Crusoe Secures $750 Million Credit Line for AI Infrastructure Growth

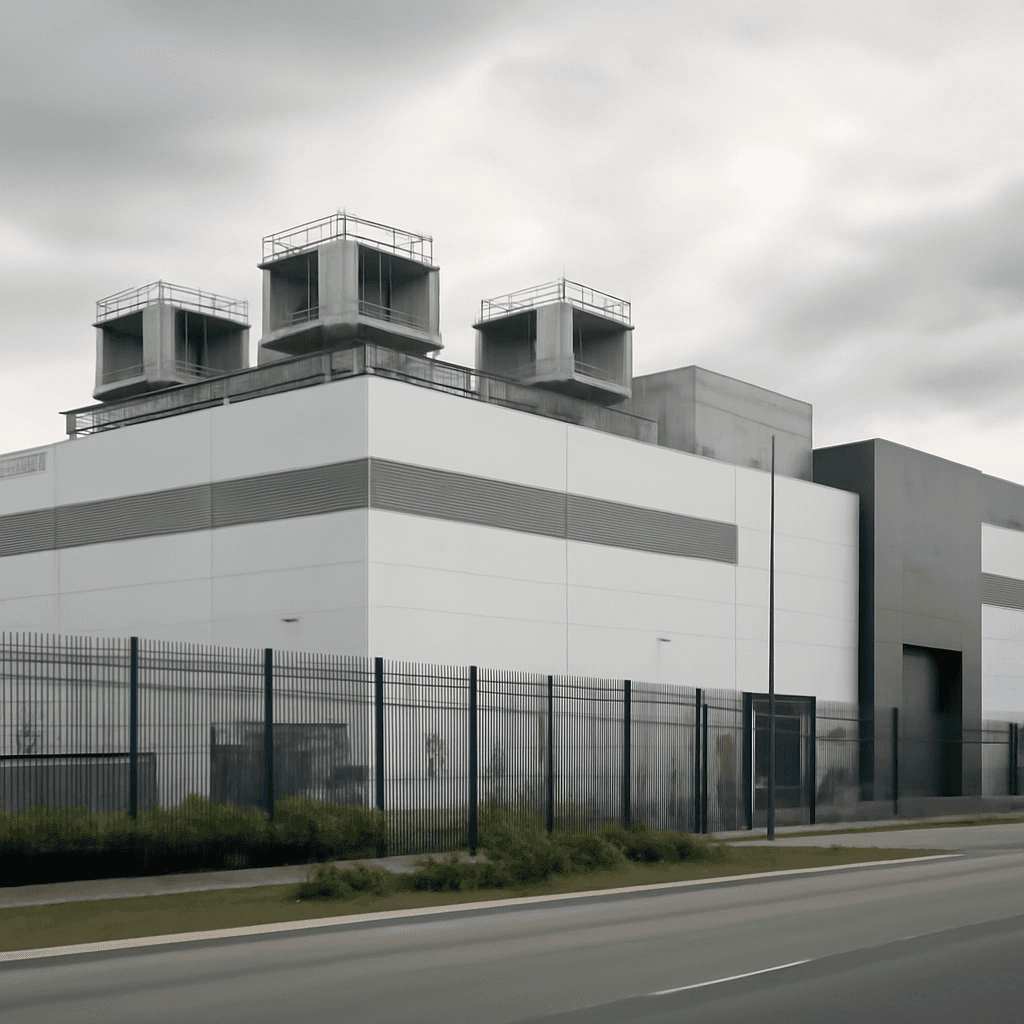

Crusoe, a Denver-based cloud infrastructure startup, has announced a substantial $750 million credit facility from Brookfield Asset Management to accelerate its involvement in building cutting-edge AI data centers. This infusion of capital is poised to fund the setup of next-generation data centers equipped with Nvidia chips alongside critical power generation and electrical infrastructure.

Driving Force Behind OpenAI's Stargate Project in Texas

The funding supports Crusoe's key role in the ambitious Stargate initiative, a colossal data center campus in Texas designed to power artificial intelligence computing at an unprecedented scale. This project, backed by OpenAI and other partners, envisions up to $500 billion invested over four years to build the foundational AI infrastructure that will fuel the future of machine learning and AI services.

Capex-Heavy Industry Demands Deep Capital Pools

According to Chase Lochmiller, Crusoe’s CEO, the company operates in an intensely capital-intensive arena. "We’re building critical infrastructure that requires significant financial backing to meet both global needs and our customers’ rapidly growing demands," Lochmiller shared. Crusoe’s commitment to owning and developing its own data centers sets it apart from many competitors that typically lease facilities.

Recent Funding Highlights Cement Crusoe’s Rapid Growth

- December 2024: Raised $600 million from investors including Fidelity and Mubadala.

- March 2025: Secured a $225 million credit line from Upper90 Capital Management.

- April 2025: Entered a $15 billion joint venture with Blue Owl Capital and Primary Digital Infrastructure to develop a massive data center in Abilene, Texas, hosting 400,000 Nvidia GPUs.

These strategic moves position Crusoe at the forefront of AI cloud infrastructure development, tapping into the explosive growth of AI applications such as ChatGPT, which recently surpassed $7 billion in annualized revenue (excluding one-time deals), marking a sharp rise from $5.5 billion in 2024.

Competing in a Crowded but Booming Market

Crusoe faces fierce competition from leading cloud providers and AI-focused platforms. For instance, CoreWeave, a public company with a current valuation near $71 billion, posted impressive revenue growth of 420% fueled by demand from OpenAI and Microsoft, albeit with rising net losses.

Unlike CoreWeave, Crusoe’s strategy hinges on owning infrastructure rather than leasing, which CEO Lochmiller believes enhances long-term equity value, especially as AI adoption continues to surge worldwide.

About Crusoe: Innovation and Expansion

Founded in 2018, Crusoe employs roughly 800 people and serves clients such as the Massachusetts Institute of Technology, Together AI, and Windsurf. In March, Nydig acquired the startup’s bitcoin mining division, allowing Crusoe to concentrate fully on AI infrastructure expansion.

As the AI revolution races ahead, Crusoe’s latest credit line and partnerships underscore its vital role in powering the complex technology that will shape the sector’s future.