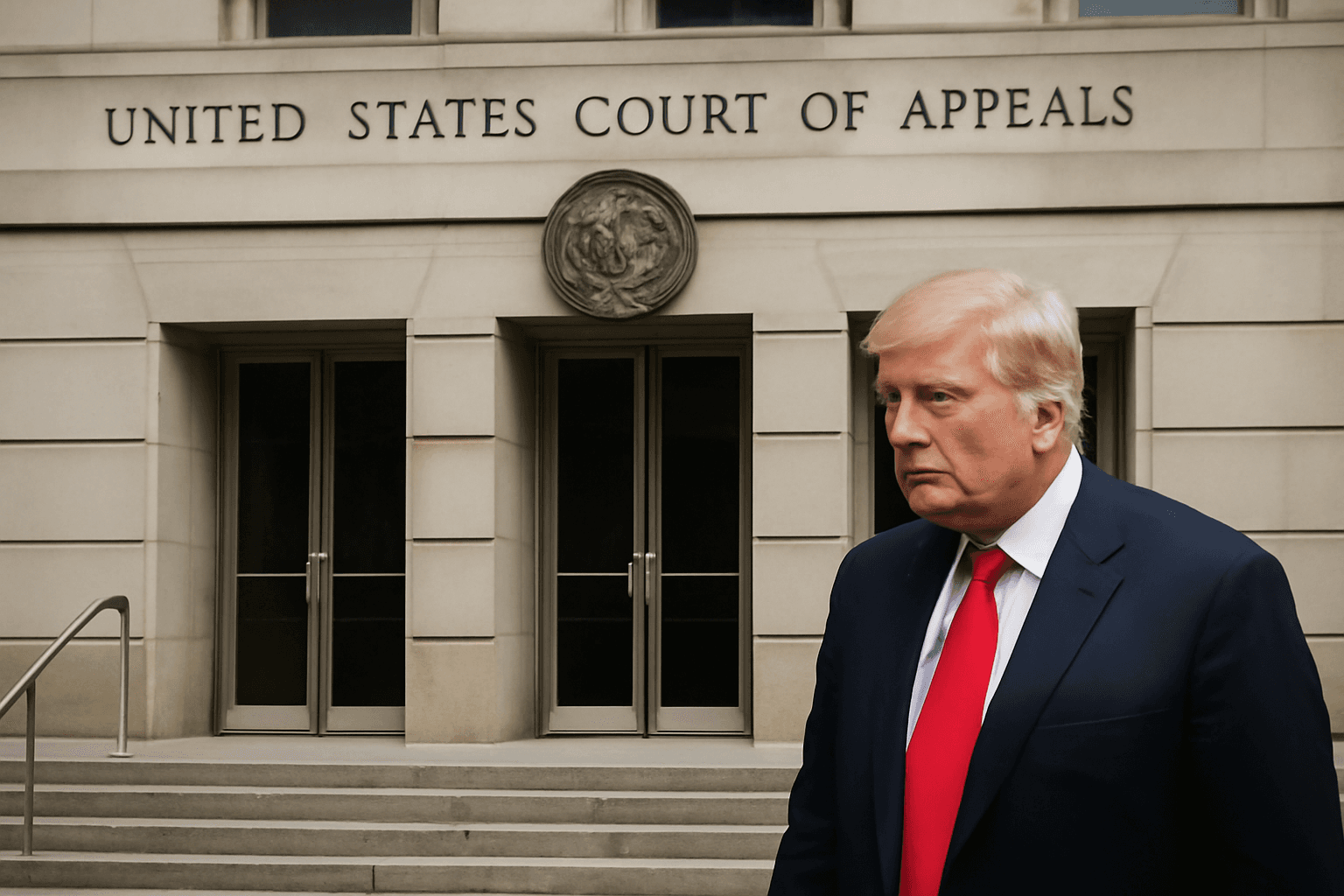

Market participants are closely watching what has been dubbed the 'TACO' trade—an acronym for "Trump Always Chickens Out." This term refers to U.S. President Donald Trump's recurring pattern of announcing aggressive tariff measures only to subsequently soften or delay them, stirring market volatility.

Ed Yardeni, president of Yardeni Research, told CNBC that "Trump's style in negotiating deals is he huffs and he puffs, but he doesn't blow the house down." This approach has generated several market spikes and subsequent recoveries. For example, in February, Trump imposed a 25% tariff on imports from Canada and Mexico before pausing them within days. Similarly, in early April, tariff escalations affected over 180 countries, igniting a steep sell-off in global equities and U.S. government bonds.

Between April 2 and April 8, the S&P 500 index dropped approximately 12%, while the MSCI World Ex-U.S. index declined over 8%. Concurrently, yields on U.S. Treasuries rose notably, signaling investor jitteriness. Then, unexpectedly on April 9, tariffs were reduced to 10% for most trading partners for a 90-day period, prompting a sharp rally in U.S. markets.

More recently, Trump announced a 50% tariff on European Union goods, only to retract this decision two days later. Such reversals showcase how market reactions influence administration policies. Yardeni highlighted that the bond market, in particular, pressured the president into postponing reciprocal tariffs.

Aberdeen Investments' Ray Sharma-Ong identified three phases in market reactions to these tariff announcements: an initial aggressive tariff rollout accompanied by risk-off sentiment; a policy walkback triggering market rebounds; and finally a phase of post-walkback ambiguity where investors remain cautious, awaiting further developments.

This pattern, however, complicates investment strategies. Brian Arcese from Foord Asset Management noted the difficulty in establishing conviction-based positions with the fluid policy environment. Calder Kieran, head of equity research at UBP Asia, observed diminished confidence in U.S. policies and assets, evidenced by capital outflows and a weakening dollar in April.

Despite the volatility, some strategists recommend focusing on fundamentals and quality stocks less susceptible to large drawdowns during market downturns. Morningstar’s Kai Wang cautioned against assuming a "Trump put"—the idea that the president will always intervene to support markets—is guaranteed.

Nomura's Rob Subbaraman emphasized that as markets and governments grow wary of the "Trump put," the administration’s leverage decreases, possibly reducing the frequency or effectiveness of such interventions. Billy Leung of Global X echoed this sentiment, urging investors to pivot away from import-reliant companies towards those diversifying supply chains and reshoring operations.

"Corporates are not waiting for policy clarity," Leung added, underscoring a strategic shift amid persistent tariff uncertainties.