Inflation Concerns Ease Amid Eased Tariff Pressures

In May, inflation fears among Americans softened notably, influenced in part by the President stepping back from some aggressive tariff proposals. The latest survey from the New York Federal Reserve highlights a downward shift in inflation expectations, signaling a potential shift in public sentiment.

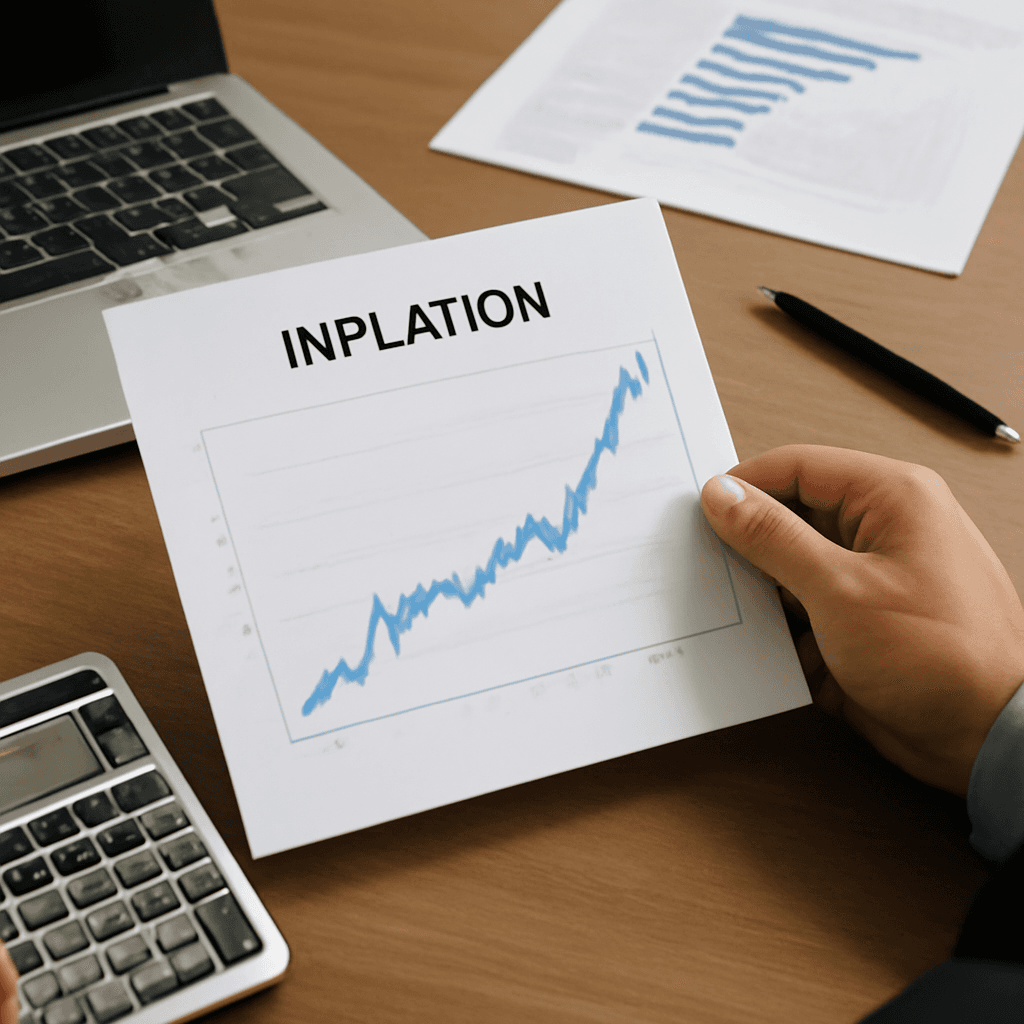

Key Inflation Forecasts See Declines

The New York Fed’s Survey of Consumer Expectations revealed that the one-year inflation outlook dropped to 3.2%, a clear decline of 0.4 percentage points from April. Looking further ahead, the three-year inflation expectation slipped to 3% while the five-year forecast nudged down slightly to 2.6%. Though all remain above the Fed’s stated 2% target, these figures reflect a marked easing from the heightened concerns sparked by tariff threats earlier in the year.

Tariff Retreat Eases Market Anxieties

Initially, the administration had imposed a blanket 10% tariff on all U.S. imports alongside several reciprocal tariffs targeting numerous countries. However, the President soon retreated from some of the harsher measures, favoring tariffs that are now set to expire in July instead. This rollback helped calm widespread worries about tariff-driven price surges.

The New York Fed’s survey, considered more stable than other measures like those from the University of Michigan or the Conference Board, offers a silver lining for policymakers seeking to demonstrate that tariff policies are not fuelling runaway inflation.

Official Inflation Metrics Reflect Similar Trends

Supporting this broader sentiment, the core personal consumption expenditures (PCE) price index — the Federal Reserve's preferred inflation gauge — came in at 2.1% in April, the lowest reading since early 2021. Excluding volatile food and energy costs, core PCE stood at 2.5%, further indicating that long-term inflation pressures may be easing.

Mixed Outlook on Price Categories

While the overall inflation outlook diminished, the survey showed notable exceptions. Respondents anticipate food prices rising by 5.5% over the coming year, marking a 0.4 percentage point increase from April and the highest expected jump since October 2023. In contrast, gas prices are expected to rise more modestly at 2.7%, down 0.8 points. Expectations for medical care, college tuition, and rent inflation also took a step back.

Positive Signals in Employment and Financial Confidence

The survey also revealed a brighter employment outlook, with the share of respondents fearing job loss over the next 12 months dropping to 14.8%. Additionally, fewer people (13.4%) anticipate missing minimum debt payments in the near term, the lowest level recorded since January.

Investor optimism received a slight boost too, with 36.3% of participants expecting stock markets to be higher a year from now, a modest increase that reflects growing confidence.

What This Means for Consumers and Policymakers

These trends indicate a subtle but meaningful shift in inflation expectations, hinting at easing economic pressures in the months ahead. While challenges remain—especially concerning food prices—the retreat from aggressive tariff policies appears to have helped soothe widespread concerns about spiraling costs.

For the Federal Reserve and the current administration, these developments offer encouraging signs as they work to balance growth with price stability.