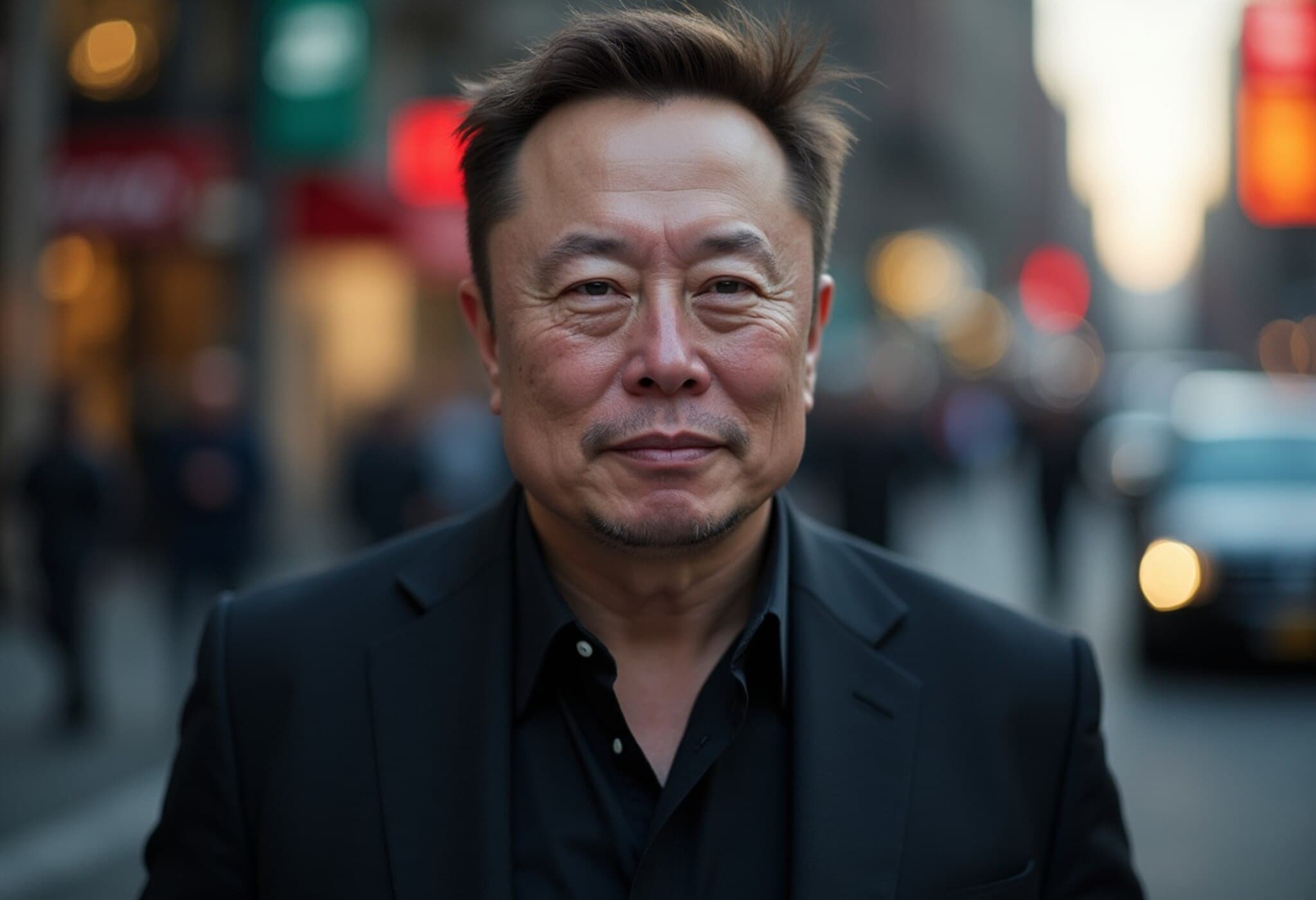

Overview of Musk's Legal Battle With the SEC on Twitter Stake Disclosure

Elon Musk, the billionaire entrepreneur famed for his leadership at Tesla and SpaceX, has filed a motion to dismiss a civil lawsuit brought against him by the U.S. Securities and Exchange Commission (SEC). The SEC alleges that Musk unlawfully delayed disclosing a significant stake he acquired in Twitter (now rebranded as X) during 2022, stirring fresh tension between the tech mogul and regulatory authorities.

Background: What Sparked the SEC Lawsuit?

In January 2025, the SEC charged Musk with violating federal securities laws by failing to promptly disclose his purchase of 5% of Twitter’s common shares within the 10-calendar-day window mandated for such filings. The complaint accuses Musk of waiting 11 days too long, a delay that allegedly allowed him to accumulate a stake valued at over $500 million at artificially suppressed prices before the market became aware. By April 4, 2022, Musk’s disclosed ownership had grown to 9.2%.

SEC’s Position

- The SEC argues that Musk’s delayed disclosure potentially harmed unsuspecting investors by misleading the market.

- They sought civil penalties and forfeiture of profits earned due to the purported violation.

- The case was filed just days before President Biden’s administration began, during which Musk became a special adviser focused on reducing federal spending.

Musk’s Defense and Legal Rationale

In the dismissal motion filed Thursday in federal court in Washington, D.C., Musk’s legal team asserted that the lawsuit is unfounded. They explained that Musk stopped purchasing Twitter shares once advised to consult with securities counsel and filed the required disclosure promptly — one business day after their internal review.

The defense further emphasized that the SEC did not accuse Musk of intentional or reckless conduct, characterizing the issue as a simple late filing corrected swiftly. They accused the SEC of improperly targeting Musk, interpreting their actions as retaliation for his vocal criticism of governmental overreach.

The Broader Context: Musk and the SEC’s Complex History

This confrontation adds a new chapter to the protracted and often contentious relationship between Musk and the SEC. Notably, the SEC sued Musk in 2018 over tweets about taking Tesla private, which Musk settled under stringent conditions. This ongoing legal friction highlights the evolving challenges regulators face when overseeing high-profile billionaires whose communications can significantly affect markets.

Why Does This Matter?

- Market Transparency: Timely disclosure of large stock purchases is critical to maintaining fair markets and protecting investors.

- Regulatory Enforcement: Musk’s case tests the SEC’s ability to impose accountability on influential figures in a rapidly changing tech landscape.

- Policy Debate: It revives discussions on how securities law applies to new forms of public communication and social media influence.

What’s Next?

Musk faces a court response deadline as this case develops, setting the stage for potential deeper legal battles that could redefine regulatory approaches to billionaire investors and corporate disclosures. Meanwhile, the SEC has not publicly commented since the filing of Musk’s motion.

Expert Commentary

Legal analysts note that while the SEC’s rules on timely stake disclosure are clear-cut, enforcing them against high-profile individuals with complex corporate structures brings unprecedented challenges. "This case could set important precedents about how securities laws intersect with social media and public communications," says a securities law expert. Furthermore, the episode raises questions about balancing regulatory rigor with innovation leadership in American capital markets.

Editor’s Note

This high-profile dispute underscores the delicate dance between regulatory bodies and influential entrepreneurs in shaping market fairness and corporate governance. Readers should watch closely how Musk’s motion unfolds, as it may influence both legal standards for disclosure and broader dialogues on government oversight, transparency, and the role of individual power in financial markets.