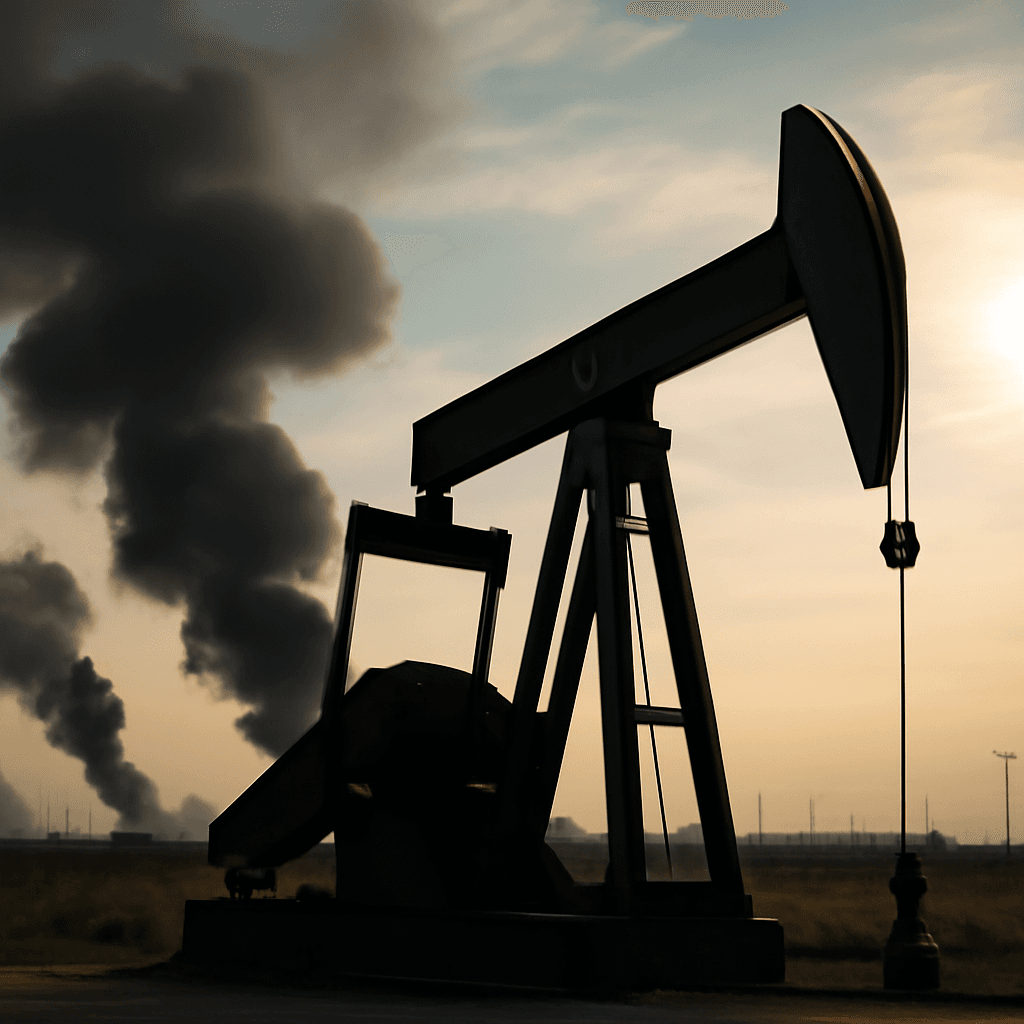

Israel-Iran Tensions Trigger Soaring Oil Prices

Early Friday, Israel launched a series of targeted airstrikes on sites linked to Iran's nuclear program, dramatically escalating tensions between the two nations. In response, Israel declared a state of emergency, while Iranian state media reported multiple fatalities in Tehran.

These developments sent oil prices surging by more than 7%, driven by fears of a wider regional conflict. U.S. stock futures reacted negatively, with Dow futures tumbling over 600 points amid growing uncertainty.

Tragic Crash of Air India Boeing 787 Dreamliner in Western India

In a heartbreaking aviation disaster, a Boeing 787 Dreamliner operating an Air India flight crashed near Ahmedabad, western India, while en route to London on Thursday. The aircraft carried 242 passengers, with all but one losing their lives. Authorities also confirmed casualties on the ground, increasing the death toll.

The tragedy sent shockwaves through the aviation sector, leading to a significant plunge in Boeing’s stock price by 13%. Other industry suppliers like GE Aerospace and Spirit AeroSystems also saw declines of 4% and 3%, respectively.

Despite the initial market reaction, industry experts caution against drawing parallels to previous Boeing crises, emphasizing that the impact will hinge on the investigation results.

U.S. Markets Edge Higher with Inflation Data Offering Relief

Amid geopolitical and aviation turmoil, U.S. stock indices managed modest gains thanks to a cooler-than-expected producer price index (PPI) for May. The S&P 500 inched closer to its all-time high, finishing just under 2% shy of its February record at 6,045.26.

- The Nasdaq Composite added 0.24%, closing at 19,662.48.

- The Dow Jones Industrial Average rose 101.85 points (0.24%) to settle at 42,967.62.

This softer inflation reading eased bond yields and bolstered investor confidence, continuing a trend seen earlier in the week with cooler consumer inflation figures.

India's Ambitious Leap Amid Manufacturing Challenges

As global companies seek alternatives to China during ongoing trade tensions, India has positioned itself as a promising manufacturing hub. With a youthful workforce and government incentives like the production-linked incentive scheme, India offers vast potential.

However, the nation's aspirations face hurdles including logistical delays, regulatory complexities, and uneven infrastructure, which could slow the path to a manufacturing boom.

Oracle Shares Jump on Strong Earnings and AI Growth Outlook

Oracle's latest earnings report surpassed expectations, driving shares higher and uplifting the technology sector. The company projected a robust cloud infrastructure revenue growth of over 70% in fiscal 2026, fueled by soaring demand for AI technologies.

CEO Safra Catz highlighted that this growth marks a considerable acceleration from last quarter’s 52% increase. Investor sentiment around Oracle remains optimistic, with some experts predicting the stock could reach $300 within the next year.

China's Semiconductor Ambitions Amid U.S. Export Controls

Facing stringent U.S. export restrictions on advanced chips and critical AI development components, China is doubling down on domestic alternatives like Huawei. These controls affect every phase of the semiconductor supply chain, from chip design to manufacturing equipment and supporting memory technologies.

While Beijing has made some gains through aggressive investments, experts agree that significant challenges remain before China can fully close the technological gap.