Salesforce reported robust fiscal first-quarter results and projected optimistic future growth, outperforming analyst expectations. The company also revealed plans to acquire data management software firm Informatica for $8 billion, marking its largest deal since the 2021 Slack acquisition.

For the quarter ending April 30, Salesforce posted adjusted earnings per share of $2.58, surpassing the consensus estimate of $2.54. Revenue reached $9.83 billion, beating the anticipated $9.75 billion and reflecting 7.6% year-over-year growth. Net income stood at $1.54 billion, or $1.59 per share, essentially flat from $1.53 billion, or $1.56 per share, in the prior year.

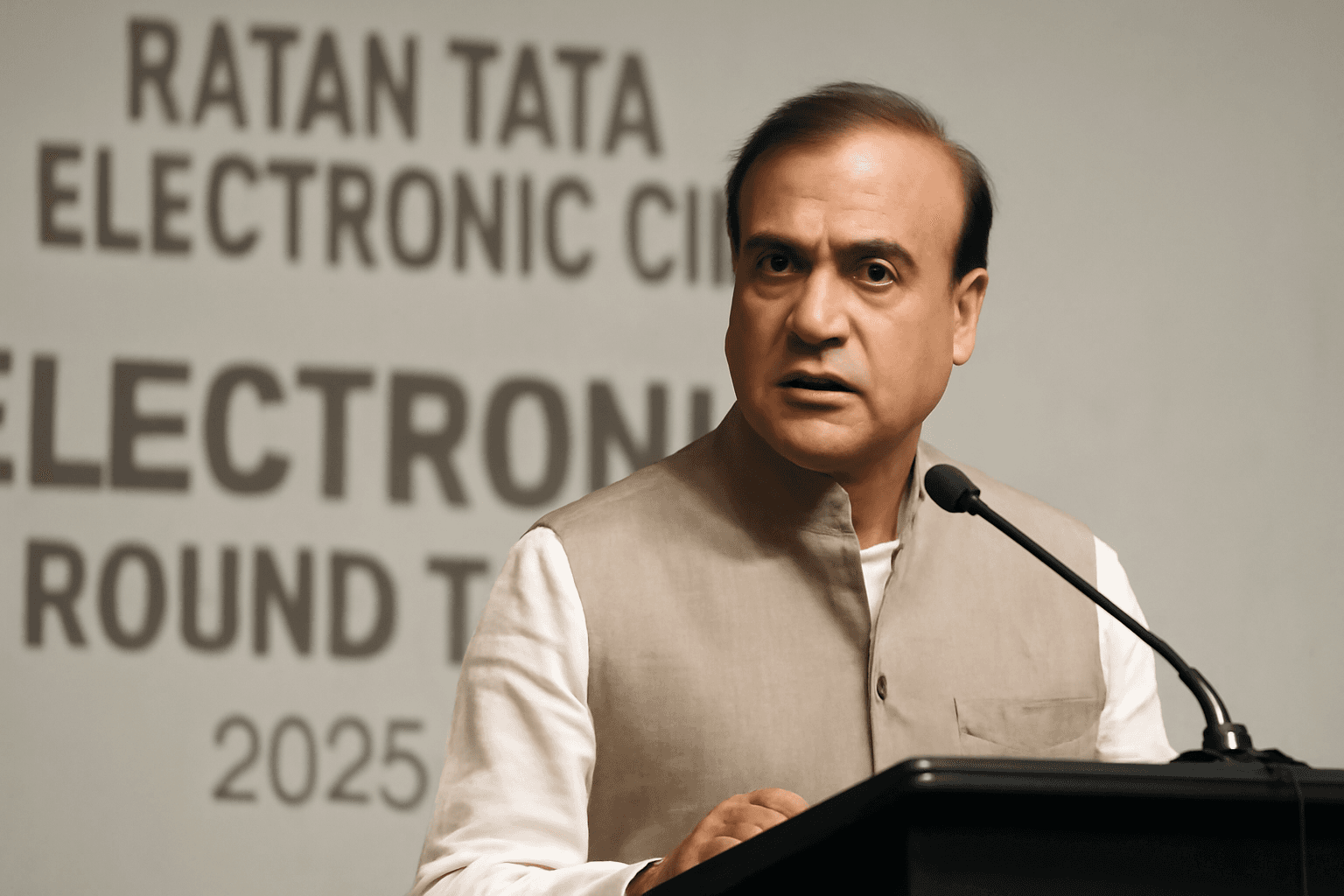

CEO Marc Benioff expressed confidence in the company’s trajectory despite recent macroeconomic headwinds, including sweeping tariffs announced earlier in April. The $8 billion Informatica acquisition builds on Salesforce’s strategic expansion efforts and represents its largest purchase since the $27.1 billion Slack deal in 2021.

While activist investors have raised concerns regarding Salesforce’s aggressive spending and slowing revenue growth, the company responded by reducing its workforce by 10% and disbanding its mergers and acquisitions committee. Salesforce’s CFO highlighted progress toward achieving profitability targets earlier than expected, and the company initiated share repurchases to enhance shareholder value.

The Informatica transaction received a favorable initial response from analysts. Stifel’s J. Parker Lane noted that Salesforce is paying a reasonable multiple and that this acquisition may be easier for investors to absorb compared to previous large deals.

Salesforce and Informatica have a long relationship, with discussions on collaboration spanning over two decades. Although talks faltered last year, the companies have now reached an agreement to combine forces. Founded in 1993 and public since 1999, Informatica was taken private in 2015 by Permira Funds and Canada Pension Plan Investment Board. It returned to the public market in 2021.

In product news, Salesforce launched a marketplace for artificial intelligence agents during the quarter, reflecting its commitment to innovation and expanding AI capabilities.

Looking ahead, Salesforce anticipates adjusted earnings per share between $2.76 and $2.78 on revenue of $10.11 billion to $10.16 billion for the fiscal second quarter, exceeding analyst forecasts. For the full fiscal year, the company raised its guidance to an adjusted EPS range of $11.27 to $11.33 and revenue between $41.0 billion and $41.3 billion, implying growth between 8% and 9%.

Despite the positive results and outlook, Salesforce shares have declined approximately 18% year-to-date as of Wednesday’s close, while the broader S&P 500 index remained flat.

Note: This is breaking news; updates will follow as more information becomes available.