European Markets Anticipate a Positive Opening

As European trading kicks off this Tuesday, investors are buoyed by hopeful signs of a ceasefire between Iran and Israel. Futures indicate gains across major indexes, with London’s FTSE 100 poised to rise by 0.3%, while Germany’s DAX and France’s CAC 40 each look set to climb about 1%. Italy’s FTSE MIB is also expected to gain 1%.

Recap: Monday’s Market Movements

The pan-European Stoxx 600 closed Monday down by approximately 0.3%, signaling caution as geopolitical tensions simmered. Certain stocks faced steep declines:

- A notable pharma company dropped 5.3%.

- Danish jewelry firm slid by 5.3%.

- One top performer, however, bucked the trend — with London-listed shares rising an impressive 15.7% after a private equity takeover bid.

The sharp move in that particular stock came after a £4.4 billion ($6 billion) acquisition offer from private equity firm Advent, following rejection of an earlier bid by KKR.

The Catalyst: Ceasefire Prospects Spark Optimism

Market enthusiasm gained fresh momentum late Monday following an announcement suggesting a “Complete and Total CEASEFIRE” between Israel and Iran, slated for 12 hours. While neither country has officially confirmed this timeline, the statement invigorated global sentiment, causing both U.S. and European markets to rally.

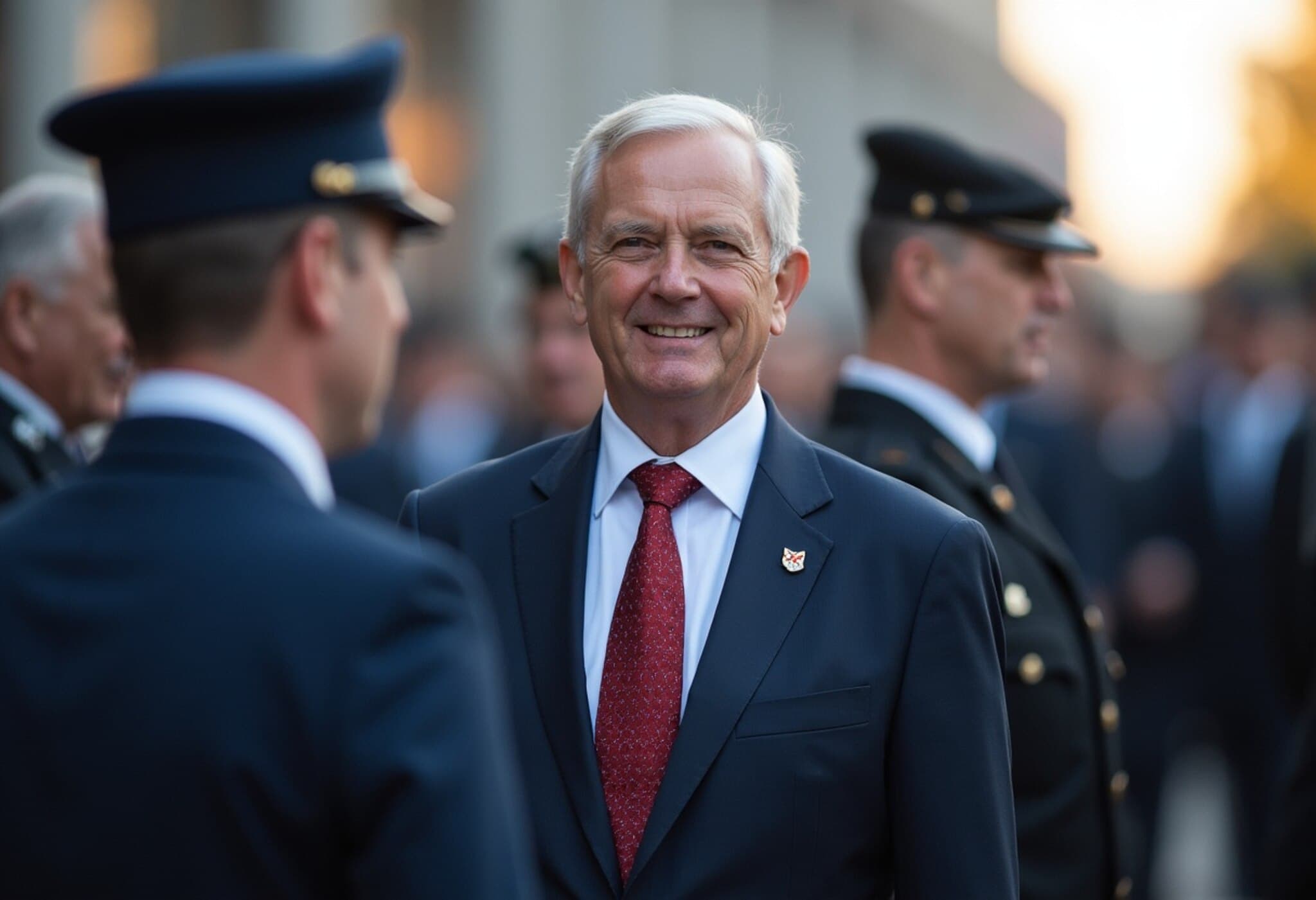

Looking Ahead: NATO Summit and Defense Spending in Focus

All eyes turn now to The Hague, where NATO's annual summit begins. A major agenda item is the proposed increase in defense budgets by member states, targeting a commitment of higher spending by 2035. Yet, internal disagreements loom, with some countries expressing reservations about the scale of these pledges.

Aside from this key geopolitical narrative, no significant corporate earnings or economic data releases are expected today, suggesting market movements will likely hinge on diplomatic developments and summit outcomes.