India-U.K. Trade Deal Signals New Era but Colors U.S. Negotiations

By Ganesh Rao, CNBC Senior Correspondent

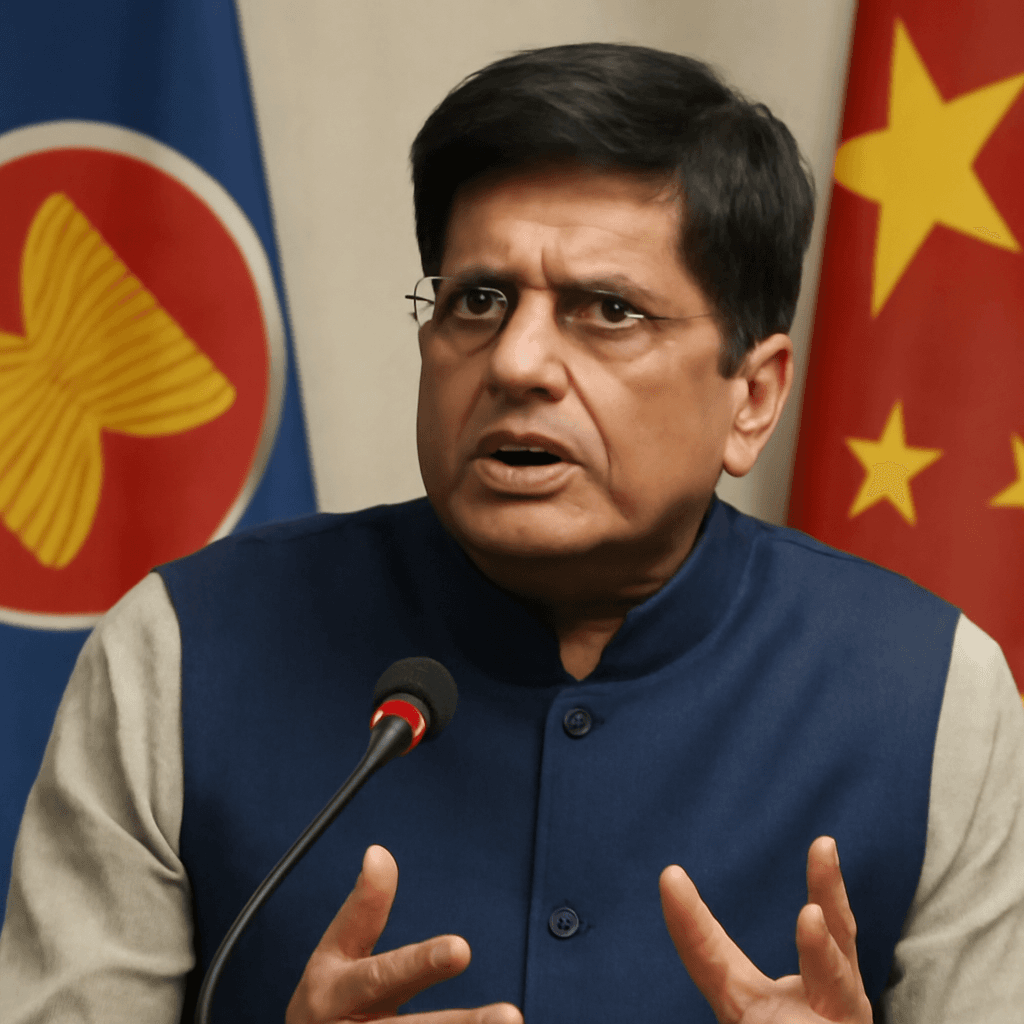

In the bustling corridors of London, I recently had the opportunity to sit down with India's Commerce Secretary, Piyush Goyal, to discuss the evolving landscape of India’s trade diplomacy. Fresh off the heels of a groundbreaking free trade agreement (FTA) with the United Kingdom that promises to reshape bilateral commerce, India faces a more fraught challenge in dialogue with the United States, revealing the intricate balancing act of global trade policymaking.

The Landmark India-U.K. Free Trade Agreement

Earlier this month, India and the U.K. inked a Comprehensive Economic and Trade Agreement, widely hailed as a milestone for both nations. According to projections from the U.K. government, bilateral trade could expand by £25.5 billion over the long term. Deutsche Bank economists anticipate an addition of approximately £2.5 billion in revenue for British coffers, underscoring the deal’s tangible economic benefits.

Key elements include the U.K. eliminating tariffs on 99% of Indian goods, up from roughly 73%, effectively zeroing tariffs for Indian exporters. This includes phased reductions of tariffs on cornerstone products such as Scotch whisky — from current levels to 40% within a decade — and significant cuts on U.K. automobiles, from highs of 110% down to 10% under new quota systems.

Keshav Murugesh, CEO of WNS Global Services and chair of the Confederation of Indian Industry's UK India Business Forum, captured the sentiment aptly: "It's much more than just a trade deal—it’s a strategic partnership setting the stage for the future." The agreement marks a deepening of ties, reflecting shared aspirations beyond mere economics.

Lingering Challenges and Sensitive Sectors

Yet, despite the triumph, friction remains. The deal notably does not grant India relief from the U.K.'s forthcoming carbon tax, slated for 2027. Commerce Secretary Goyal characterized such levies as potential "non-tariff barriers," underscoring India's commitment to challenging trade measures it views as protectionist through avenues like the World Trade Organization (WTO).

The absence of a renewed investment treaty corresponds with India's prior exit from existing agreements in 2017. However, Goyal points out that foreign direct investment into India has surged even in their absence, suggesting evolving confidence in the Indian market despite regulatory uncertainties.

Another sticking point is India's refusal to allow tariff-free access for U.K. dairy and agricultural products. Agriculture supports nearly half of India's population and remains a politically sensitive sector. Goyal emphasized, "We are always very mindful of our farmers and micro, small, and medium enterprises, ensuring their interests are safeguarded." Protecting domestic stakeholders remains a critical factor when negotiating trade concessions.

Complexities in Negotiating with the U.S.

While the U.K. deal comes amid optimism, U.S.-India trade talks have recently hit turbulence. Just days after the India-U.K. deal, U.S. President Donald Trump announced 25% tariffs on Indian goods, effective August 1, citing concerns over India’s trade policies and its procurement of military and energy supplies from Russia.

This move marks a significant pivot from earlier hopeful negotiations and highlights the complex legal and political constraints India faces, especially regarding the WTO's "Most Favored Nation" (MFN) obligation. Under this principle, any tariff concessions granted bilaterally must be universally extended to all WTO members.

Consequently, accepting U.S. demands for tariff reductions on sensitive goods, notably agriculture, could trigger automatic liberalization with other major trade partners such as the European Union and the U.K. This multilateral spillover creates strategic dilemmas for Indian policymakers balancing liberalization with domestic protection.

Goyal remains optimistic about India's economic trajectory, noting, "People trust India. India is the fastest-growing large economy globally and where the action is." Yet, the path forward requires deft negotiation to reconcile global economic integration with the realities of India's socio-political fabric.

Market Response and Future Outlook

In the wake of these developments, Indian stock markets have shown volatility, with the benchmark Nifty 50 index down about 3% in July, though still posting an overall gain of 4.7% year-to-date. Bond yields remain steady around 6.35% for the 10-year government bonds, reflecting cautious investor sentiment amid geopolitical uncertainties.

Looking ahead, the Reserve Bank of India's upcoming interest rate decision and a series of initial public offerings from key sectors could influence market sentiment and underscore India's resilience amid external pressures.

Expert Insight: What Lies Beneath the Headlines?

- Trade Pragmatism vs. Political Realities: India's careful navigation of trade concessions reflects a broader tension between economic openness and protecting politically sensitive sectors like agriculture, vital for rural livelihoods and electoral stability.

- Geopolitical Nuances: The U.S.'s imposition of tariffs amid India’s ties with Russia highlights how global diplomacy increasingly intersects with trade policy, complicating India's balancing act.

- WTO Constraints: The Most Favored Nation clause remains a double-edged sword, fostering multilateral fairness but limiting India's negotiation flexibility in bilateral agreements.

Editor's Note

The India-U.K. trade agreement represents a pioneering milestone that could catalyze deeper economic integration and strategic partnership. However, the contrasting stance of the United States reveals the complex, often contradictory pressures shaping India's trade agenda. As India advances, key questions remain: How will India reconcile WTO obligations with desires for selective trade liberalization? Can it strategically protect domestic interests while embracing global commerce? What role will geopolitical alliances play moving forward? These dilemmas underscore the delicate art of trade diplomacy in an interconnected yet fractious world economy.

For stakeholders and observers alike, monitoring how India maneuvers these multifaceted challenges will offer valuable insights into the future of global trade and emerging market dynamics.