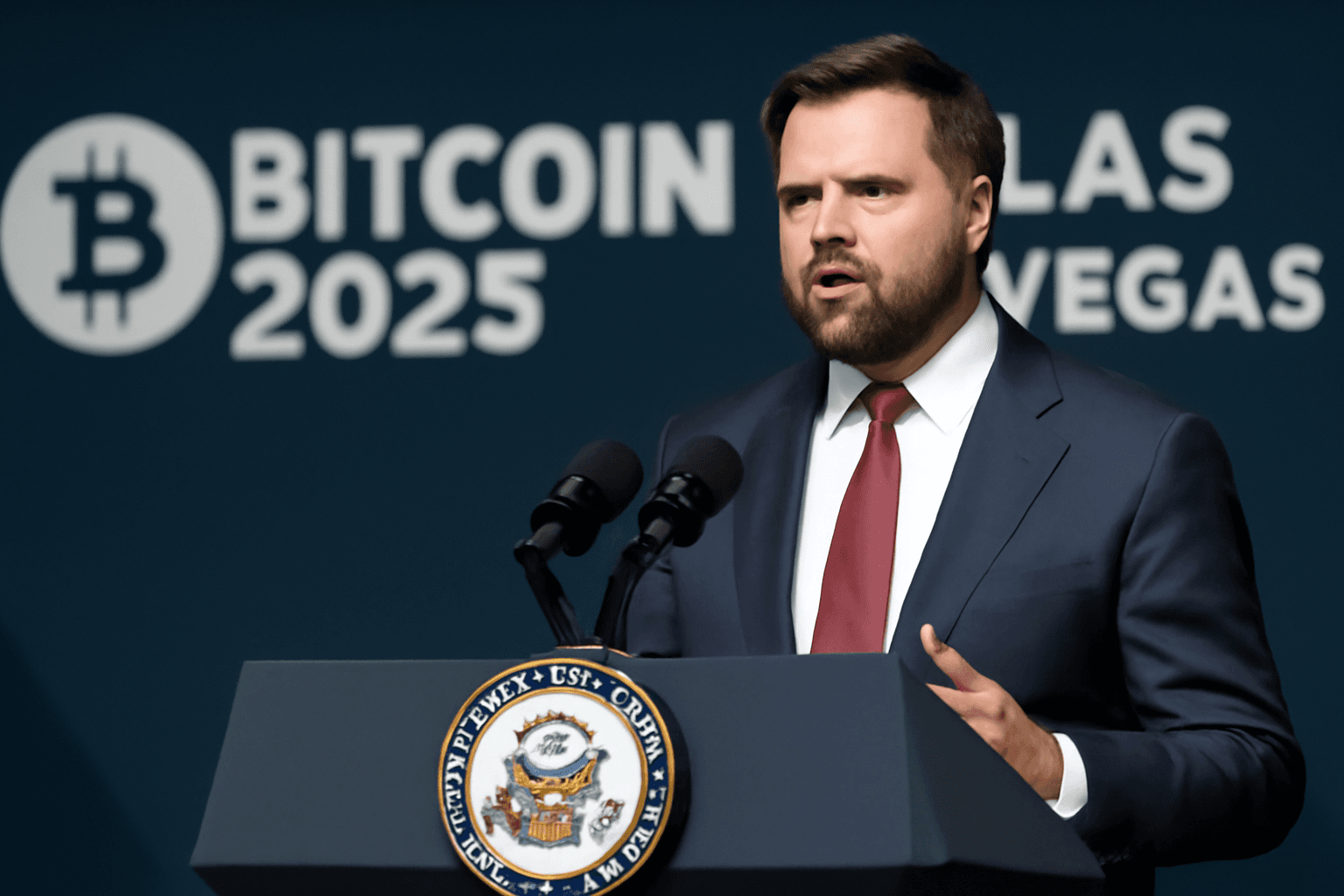

During a bitcoin conference in Las Vegas, Vice President JD Vance stated that cryptocurrencies have a strong advocate in former US President Donald Trump. Vance emphasized that the Trump administration aimed to develop a "pro-growth legal framework" for stablecoins in the United States, signaling an end to what he described as regulatory "weaponization" against the crypto sector.

Stablecoins are digital tokens pegged to stable assets, such as the US dollar, designed to minimize volatility in the cryptocurrency market.

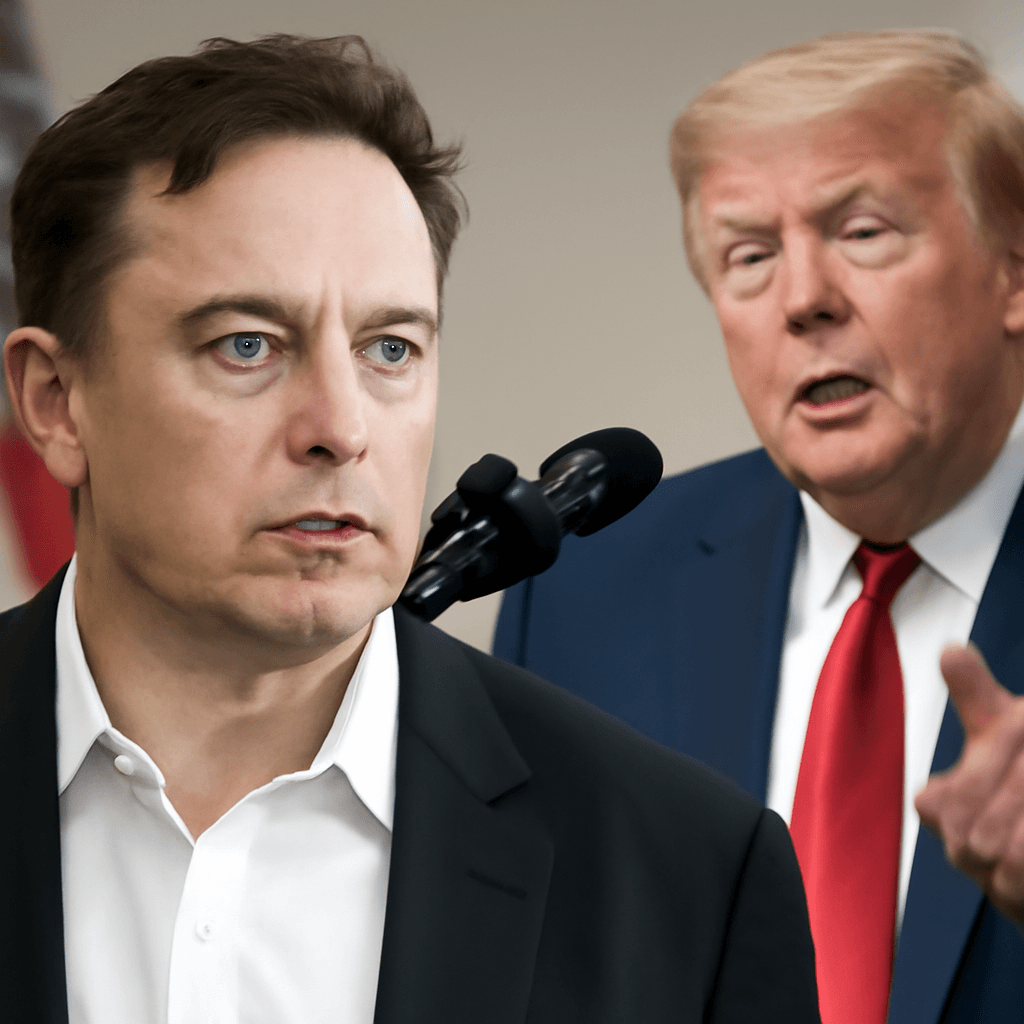

Vance’s remarks followed an announcement from Trump Media & Technology Group, the operator of Truth Social, which plans to raise approximately $2.5 billion to establish a "bitcoin treasury," with cryptocurrency set to form a significant part of its asset portfolio.

Last week, Trump hosted an event at his golf club near Washington, attracting hundreds of top investors to promote his crypto memecoin. The event drew criticism from Democratic politicians and protestors, who labeled it as a conflict of interest blending presidential authority with personal business.

At the conference, Vance, who was the keynote speaker, criticized regulatory approaches under former Securities and Exchange Commission (SEC) chairman Gary Gensler, who aggressively pursued enforcement actions against major crypto exchanges such as Coinbase, Binance, and Kraken.

Vance stated, "We reject regulators" pursuing harsh crackdowns and advocated for integrating cryptocurrencies like Bitcoin into the mainstream economy through innovation-friendly regulations.

Additionally, Donald Trump Jr. and Eric Trump were scheduled to speak at the event, highlighting the family's expanding involvement in digital currency ventures, including investments in Binance, whose founder is currently seeking a presidential pardon to re-enter the US market.

Supporting this momentum, US lawmakers recently advanced the GENIUS Act, a significant bill proposing a regulatory framework specifically for stablecoins, marking progress towards clearer crypto governance.