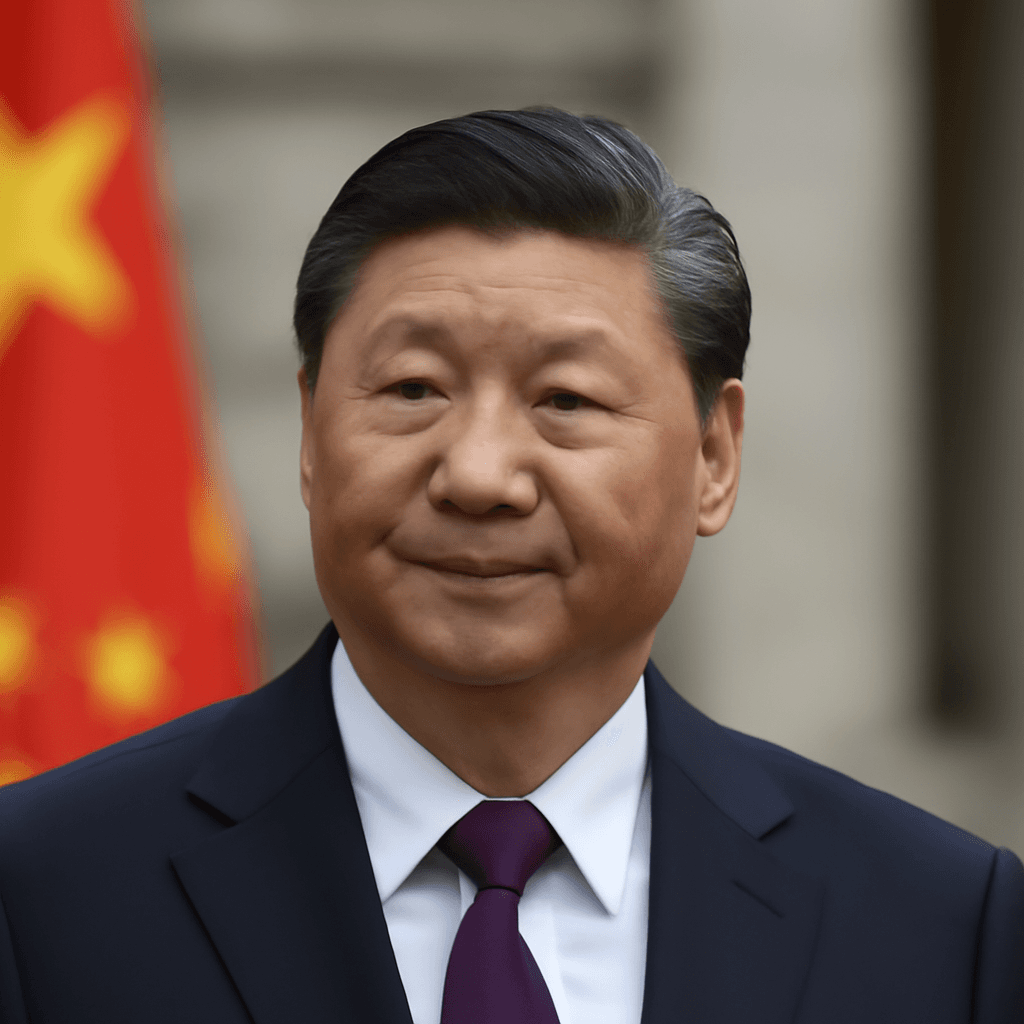

Chinese President Xi Jinping recently reiterated China’s commitment to a manufacturing-led economic growth strategy during his visit to Henan Province. This approach emphasizes self-reliance in advanced manufacturing sectors, including high-tech industries such as electric vehicles, semiconductors, and robotics. Xi described advanced manufacturing as "the right path" and the "backbone" of China’s economy.

This focus contrasts sharply with U.S. President Donald Trump’s call for boosting domestic manufacturing, particularly in non-apparel sectors, and addressing trade imbalances with China. The Trump administration has criticized China’s state subsidies to local companies, which it asserts distort global competition. However, experts suggest China is unlikely to significantly alter its manufacturing strategy, given its role in Beijing’s broader goals of economic self-reliance.

China’s ten-year plan, launched in 2015, aims to position the country as a leader in high-end manufacturing. According to the Center for Strategic and International Studies, China invested approximately 1.73% of its GDP in supporting favored industries as of 2019, far surpassing the U.S. investment in similar sectors. Despite these efforts, some projects have underperformed and contributed to unhealthy industrial competition and international trade tensions.

Meanwhile, the U.S. trade deficit with China continues to be substantial. While there are hopes of rebalancing trade by encouraging China to increase domestic consumption and the U.S. to reshore manufacturing, analysts remain skeptical about meaningful progress in the near term. China’s efforts to expand exports beyond the U.S., particularly to Europe, have raised concerns about the potential for new trade disputes.

At a recent G7 meeting, finance leaders discussed measures to address overcapacity and unfair trade practices related to China’s export policies. Such discussions heighten the risk of retaliatory actions from Beijing, including stricter regulatory oversight and exclusion of foreign businesses from local incentives.

China’s dominance in low-end manufacturing also affects developing economies, with countries like India experiencing stagnation or decline in export sectors where China has been expanding its market share. Protectionist policies in various nations aim to shield domestic industries from Chinese competition.

Despite the geopolitical and economic tensions, cheaper Chinese exports may provide some relief to inflation-pressured economies by lowering consumer costs. However, shifting China from a manufacturing-led to a consumption-driven economy remains a gradual process. China’s domestic demand growth has been slow, evidenced by recent data showing a 5.1% growth rate and underwhelming automobile sales.

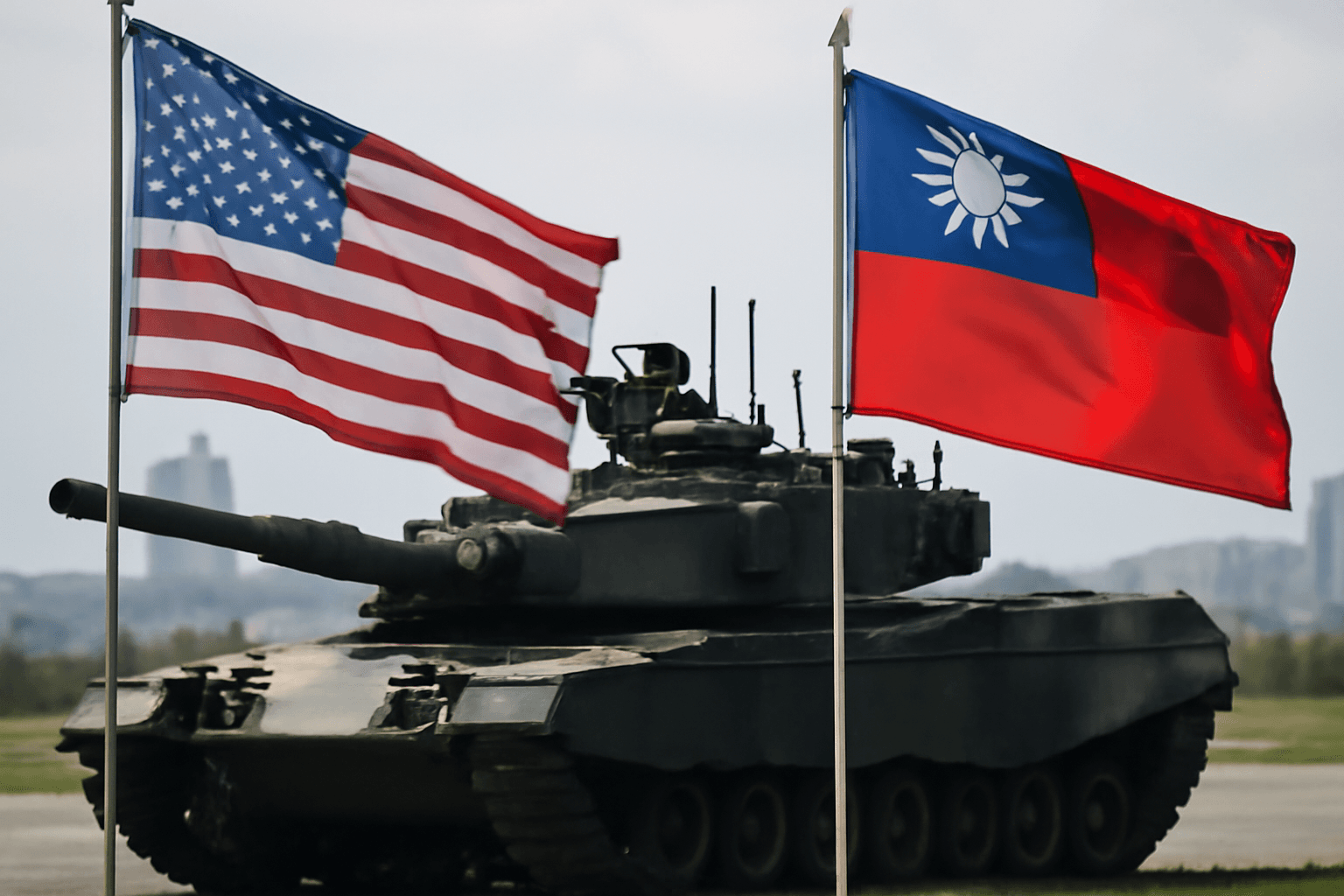

Experts predict that consumption will account for only about half of China’s economy by mid-century, compared to around 70% in the U.S. Xi Jinping’s manufacturing focus aligns with continuing restrictions by the U.S., which aims to block China’s access to critical advanced technologies, deepening the strategic decoupling between the two nations.

As trade negotiations continue, the clash between China’s industrial ambitions and U.S. trade policies signals ongoing challenges ahead in global economic relations.

— Reporting by Evelyn Cheng and additional contributions from CNBC's editorial team.