Deportation Anxiety Sparks Record Remittances to Latin America

In the shadow of intensified U.S. immigration enforcement, an often overlooked but telling sign of unrest among Latin American migrant communities has emerged — a dramatic surge in money sent back home. Undocumented migrants in the United States, gripped by fears of sudden deportation, are urgently transferring funds to their families in Central America, reshaping economic lifelines across the region.

Fearing the Loss of Hard-Earned Savings

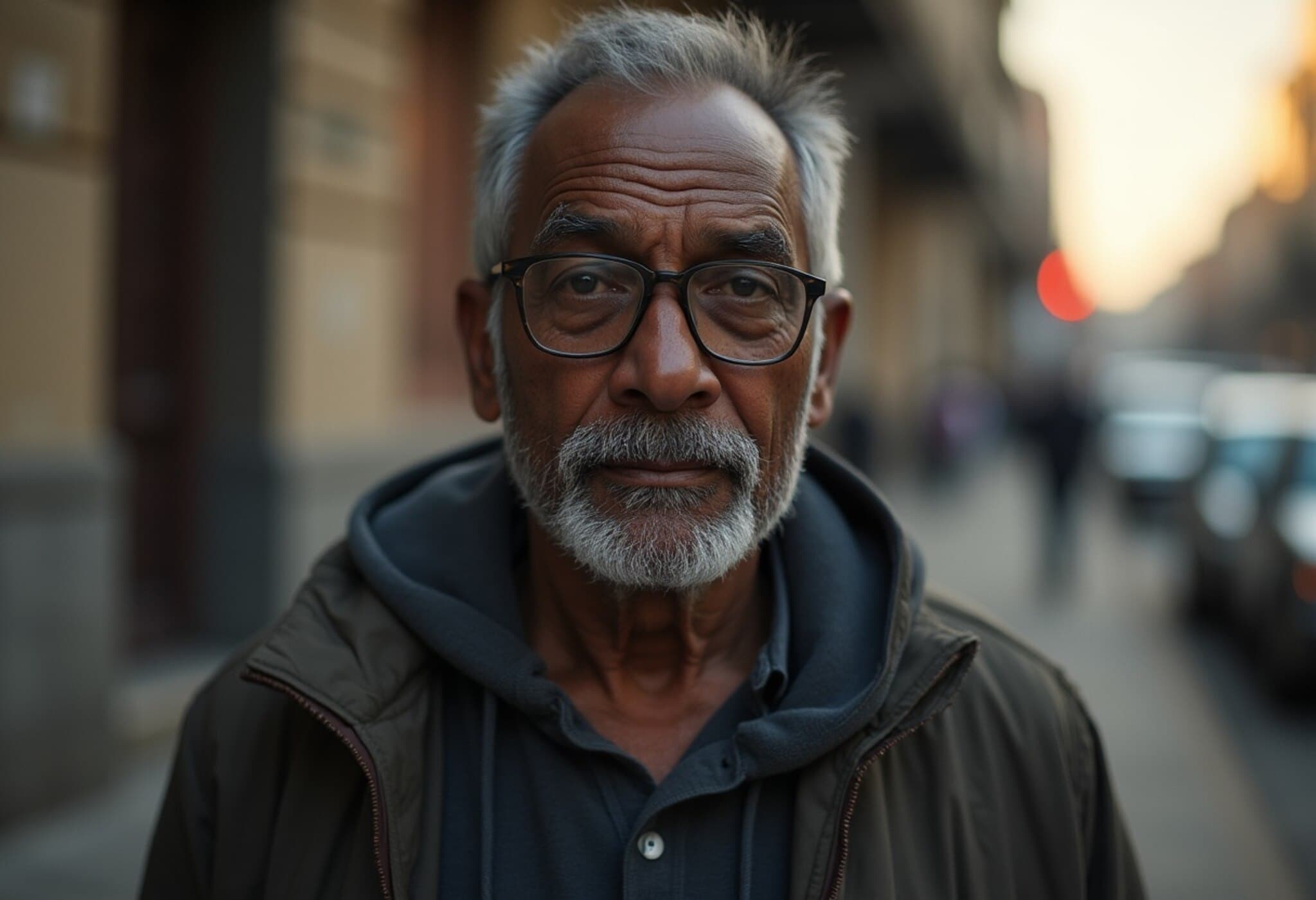

Julio Fuentes, a 35-year-old undocumented plumber living in California, embodies this growing trend. This year, he moved a significant portion of his savings from the United States to his bank account in Guatemala, anxious about the consequences of potential deportation and looming policies targeting remittance flows.

“There is fear,” Fuentes explains. “If they catch you, you go home with nothing.”

His predicament is far from unique. Across states with sizable immigrant populations, remittances — the money sent by migrants to relatives abroad — have soared by billions of dollars in recent months, reflecting a collective urgency to protect family support networks before it’s too late.

An Economic Lifeline Now Under Pressure

Remittances are more than just personal family help; they form the economic backbone of many Latin American and Caribbean countries. In nations like Honduras and Nicaragua, these transfers account for as much as 20% of the national GDP, underscoring their critical importance in sustaining communities.

According to financial data spanning multiple Central American countries, the volume of money being sent home has surged approximately 20% over recent months. Transfers occur through conventional cash channels at transfer shops and increasingly through digital platforms, highlighting migrants’ adaptability in times of uncertainty.

Policy and Human Stories Behind the Numbers

This surge is intricately linked to the U.S. administration’s stringent immigration policies under President Trump’s tenure, which have magnified deportation fears and heightened scrutiny of undocumented migrants. Federal enforcement efforts and rhetoric have created a climate where migrants feel compelled to safeguard their earnings by sending them out of the country preemptively.

Experts note this trend reflects not only economic behavior but emotional realities. The migrant’s remit is a testament to resilience, but also vulnerability — an urgent bid to secure family stability amidst geopolitical pressures.

Looking Ahead: What Does This Mean for Migration and Economy?

- For destination countries like the U.S.: The trend might indicate heightened anxiety within migrant communities, potentially influencing social cohesion and integration efforts.

- For home countries in Latin America: The inflow of remittances provides critical socio-economic support but also exposes dependencies that governments must address through sustainable economic policies.

- For policymakers: The interplay between immigration enforcement and remittance flows calls for nuanced approaches that consider human impacts alongside security and economic concerns.

Expert Insight

Dr. Maria Hernandez, a migration policy analyst based in Washington, D.C., explains, “Remittances act as a financial bridge between immigrant workers and their families, but spikes like this can indicate distress rather than prosperity. It underscores the human cost of enforcement measures and the necessity for comprehensive immigration reform.”

Editor’s Note

This rising tide of remittances amid deportation fears highlights how immigration policies ripple far beyond borders, affecting economies and families in profound ways. While remittances bolster home economies, sharp fluctuations may signal deeper instability within migrant communities. As the U.S. continues to grapple with immigration reform, understanding these financial flows offers a vital lens into the lived realities of millions of migrants and their families.

Questions to ponder: How can immigration policies balance enforcement with the economic and emotional well-being of migrant families? What long-term impacts will sustained fluctuations in remittances have on Latin American development? And how might digital transfer technologies evolve to offer safer, more accessible avenues for migrant workers worldwide?