Denmark has officially raised its retirement age to 70, setting the highest threshold in Europe. This reform, scheduled to fully take effect by 2040, reflects adjustments linked to increased life expectancy and signals a broader trend towards longer working lives.

In Denmark, the retirement age for public pension eligibility currently stands at 67 but will incrementally increase to 70 by 2040. This policy means younger generations in Denmark will need to work longer before qualifying for public pensions. Despite options for early retirement through private savings or early pension schemes, this change strongly encourages extended workforce participation.

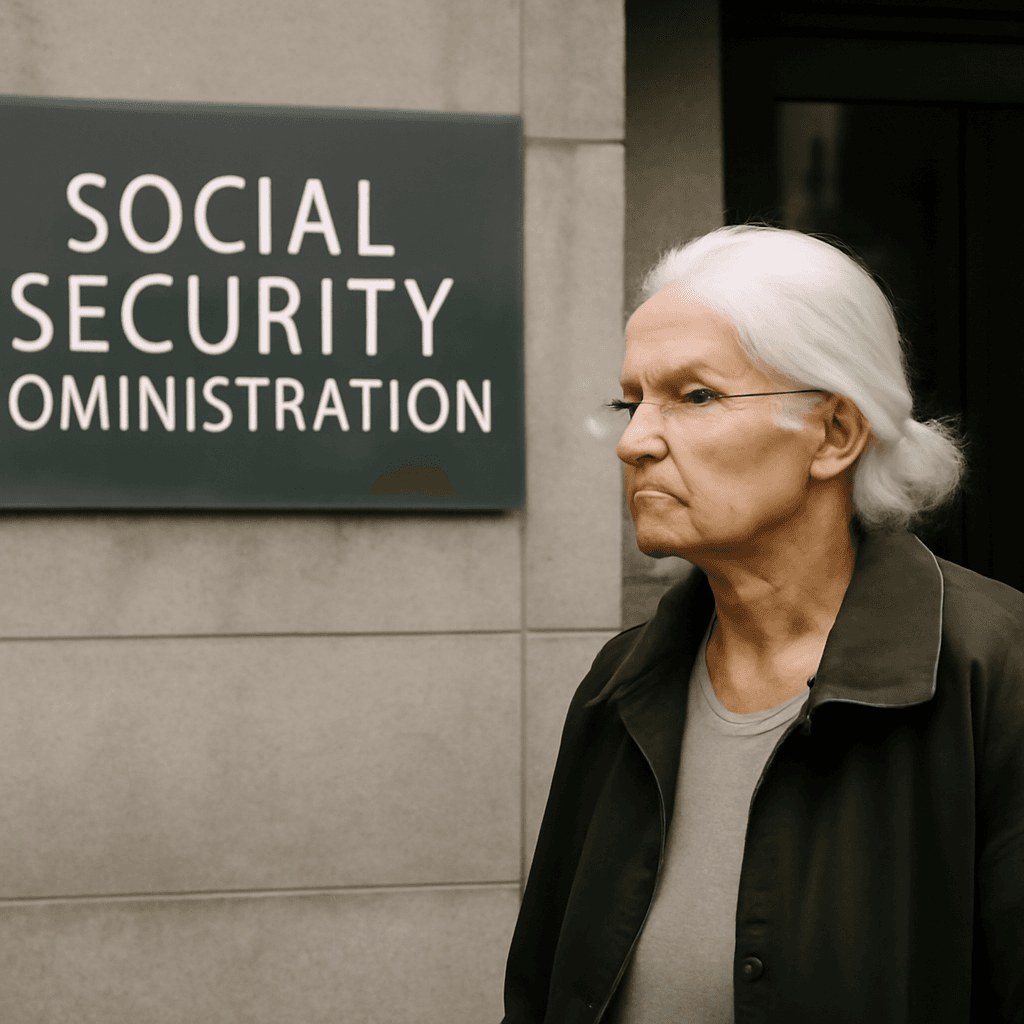

Meanwhile, the United States faces ongoing discussions around its Social Security retirement age. Unlike Denmark, the U.S. has no set official retirement age. Medicare eligibility begins at 65, while full Social Security retirement benefits are available between ages 66 and 67, depending on birth year. Individuals can delay claiming benefits until age 70 to maximize their monthly payments, increasing benefits by roughly 8% annually past full retirement age, yet only about 10% of individuals delay benefits until then.

Efforts to formally raise the U.S. Social Security full retirement age have surfaced, including legislative proposals advocating a gradual increase to age 70 in response to longer life expectancies. Past reforms have incrementally raised the full retirement age from 65 to 67. Increasing this threshold remains a contentious issue due to its potential impact on beneficiaries and the program’s finances.

Experts caution that raising the retirement age in the U.S. could disproportionately affect lower-income individuals who tend to have shorter life expectancies and typically receive Social Security benefits for fewer years. Moreover, due to the gradual nature of such increases, any fiscal relief may occur too far in the future to address immediate funding challenges faced by Social Security.

Denmark's policy has bolstered its public finances, contributing to minimal public debt. In contrast, the U.S. contends with significant national debt and Social Security’s looming funding shortfalls. Some policy analysts suggest raising the retirement age could serve as an effective measure to reduce Social Security's long-term deficits, yet emphasize the complexity involved in balancing fiscal sustainability with equity considerations.

As demographic and economic pressures continue to mount, the debate on adjusting retirement ages remains critical to ensuring the sustainability of pension systems both in Denmark and the United States.