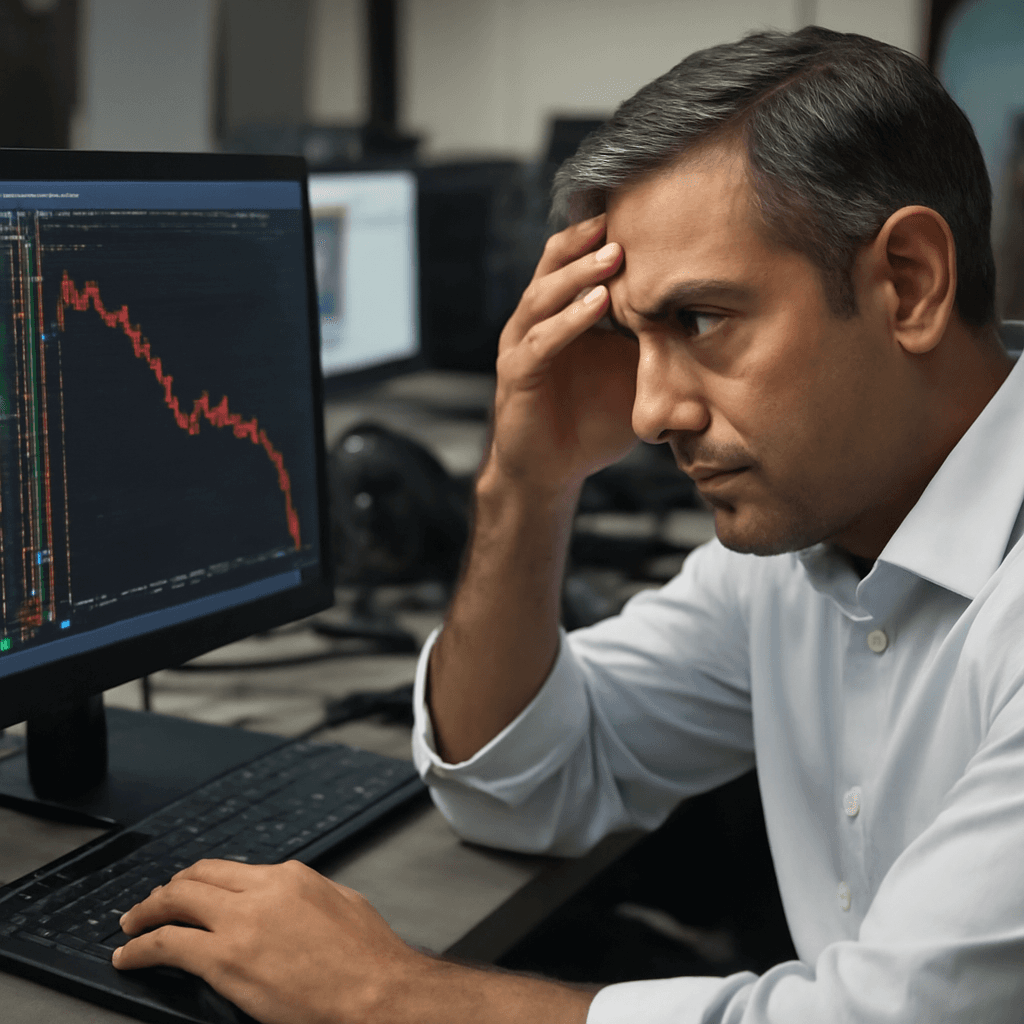

Sensex Slumps Over 1,000 Points Amid Israel-Iran Tensions

On Friday morning, Indian markets opened under heavy pressure following a series of Israeli airstrikes deep inside Iran. The Sensex plunged approximately 1,094 points, settling at 80,597.72, while the Nifty dropped 332 points to open at 24,555.80.

Israel Targets Key Iranian Sites

The Israeli military launched coordinated strikes against nuclear facilities and military-industrial complexes across Iran in the early hours. The offensive reportedly included targeted assassinations against high-ranking military officials, signaling a significant escalation in the region's longstanding tension.

Oil Prices Surge, Triggering Global Market Reaction

These developments sent shockwaves through global commodity markets, with crude oil prices spiking sharply. Brent crude futures surged nearly 13%, reaching $78.31 per barrel, while West Texas Intermediate crude jumped 11% to $75.49. The prospect of a wider conflict in West Asia has fueled fears of supply disruptions, exacerbating volatility.

Market Breadth and Sector Impact in India

Domestically, the selloff was broad-based. Out of all shares traded, 1,963 declined, contrasted with only 412 stocks advancing, and 104 unchanged. Major Nifty constituents such as L&T, Shriram Finance, SBI Life Insurance, Tata Motors, and Bajaj Finserv faced significant losses, while ONGC was among the few gainers, likely benefiting from rising crude prices.

Global Market Downturn Follows Escalation

Overseas bourses also reacted negatively. US futures tied to the Dow Jones Industrial Average slipped 1.5%, the S&P 500 futures fell 1.6%, and the Nasdaq 100 futures dropped 1.7%. These declines underscore investors' growing concerns over geopolitical risks impacting economic stability.