Vantage Completes Groundbreaking €720 Million Data Center Finance Deal in Europe

In a pioneering move for the European market, U.S.-based data center operator Vantage has successfully raised €720 million ($821 million) through a unique asset-backed securitization (ABS) deal. This transaction marks the first euro-denominated ABS involving data center assets on the continent, signaling a new wave of financing opportunities in the cloud and AI infrastructure sector.

Key Details of the ABS Deal

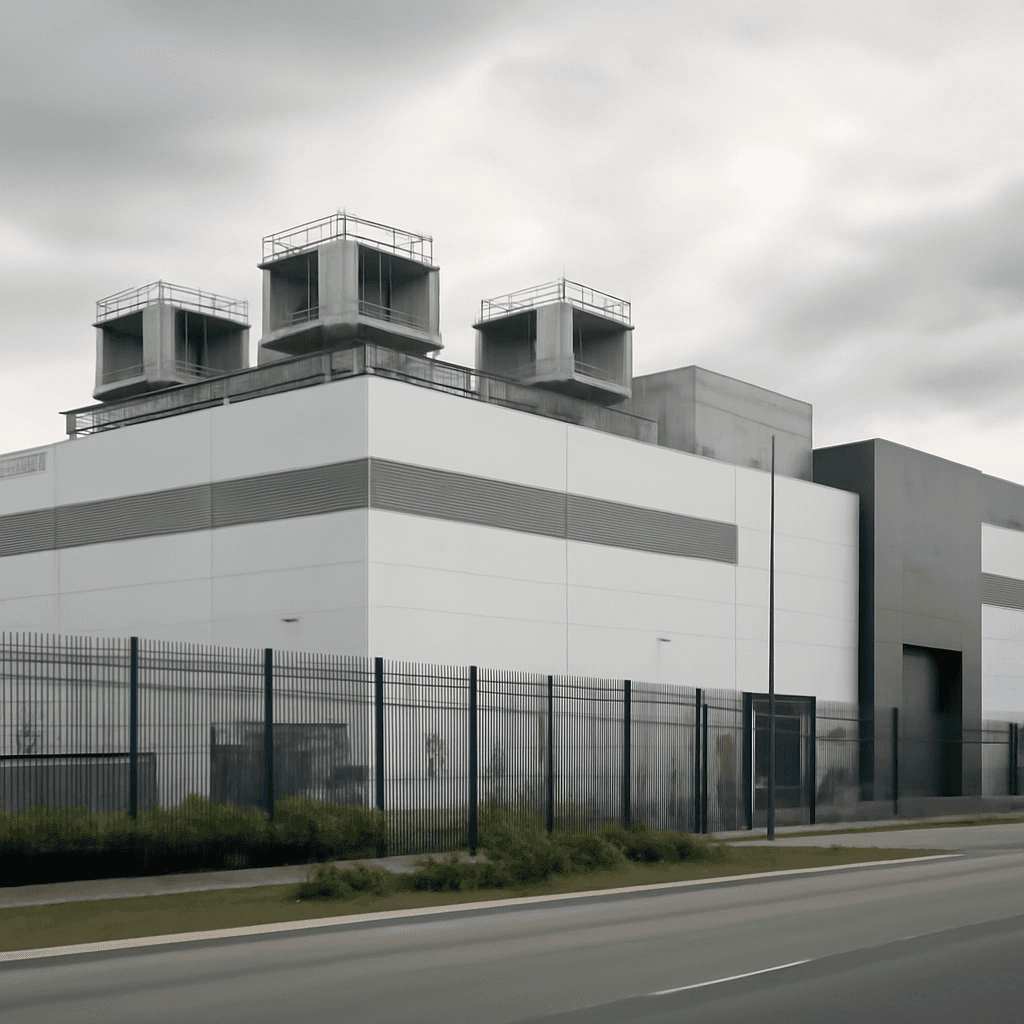

The ABS arrangement leverages four strategically located data centers in Germany — two facilities each in Berlin and Frankfurt. Collectively, these centers have access to approximately 55 megawatts of power and are fully leased to hyperscale customers, highlighting their robust and stable operational profile.

Vantage plans to channel the raised funds primarily toward repaying previous construction loans tied to these facilities. The company will issue bonds with an average coupon rate of 4.3%, underpinning its confidence in the bond market despite the deal's sizeable scale.

Why Asset-Backed Securitization Fits Vantage’s Model

Vantage's Chief Financial Officer emphasized the suitability of ABS for their portfolio, noting, "Our assets are real estate-focused, have high-credit quality tenants, and benefit from long-term leases—essentially ticking all the boxes that ABS investors look for." This alignment not only enhances investor confidence but also opens the door for more data center operators to consider similar financing structures.

Investor Appetite Surpasses Expectations

Interestingly, despite the high leverage and the substantial amount raised, demand from investors outpaced the issuance. Senior VP of Global Capital Markets at Vantage remarked, "While some investors were cautious about the leverage level, we saw oversubscription rates of two to four times our issued bonds, allowing us to improve pricing significantly during marketing.”

Significance of the Four Data Centers

The quartet of data centers involved in this deal represents some of Germany's most critical cloud infrastructure assets. Valued at over $1 billion earlier this year, these centers underline Vantage’s expanding footprint in Europe’s high-growth data hub markets.

Context Within Vantage’s Broader European Strategy

This latest capital raise follows last year’s landmark £600 million securitization of two units within Vantage’s Cardiff campus—the first data center securitization in Europe, the Middle East, and Asia (EMEA). That facility offers a substantial power capacity of 148 megawatts. Across these regions, Vantage commands an impressive operational and developmental data center capacity exceeding 2,500 megawatts.

Transaction Leadership and Legal Support

The deal was skillfully led by Barclays Bank and Deutsche Bank as joint lead managers. Legal counsel came from the renowned British law firm Clifford Chance, ensuring the complex structuring met the highest standards.

Looking Ahead

Vantage's pioneering move not only unlocks new financing avenues but also underscores the growing importance of data centers in fueling Europe’s cloud and AI growth. As hyperscale demand surges, the ABS structure could become an increasingly popular financing tool within this vital sector.