Growth

Nvidia's CEO highlighted a transition in AI workload demand from training to inference—the process of deploying AI models to serve millions of end users. He described a significant surge in inference demand driven by advancements in AI complexity and reasoning capabilities.

According to Huang, modern AI models require exponentially more computing power, performing intricate tasks such as breaking down problems step-by-step, planning multiple solution paths, and leveraging diverse data sources like PDFs and videos. Nvidia's Blackwell chips are specifically designed to meet these evolving requirements.

Strategic Concerns from CEO Jensen Huang

During the earnings call, Huang conveyed a more cautious outlook, emphasizing the strategic importance of global semiconductor leadership beyond chip manufacturing. He stressed that the AI race encompasses the entire technology stack, including emerging areas like 6G and quantum computing, highlighting the risks to U.S. infrastructure leadership posed by export restrictions.

Overall, market analysts remain optimistic about Nvidia's growth trajectory, citing strong demand from cloud providers and AI applications despite geopolitical headwinds.

Reported by CNBC with contributions from Kristina Partsinevelos.