China's GDP Growth Surpasses Expectations Amid Ongoing US Trade Negotiations

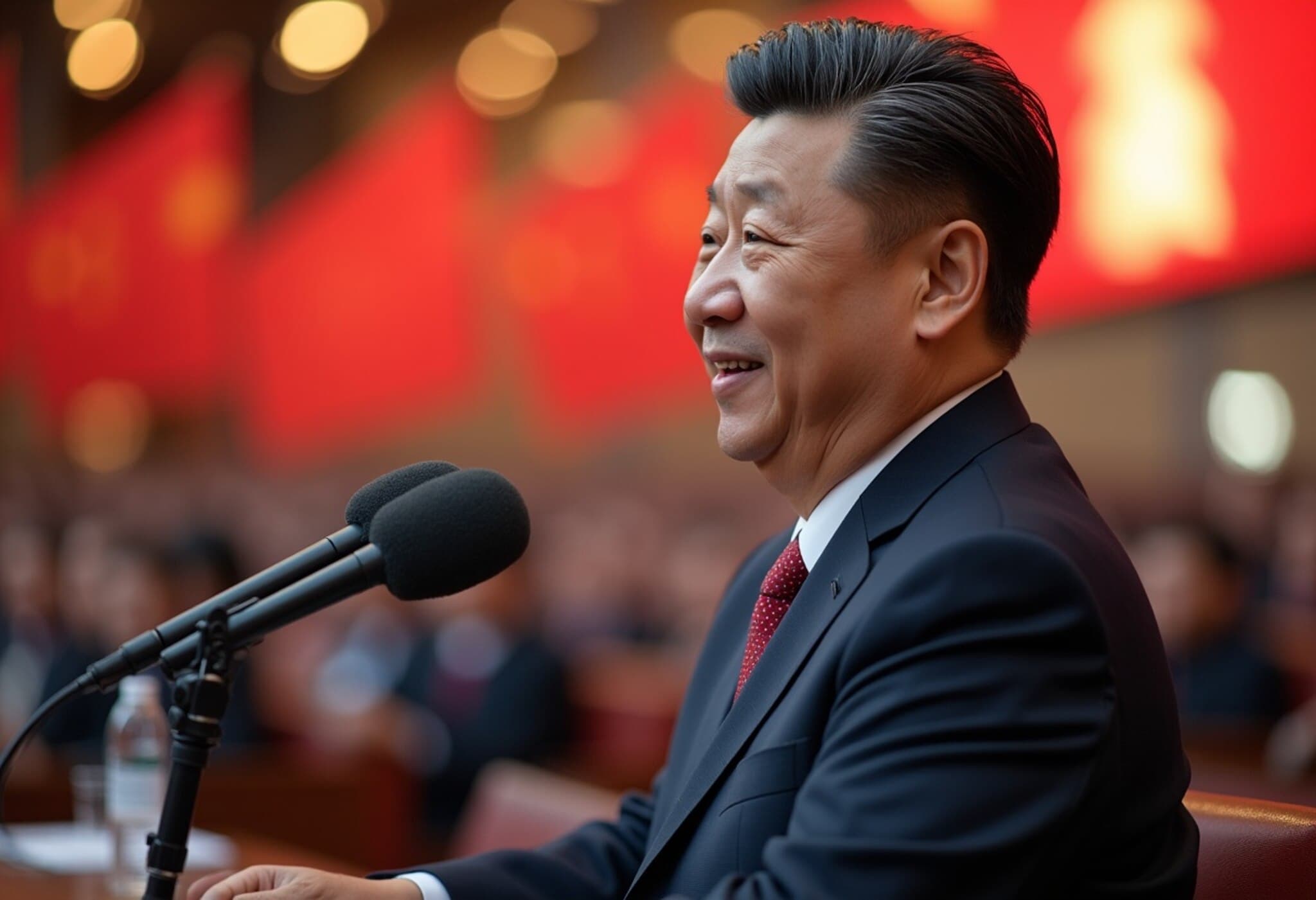

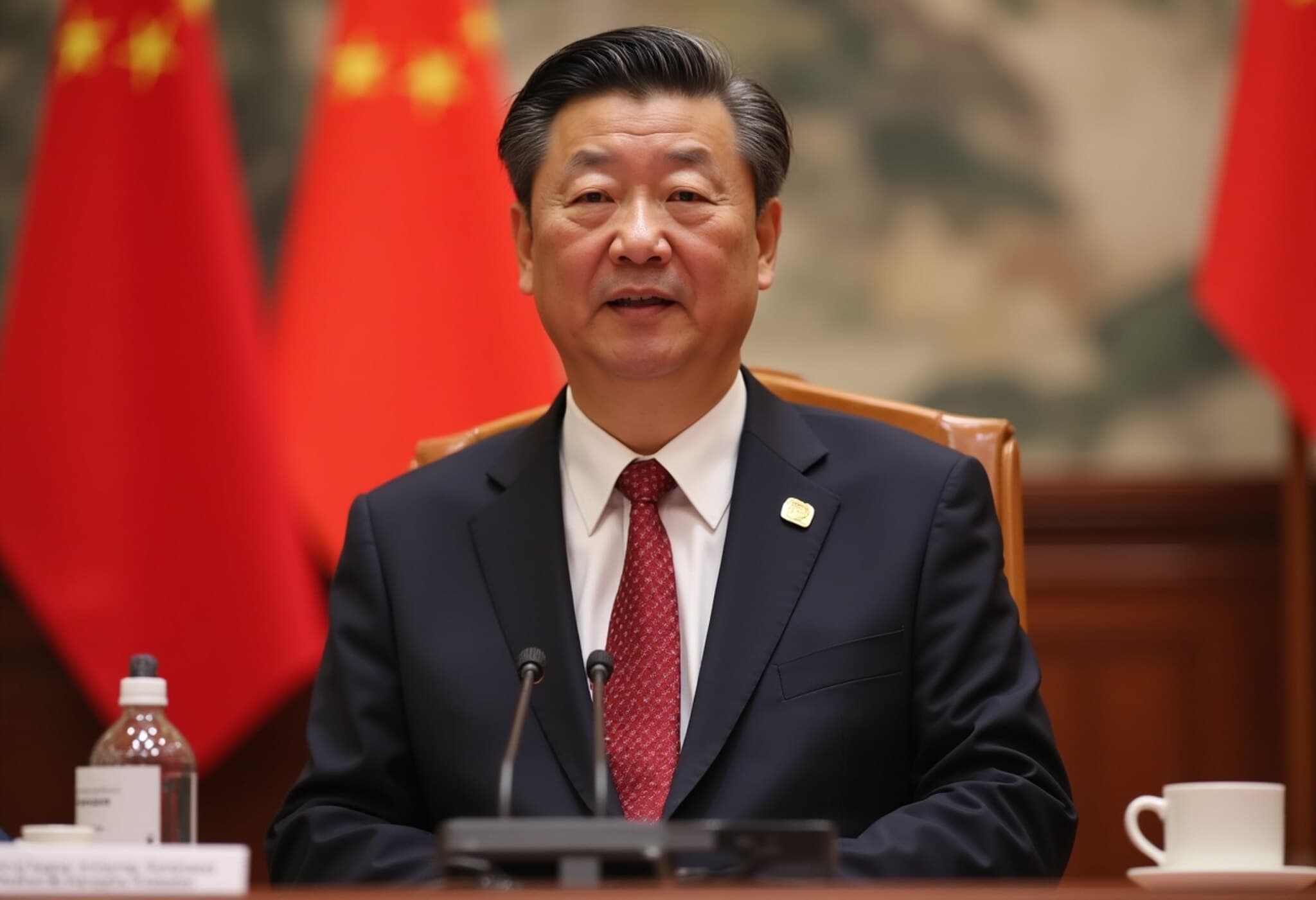

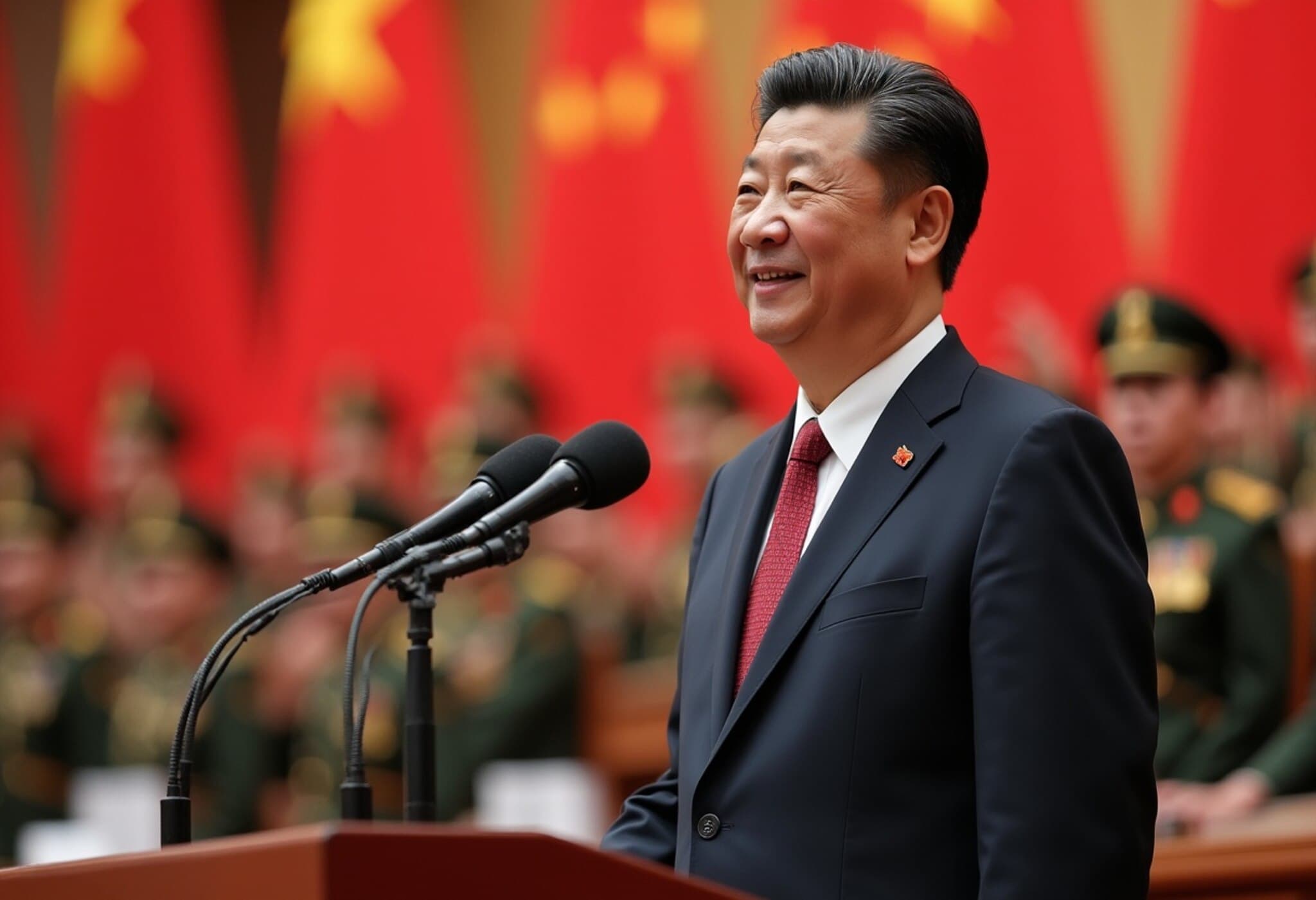

China's economy showed unexpected resilience in the second quarter of 2025, with a gross domestic product (GDP) growth rate of 5.2%, exceeding both government targets and analysts' forecasts. This positive economic performance offers a valuable boost to Chinese President Xi Jinping as he navigates high-stakes trade negotiations with the United States under the Trump administration.

Economic Performance Defies Tariff Pressures

Despite enduring intense tariffs imposed by the US, including rates as high as 145% on certain goods, China managed to maintain a robust growth trajectory. Official data released recently revealed that China's economy remained steady, outpacing the 5.1% growth predicted by economists and surpassing the government's own 5% target. This resilience not only showcases the adaptability of China's economy but also highlights its strategic diversification efforts.

Leverage Through Rare Earths and Market Diversification

China's near-monopoly on rare earth elements—a crucial component for electronics, automotive, and defense sectors—continues to serve as a critical bargaining chip in trade discussions. This dominance effectively gives China substantial leverage, enabling President Xi to pressure the US into concessions.

Additionally, China’s export strategy has evolved in the face of the US tariffs. While shipments to the US declined by 10.9% this year, Chinese exports to Southeast Asia and the European Union have risen by 13% and 6.6% respectively. This diversification cushions China’s economy from the brunt of US trade restrictions, illustrating a tactical pivot toward new markets and deepening economic ties across other global regions.

Expert Insights: What the Numbers Really Mean

However, the headline growth figures mask some underlying economic challenges. Senior analysts paint a more cautious picture:

- Slowing momentum: GDP growth, while strong, actually slipped from 5.4% earlier in the year to 5.2%, suggesting a gradual slowing trend.

- Weak domestic demand: Retail sales and investment remain subdued, indicating that Chinese consumers and businesses are hesitant to spend and invest.

- Employment concerns: Industrial production, the primary growth driver, is highly automated, resulting in minimal job creation. This raises concerns about sustainable economic growth and social stability.

Dan Wang, Director for China at Eurasia Group, highlighted these nuances in an interview with Reuters: "Consumption is weaker than expected, housing is dragging with low transaction volumes, and smaller exporters face bankruptcy risks due to tariffs. Both consumer and business confidence have faltered, and export activities are increasingly shifting overseas."

Similarly, Nick Marro, Principal Economist for Asia at the Economist Intelligence Unit, pointed to the psychological impact: "For many, this doesn’t feel like a rapidly growing economy. This sentiment can curb retail spending, dampen investment expansions, and hamper wage growth."

Implications for US-China Trade Relations

From a geopolitical and economic policy perspective, China’s latest economic data arrives at a critical moment. President Xi’s strengthened position could influence the tone and outcomes of ongoing talks with the Trump administration. China’s resilience sends a message: while tariffs create friction, they have yet to achieve the intended economic disruption.

This dynamic complicates US strategy, as the country must weigh the costs of escalating tariffs against the benefits of pressing for concessions. Moreover, China’s successful market diversification and rare earths leverage reveal deep structural shifts in the global economic landscape, emphasizing the interconnectedness and vulnerabilities each nation faces.

Looking Ahead: Opportunities and Risks

While China holds several cards in the trade negotiations, economic experts caution that structural weaknesses may limit its long-term bargaining power. Without robust consumer demand and broad-based domestic growth, maintaining momentum will require careful policy adjustments, including potential fiscal stimulus.

For the United States, the challenge lies in crafting trade policies that encourage fair practices without igniting a broader economic conflict that could hurt both economies and global markets.

Summary Box: Key Takeaways

- China's Q2 2025 GDP growth of 5.2% outperformed expectations, bolstering Xi Jinping’s negotiating position.

- Export diversification and rare earth element dominance offer China strategic leverage against US tariffs.

- Underlying domestic economic issues, like weak consumer spending and limited job growth, temper optimism.

- Trade tensions continue to reshape global economic alliances, underscoring the nuanced challenges of US-China relations.

Editor's Note

China’s latest economic data reflects both resilience and fragility, serving as a pivotal backdrop for one of the most consequential trade negotiations in modern history. As policymakers on both sides weigh tariffs, market access, and technological dominance, it's essential to consider the human factors behind the numbers—consumer confidence, job creation, and broader economic sentiment shape not just statistics, but real lives. The evolving US-China dynamic will profoundly impact the global economy, making it vital to watch this space closely.