Chinese Companies Keep Growing in U.S. Market Amid Trade Strains

Despite ongoing geopolitical tensions, Chinese companies are boldly pushing into global markets, with the United States emerging as a top revenue source alongside China and Europe. This trend is evident in the recent landmark stock offering by Shenzhen-based Insta360, a contender to GoPro in the 360-degree camera space.

Insta360’s Record-Breaking Public Listing

In a major move, Insta360 raised nearly 1.94 billion yuan ($270 million) on Shanghai’s tech-focused STAR Market, marking the board’s largest fundraising round to date. Shares surged by an impressive 274%, pushing the company’s market valuation close to 71 billion yuan ($9.88 billion).

Remarkably, Insta360’s revenue split last year showed the U.S., Europe, and mainland China each accounted for just over 23% of sales, underlining the company's strong foothold in international markets. Since 2018, its cameras have been sold in Apple Stores in the U.S., complemented by proprietary video editing software, appealing to consumers worldwide.

Confidence Despite Geopolitical Challenges

Max Richter, Insta360’s co-founder, emphasized the firm's commitment to innovation and user-focused research as key to sustaining demand, particularly in the U.S. market. He downplayed worries about geopolitical risks, stating that understanding consumer needs and market trends remain their top priorities.

The Growing Global Footprint of Chinese Tech Firms

The STAR Market, established to fuel growth for tech firms with higher investor requirements than traditional boards, has seen a rise in companies earning substantial revenue overseas. Analysis reveals that while only 12% of firms in 2019 derived over half their sales abroad, this has grown to more than 14% by 2024.

King Leung, a financial services and sustainability expert, describes this as just “the tip of the iceberg,” noting established giants like battery maker CATL are expanding rapidly. Even smaller, tier-two and tier-three firms are proving capable of making their mark internationally.

Bridging Mainland China with Global Markets

Hong Kong’s InvestHK agency is actively facilitating these cross-border expansions, organizing initiatives to connect Chinese businesses with overseas opportunities, including recent ventures into the Middle East.

Roborock, another STAR-listed company renowned for its robotic vacuum cleaners, recently announced plans to list in Hong Kong, bolstered by the fact that over half its revenue comes from abroad. Innovations like its robotic arm to navigate obstacles debuted recently at global trade shows, signaling a continued focus on international consumers.

Expanding Beyond Electronics: New Frontiers for Chinese Brands

Chinese firms are moving beyond traditional manufacturing roles into brand-building with international offices and locally hired teams. Charlie Chen, an Asia research chief, highlights a shift toward independent global brand presence, contrasting earlier stages where Chinese companies mainly served as manufacturers or formed joint ventures.

Insta360, for example, operates manufacturing in Shenzhen but maintains offices in Berlin, Tokyo, and Los Angeles, the latter focusing on marketing and service. They even held a flagship product launch at New York’s Grand Central Terminal in April, underlining their global ambitions.

Toys and Lifestyle Products Showing Rapid International Growth

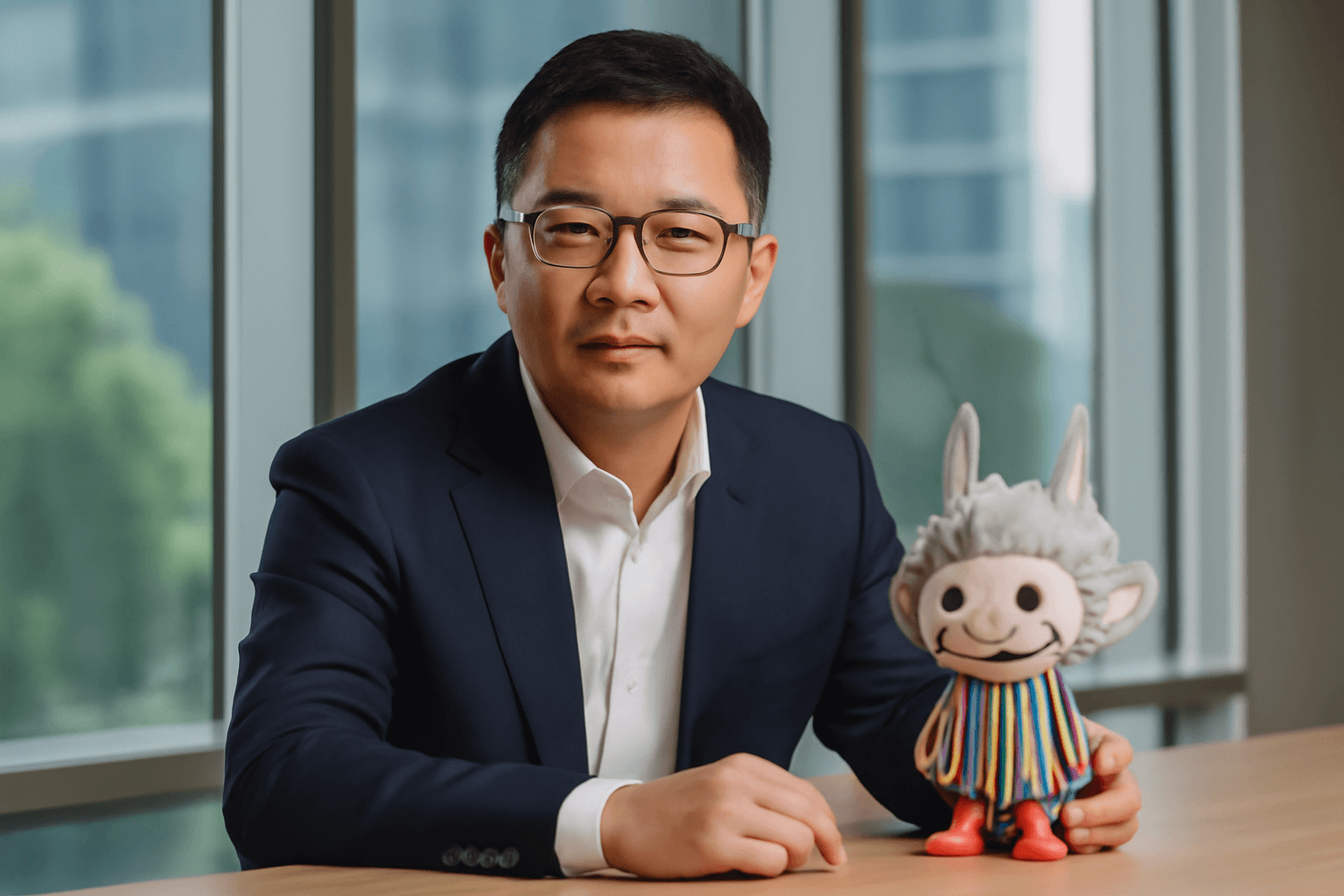

Beijing-based Pop Mart exemplifies this broader expansion. Known for its collectible figurines like the Labubu series, the company’s overseas sales jumped 373% year over year in 2024, reaching 5.1 billion yuan—surpassing its total domestic sales from 2021. Mainland China sales also continue to grow, hitting nearly 8 billion yuan.

Without widely publicizing its global store rollout, Pop Mart has rapidly opened multiple international locations since 2022. Experts predict sustained growth fueled by popular character-driven products, which resonate strongly during economic uncertainty.

Looking Ahead: Chinese Companies Embrace a New Global Phase

The pandemic slowed consumer growth, spurring Chinese firms to accelerate overseas ventures. Going forward, experts foresee diversification beyond home appliances and electronics, with toys and lifestyle products gaining prominence.

These companies are not only navigating complex geopolitical landscapes but also redefining global consumer markets by localizing operations and crafting authentic brands worldwide.